Alan Collinge’s Student Loan Justice Facebook page. I keep talking about how the consolidation fees, late fees, forbearance interest, etc. and the interest on the previous adds up over time. Pretty soon, it surpasses the original loan balance. There are probably worse examples of this occurring. As it is, the non-principal payments are more than twice the original principal. The original loan was 5,000. As you can see there is ~,000 in interest capitalized into the loan resulting from nonpayment, consolidation, etc. (mentioned above. Future interest is calculated at almost 6,000. Typically in these loans if a payment is not made as in forbearance, the interest must be paid first before any funds are applied to the principal. As

Topics:

run75441 considers the following as important: Alan Collinge, Education, Hot Topics, Student Loan Justice Org, student loans, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Alan Collinge’s Student Loan Justice Facebook page.

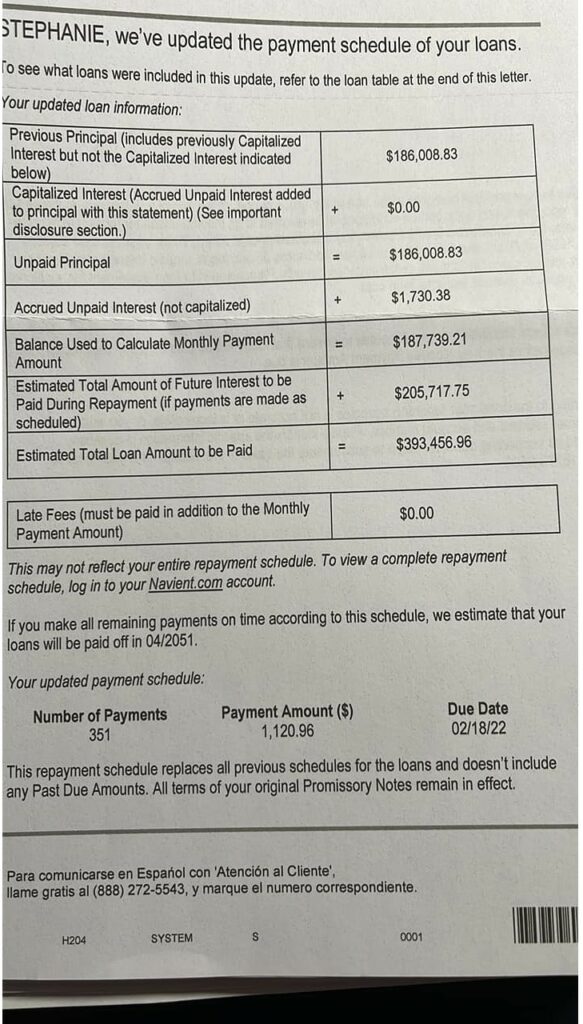

I keep talking about how the consolidation fees, late fees, forbearance interest, etc. and the interest on the previous adds up over time. Pretty soon, it surpasses the original loan balance. There are probably worse examples of this occurring. As it is, the non-principal payments are more than twice the original principal.

The original loan was $105,000. As you can see there is ~$81,000 in interest capitalized into the loan resulting from nonpayment, consolidation, etc. (mentioned above. Future interest is calculated at almost $206,000. Typically in these loans if a payment is not made as in forbearance, the interest must be paid first before any funds are applied to the principal.

As you can see, much of the balance is accumulated interest on various items mentioned above making it harder to even make a payment. We are arguing about a loan of which the amount originally loaned is far less than the balance.

This loan will never be paid off for obvious reasons as described below. The relief? Die . . .

Payment Schedule

The story:

“This was my Christmas present from our government! I am 56 years old and have survived cancer 3 times. According to Navient, I will not be able to die till I am 85 years old! That is how long it will take me to pay off this crap! If you wonder how I got this high Balance, ask Sallie Mae. I left school with a balance of a little over $105,000 but thanks to the fees and interest I now owe this! Anyone who thinks this crap is not corrupt needs to do some research. This has to stop!”

There are other consequences to owing money to the government. You are blocked from other programs, etc.