Scenes from the November employment report: the short leading jobs indicators – by New Deal Democrat Every month as part of my post on the jobs report, I run through the changes in those measures which are short leading indicators for the economy. There were some significant developments in the past several months, so let’s take a closer look here. Here’s a historical look at temporary help services, residential construction jobs, and total construction: The first two typically turn down months before employment as a whole, and the last one at least turns flat. Now here’s the close-up: Temporary help didn’t just turn down in November, but several previous months were revised down as well (h/t Bob Dieli). Residential construction

Topics:

NewDealdemocrat considers the following as important: employment report, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Scenes from the November employment report: the short leading jobs indicators

– by New Deal Democrat

Every month as part of my post on the jobs report, I run through the changes in those measures which are short leading indicators for the economy.

There were some significant developments in the past several months, so let’s take a closer look here.

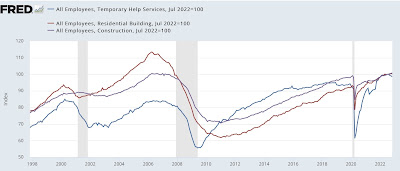

Here’s a historical look at temporary help services, residential construction jobs, and total construction:

The first two typically turn down months before employment as a whole, and the last one at least turns flat.

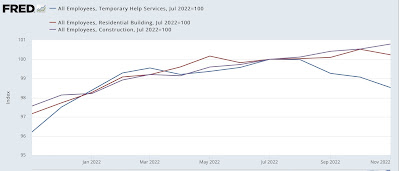

Now here’s the close-up:

Temporary help didn’t just turn down in November, but several previous months were revised down as well (h/t Bob Dieli). Residential construction jobs turned down, and have been generally flat for half a year. Only total construction jobs are still increasing.

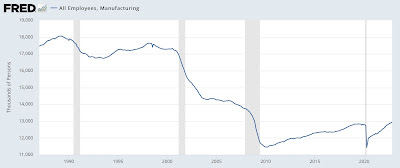

Manufacturing jobs also typically turn down before a recession:

These have continued to increase through November (pretty surprising given the weak Fed new orders and ISM manufacturing reports).

But manufacturing *hours* are much a more sensitive indicator than manufacturing jobs (shown YoY for better comparative purposes):

And manufacturing hours YoY are down by a % typically associated with previous recessions.

In the past, a decline of -0.6 hours from the expansion peak has been the average consistent with the onset of a recession, and that is what we have now:

Finally, in a manner similar to initial jobless claims, the number of those unemployed for less than 5 weeks has typically risen before the onset of a recession (very noisy, but true even for the smoother 3 month rolling average):

Here is the close-up of that metric for the past year:

In short, most of the leading indicators of a jobs recession are either signaling an oncoming recession now (temporary jobs, manufacturing hours, short term unemployment) or at very least are close (residential construction). Only total manufacturing and construction jobs are still increasing.

I expect both manufacturing and construction jobs to turn down in the next few months as well, given the poor ISM manufacturing index, and the likelihood that housing units under construction will turn down significantly.

“Foreboding Economic Signs Coming from consumption and employment data,” Angry Bear, angry bear blog