Jobless claims continue to drift higher, are no longer a positive; but no recession signaled Initial jobless claims rose 4,000 to 235,000 last week, vs. the 50+ year low of 166,000 set in March. The 4 week average also rose by 750 to 232,500, compared with the all-time low of 170,500 three months ago. Continuing claims rose 51,000 to 1,375,000, which is 69,000 above their 50 year low set on May 6: Initial claims have now been in an uptrend for 3 months, meaning they no longer qualify as a “positive” in my array of short leading indicators. Last week I noted that reviewing the entire 50+ year history of initial claims, “there are almost always one or two periods a year where the four week moving average of jobless claims rises between 5% and

Topics:

NewDealdemocrat considers the following as important: jobless claaims, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Jobless claims continue to drift higher, are no longer a positive; but no recession signaled

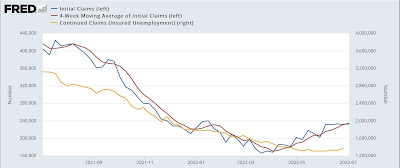

Initial jobless claims rose 4,000 to 235,000 last week, vs. the 50+ year low of 166,000 set in March. The 4 week average also rose by 750 to 232,500, compared with the all-time low of 170,500 three months ago. Continuing claims rose 51,000 to 1,375,000, which is 69,000 above their 50 year low set on May 6:

Initial claims have now been in an uptrend for 3 months, meaning they no longer qualify as a “positive” in my array of short leading indicators.

Last week I noted that reviewing the entire 50+ year history of initial claims, “there are almost always one or two periods a year where the four week moving average of jobless claims rises between 5% and 10%. About once every other year for the past 50+ years, it rises over 10%. Typically (not always!) it has risen by 15% or more over its low before a recession has begun. And a longer-term moving average of initial claims YoY has, with one exception, turned higher before a recession has begun.”

Both initial and continuing claims are continuing to drift higher, and since there is a very long history that initial claims lead the unemployment rate by several months, in tomorrow’s report it would not be surprising if there were a 0.1% increase in the latter:

But initial claims are not a “negative” yet either, since YoY they are still down almost 45%. So they are not signaling recession.