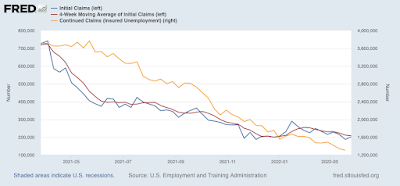

Jobless claims continue near or at record lows Initial claims (blue) rose to 14,000 to 202,000, just above last week’s 50 year low. The 4 week average (red) declined 3, 500 to 208,500 (vs. the pandemic low of 199,750 on December 25). Continuing claims (gold, right scale) declined 35,000 to 1,307,000, the lowest number since December 1969: With Omicron in the rear view mirror, and BA.2 more of a ripple so far, we are having a COVID respite, and basically, nobody is getting laid off. As once again demonstrated in the February JOLTS report released earlier this week, the number of jobs available relative to the number of applicants remains tight, meaning there will be continuing upward pressure on wages.

Topics:

NewDealdemocrat considers the following as important: jobless claims, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Jobless claims continue near or at record lows

Initial claims (blue) rose to 14,000 to 202,000, just above last week’s 50 year low. The 4 week average (red) declined 3, 500 to 208,500 (vs. the pandemic low of 199,750 on December 25). Continuing claims (gold, right scale) declined 35,000 to 1,307,000, the lowest number since December 1969:

With Omicron in the rear view mirror, and BA.2 more of a ripple so far, we are having a COVID respite, and basically, nobody is getting laid off.

As once again demonstrated in the February JOLTS report released earlier this week, the number of jobs available relative to the number of applicants remains tight, meaning there will be continuing upward pressure on wages.