That coming from Alan Collinge of Student Loan Justice Org. I have been writing about him, his supporters and followers, his Org. Student Loan Justice, and the government’s response to student loans for a decade now. This is news, facts, etc. about 45 million people in 2022 and not some anecdote. The post title comes from Alan Collinge’s* article in an email to me after I sent him this article, surprisingly originating in the New Yorker. Federal Student Loan Debt by Age, Source: U.S. Department of Education (Q4 2021) “The Aging Student Debtors of America” | The New Yorker, Eleni Schirmer, long and well written with a plethora of facts. I am also not going to just C&P this article. I am not new to this topic. To the left is a chart breaking

Topics:

run75441 considers the following as important: Alan Collinge, Education, student loans, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

That coming from Alan Collinge of Student Loan Justice Org. I have been writing about him, his supporters and followers, his Org. Student Loan Justice, and the government’s response to student loans for a decade now. This is news, facts, etc. about 45 million people in 2022 and not some anecdote.

The post title comes from Alan Collinge’s* article in an email to me after I sent him this article, surprisingly originating in the New Yorker.

“The Aging Student Debtors of America” | The New Yorker, Eleni Schirmer, long and well written with a plethora of facts. I am also not going to just C&P this article. I am not new to this topic.

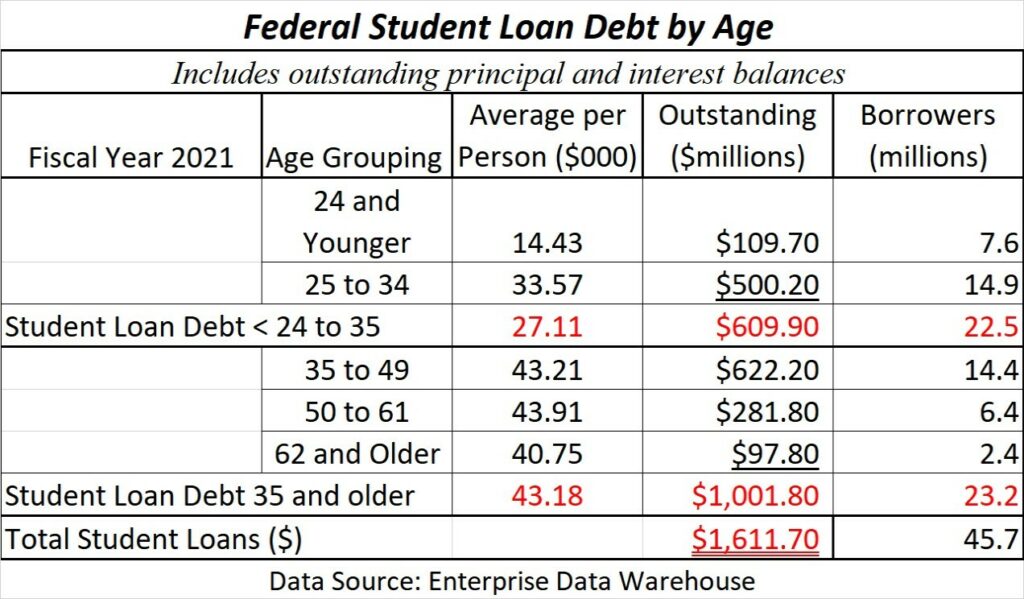

To the left is a chart breaking down the total numbers of people who have outstanding student loans in $millions. The chart is also broken down by age group. You can also find the numbers of borrowers. in each group and the average amount of debt per student loan. It is relatively current using numbers from 4th qtr 2021.

I am going to concentrate on one article. The chart above has the numbers. What we need s to understand the driving force withing people who wish to do better in life.

On a warm October evening, in 1932, Franklin Delano Roosevelt stood in a baseball field in Pittsburgh, delivering an impassioned speech about passion’s improbable subject: the federal budget to a crowd.

“Sometime, somewhere in this campaign, I have got to talk dollars and cents, and it’s a terrible thing to ask you people to listen for forty-five minutes to the story of the federal budget, but I am going to ask you do it,”

Two-year-old Betty Ann, a Black girl was sitting on the shoulders of her father, Robert. He was straining to point out to Betty the man he was sure would become President. Robert was a dyed-in-the-wool Republican. His grandfather was an enslaved man from Virginia, who had been emancipated by President Abraham Lincoln. Still, he felt compelled by F.D.R.’s message.

The economy was not doing so well when FDR made his speech.

Hard times found Robert paying the reporters of Pittsburgh’s Black newspaper, he ran, out of his own pocket. Much to his distress, his wife had taken to standing in relief lines in order to feed Betty Ann and her sisters. A few weeks later, when Robert cast his ballot for F.D.R., he wept, aghast to vote against the party of Lincoln. Thereafter, he became a devoted Democrat and jumped into local politics with fervor until he fell ill, five years later. He had two dying wishes:

- For his wife to take over his role as a Democratic ward chairperson, and

- for Betty Ann and her sisters to go to college.

The family made good on both. As ward chairwoman, Robert’s wife maintained the family home as a community backbone. Betty Ann, grew up with a steady stream of neighbors flowing through the house.

Although her mother had no money, Betty Ann was a strong student and earned enough scholarship funds to receive a bachelor’s and master’s degree in education. For the next few decades, she worked as a public-school teacher in Pittsburgh and Harlem, in addition to raising two children as a single mother. But she grew increasingly frustrated by the marks of economic and educational inequity, the moldy lunches, low-grade reading materials, and less than average conditions plaguing her classrooms.

“I thought the only way that I could change things was to have a higher degree,”

That thought epitomizes many of the people who reach out to higher education as a way to improve their lives and those around them.

Many people also believe higher education will give people greater authority and credence. From early on in grade school, we are told a college education is essential. In most cases, it does bring greater earnings, belongings, and status. Colleges are supposedly not commercial enterprises even though there are commercial variations. Picking the saleable education in society is important. Getting the education needed to be successful is the good part. The pitfall beyond the education are the costs, whether a student can afford it, the business end of the institute, and government entity making the loan. At ~18 years of age, few young people understand the dynamics of signing on the dotted line. There is no financial planning involved and few do not understand being locked into financial responsibility for life. Once you sign, you are locked into a cost outside of the college you are attending.

In 1983, at the age of fifty-two, Betty Ann enrolled in New York University’s law school. As a middle-aged Black woman, she wasn’t exactly the typical N.Y.U. law student. Her white male classmates would slyly elbow her books off the long library tables While standing at her locker, a classmate waved a ten-thousand-dollar tuition check in her face. A check signed by his father, Betty Ann borrowed twenty-nine thousand dollars in federal loans to attend NYU. Today, she owes $329,309.69 in student debt.

Betty is ninety-one years old. She is not the only older person locked into a loan which will never be paid off. If you reveal the chart above, you will see an approximate 8.8 million others with balances greater than $40,000. I once worked the numbers on this. You could not pay the loans off in fifteen years at a few hundred a month. Not other commercial loan exists like this.

Americans aged sixty-two and older are the fastest-growing demographic (2.4 million 4th Qtr. 2020) of student borrowers. Of the forty-five million Americans who hold student debt, one in five are over fifty years old. (Alan Collinge expands the age groups to 35 and older. In which case millions more who are older are included and also carry large amounts of student loan debt).

Between 2004 and 2018, student-loan balances for borrowers over fifty increased by 512%. The flaw here is policymakers believing student loan debt to be the burden of upwardly mobile people with an emphasis on age. Inaction by government to resolve debt issues has seemed a reasonable response given a potential upward mobility.

It ignores those over 35whose upward mobility has been economically stymied since 2001. At 35, there is still a chance. At 45 years of age, the chance lessens Given the growing numbers of older people in debt with student loans as shown in Alan Collinge’s chart, upward mobility has not occurred in time to solve the problem.

In an era of declining wages and rising debt with jobs migrating overseas or automation, Americans are not aging out of their student loans. Continuing education has not readied them for change and they are left with an education which will not garner the money needed. Instead, they are aging into their loans beyond retirement.

A common assumption by Credit companies is what we cannot afford today, we will be able to be pay back by tomorrow’s wealthier self. A wealthier self-made wealthier due to higher education, demanding a rapidly growing income earned from having the higher education. Economic circumstance and politics did not occur as planned to leverage the increased student loan debt into higher incomes

Perhaps no form of credit better embodies the myth of a future, richer self than student loans. Under the vision of the free-market economist Milton Friedman, student loans emerged in the nineteen-fifties as an outgrowth of “human capital” theory1, which posits the self as, above all, a unit of investment. Lending money for people to be educated was not only a sound investment as borrowers were sure to get high-paying jobs allowing them to repay the loan. Smart macroeconomics:

More educated people would increase the nation’s G.D.P. Education would be an incidental benefit.

But the surge of aging debtors calls into question the premise of education for human capital. Eroding union density, declining wages, and skyrocketing tuition have all made college less a path to high-paying jobs than an escape hatch from the worst-paying ones. Those who have taken on debt are increasingly unable to pay it off. Many who have not even received diplomas are saddled with the debt.

Alan Collinge in his commentary2 gives numbers to the issue.

A 2014 GAO Study found more than 50% of student loan borrowers 75 years of age or older were in default. For people between 65–74 years of age it was 27%. We also know about 20% of defaulted borrowers “rehabilitate” their loans into new, much larger, consolidation loans (having a 75% chance of defaulting again) combining fees, interest, and the principal. Given the reoccurring cycle it is likely the majority of senior citizens with student debt are in default, or are defaulting on their loans. Subjected to collection activities over the years or decades, social security and disability income are likely garnished. It is obvious the vast majority of seniors will never be able to pay off their loans.

A stone loan is the worse type of loan to take out. You are obligated for life regardless of health or economic opportunity.

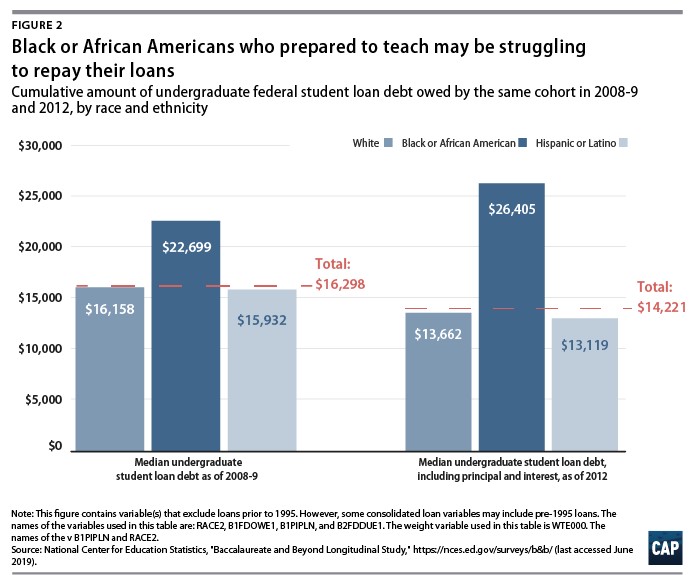

The student-debt crisis is particularly dire for Black borrowers. Racial wealth gaps mean Black debtors borrow more to attend college and carry balances for a longer time. Effectively they pay more for the same degree than their white classmates. Four years after graduating, nearly half of Black graduates owe more on their loans than their initial balance, compared with seventeen per cent of white graduates.

In “Student Debt: An Overlooked Barrier to Increasing Teacher Diversity4,” the Center for American Progress discusses “the disproportionate effect of student debt on black and Latinx graduates may explain the lack of teacher diversity in America. Without debt hanging over their heads, how many Morehouse grads would become teachers, or artists, or bankers?”

“CAP4 analysis adds to the growing body of research showing Black and Latinx college graduates bearing a larger amount and greater burden of student loan debt when entering the workforce compared with white college graduates.”

Much of this is the result of the base from where each student starts. Many white families start at a higher income base than black families. Consequently, they will or may borrow more to subsidize tuition. Liberty Blog offers a difference analysis which does not judge by income at much as ethnicity. Black Americans need more help and should gain such as I have portrayed in the use of a bar graph. One issue is the lack of enough and the size of financial aid. The second issue being the inability to recognize these loans are illegitimate just by the way they are written. No other loans commercial exist that can not be discharged in bankruptcy. Why is it so ethical to penalize young people and disproportionately minorities? The nation is shooting itself in the foot.

Four years after graduating and looking at percentages, nearly half of Black graduates owe more on their loans than their initial balance, compared with just seventeen per cent of white graduates.

Older student debtors are not the only exceptional cases within the mounting student-debt crisis. Their experiences are in indicative of Student Loan hallmark features. Mounting interest, looming balances, faulty relief methods, and declining wages all force borrowers to carry loans for longer and longer. pushing student debt across generations.

The Department of Education is effectively one of the country’s largest banks. In part due to its 1.6-trillion-dollar student-loan portfolio to which they will be unlikely to collect. Whn many of these loans were transferred to the government, they came without their loan information. The Department of Education is unable to provide accounting for its forty-five million clients.

Just this spring, the Government Accountability Office released a bombshell report revealing the vast disarray of student-loan bookkeeping. Five years ago, the Department of Education drafted bookkeeping requirements for loan-servicing companies. Out of long-standing concerns about accuracy, it abandoned such regulations “due to cost and complexity.” As loan-servicing companies open and close, and interest rates skyrocket, student debtors are left to navigate the system mostly on their own.

The lack of information around student loans infuriates borrowers and social scientists alike.

“I’ve never seen a nationally known topic that is so void of information,”

Daniel Collier, an assistant professor of higher and adult education who researches income-driven-repayment programs, said. But, perhaps more profoundly, a lack of clear information has allowed the system to operate without accountability. The sociologist Louise Seamster stated we know the total amount of student debt. We do not know how much of the number is capitalized interest. The Department of Education reports that, of the 1.6 trillion dollars in student debt, 116 billion is interest. The number does not include interest that has been capitalized into the principal amount. The public is told the measure of the suffering, while the profits have remained obscured.

Considering consolidation and penalty fees on top of each other, the interest incorporated with each, ant the interest on the total loan, I would suggest the total is several times greater than the $166 billion. Fees and interest which would not be found in anormal loan.

1What Is College Worth? | The New Yorker

3 The Aging Student Debtors of America | The New Yorker

4Student Debt: An Overlooked Barrier to Increasing Teacher Diversity – Center for American Progress

This popped