JOLTS report for June amplifies likelihood of substantial downturn in job growth, upturn in unemployment Before we get to the JOLTS report for June, which was released this morning, I wanted to make a point about the overall trend in employment. Because, the two best short leading indicators for employment and unemployment are both pointing South. First, as I have written dozens of times over the past 10+ years, consumption leads employment, not the other way around. More specifically, real retail sales tend to lead employment levels by about 3 – 6 months. Here is the history from 1994 until just before the pandemic: Now here is the past two years: Flat or even negative YoY changes in consumption have not historically been compatible with

Topics:

NewDealdemocrat considers the following as important: JOLTS, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

JOLTS report for June amplifies likelihood of substantial downturn in job growth, upturn in unemployment

Before we get to the JOLTS report for June, which was released this morning, I wanted to make a point about the overall trend in employment. Because, the two best short leading indicators for employment and unemployment are both pointing South.

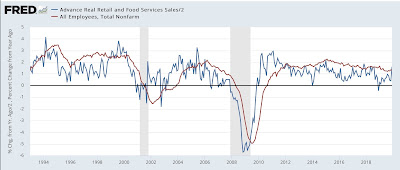

First, as I have written dozens of times over the past 10+ years, consumption leads employment, not the other way around. More specifically, real retail sales tend to lead employment levels by about 3 – 6 months. Here is the history from 1994 until just before the pandemic:

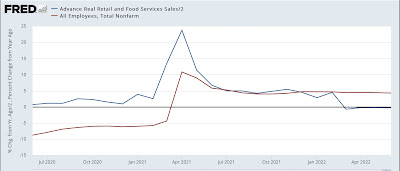

Now here is the past two years:

Flat or even negative YoY changes in consumption have not historically been compatible with continued strong employment growth, to say the least. We have already seen some slowing, from an average of 550,000 to 380,000 jobs gained per month, in the past half year, and the above graph strongly argues for a much more significant deceleration.

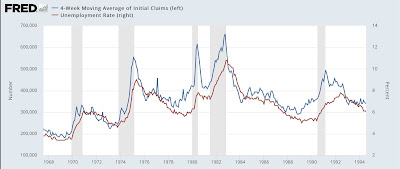

Second, initial jobless claims are an excellent short leading indicator for the unemployment rate, also with a 3 – 6 month lead time. Here is the history since the 1960s until just before the pandemic:

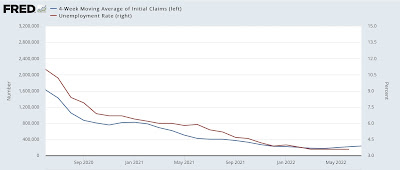

And here is the past two years:

Since its end of March bottom, the average number of initial jobless claims has risen enough to suggest a 0.1% or even 0.2% increase in the unemployment rate is very close.

Which brings us to this morning’s JOLTS report, because I have been writing for the past number of months that, because of the pandemic, there have been several million fewer persons looking for work, leaving a huge number of unfilled job vacancies, particularly in the face of a roughly 10% higher jump in demand. This has created a sharp increase in wages, but more to today’s point, I have further posited that the dynamic would only slow down once some employers throw in the towel, and the number of job openings signficantly declines.

Last month I wrote that “Openings likely peaked in March.” This morning we got confirmation, as job openings declined for the 3rd straight month, down -605,000 in June to 10.698 million; down -10% from March to an 11 month low; and only 8.6% higher YoY. In other words, they are very likely to be *down* YoY next month. Here’s the 2 year trend:

Actual hires declined -133,000 to a 10 month low as well. The decelerating trend is now easy to see:

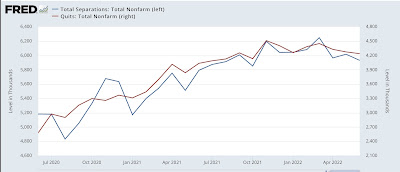

Both quits and total separations also declined, by -37,000 and -86,000 respectively, to 8 month lows:

The deceleration in voluntary quits is now also apparent.

Finally, layoffs and discharges declined -89,000 to 1,327,000, about average for the past 12 months:

While any one jobs report can be noisy, it is much more likely than not that we are going to see a significant further slowdown in job gains, a likely small increase in the unemployment rate, and also a deceleration in wage gains, in Friday’s jobs report.