December JOLTS report: with Omicron raging, the pool of potential employees refuses to fill, meaning more record wage gains The Census Bureau has started to release the JOLTS report earlier in the month. So we got December’s report yesterday as opposed to in a week or two. Last month I introduced the idea of a game of musical chairs, where employers added or took away chairs, and employees tried to best allocate themselves among the chairs. Because of the pandemic, there are several million fewer players trying to sit in those chairs. As a result, wages have continued to increase sharply, as employers attempt to attract potential employees to sit in the empty chairs. This pattern continued in December. Layoffs and discharges (violet, right

Topics:

NewDealdemocrat considers the following as important: JOLTS, report, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

December JOLTS report: with Omicron raging, the pool of potential employees refuses to fill, meaning more record wage gains

The Census Bureau has started to release the JOLTS report earlier in the month. So we got December’s report yesterday as opposed to in a week or two.

Last month I introduced the idea of a game of musical chairs, where employers added or took away chairs, and employees tried to best allocate themselves among the chairs. Because of the pandemic, there are several million fewer players trying to sit in those chairs. As a result, wages have continued to increase sharply, as employers attempt to attract potential employees to sit in the empty chairs. This pattern continued in December.

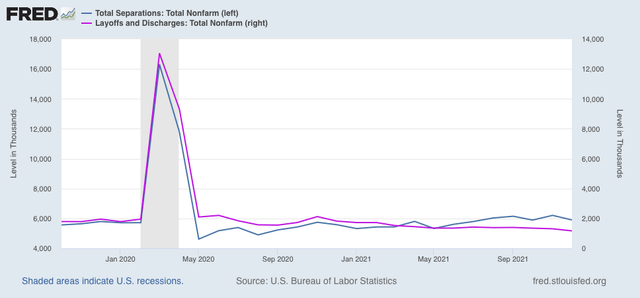

Layoffs and discharges (violet, right scale in the graph below) decreased 140,000 to 1.169 million, yet another new record low. Total separations (blue) declined 305,000 to 5.900 million:

Essentially, nobody is getting laid off.

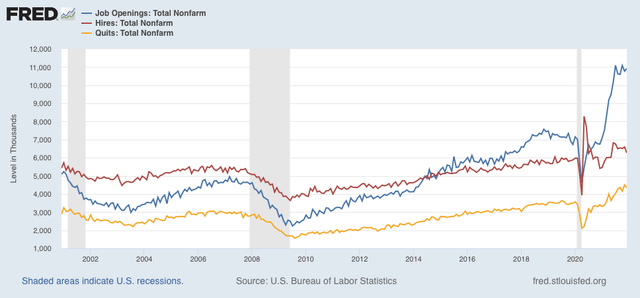

Meanwhile, job openings (blue in the graph below) increased 150,000 to 10.925 million, a little below the July peak of 11.098 million. Openings have been basically steady for the past 6 months at record high levels. Voluntary quits (the “great resignation,” gold, right scale) declined -161,000 from November’s record high to 4.338 million. Actual hires (red) declined -333,000 to 6.263 million, significantly below the June high of 6.827 million:

Hires and quits are in line with the relatively modest employment gains in the past few months compared with earlier in the year.

In summary, we continue to have near-record high job openings and quits, record low layoffs, with still-strong total separations, and slightly fading hires. Once again, little progress is being made towards establishing a new equilibrium.

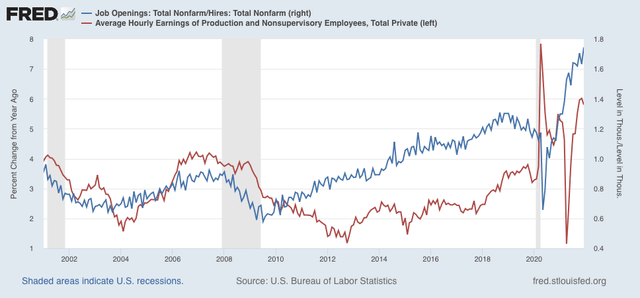

As a result, wages continue to soar. Let me debut a new graph that I think shows the dynamic better than I have before.

Below I show job openings divided by actual hires (blue, right scale). This gives me the rate at which openings are above or below hires, where 1.0 represents the level at which the number of openings and hires are equal. As you can see, this rate increases as expansions go on, and in the last 18 months has repeatedly made new all-time highs.

YoY wage gains for non-managerial workers (red, left scale) are a “long lagging” indicator, typically turning up well after an expansion is underway, and typically when the U-6 underemployment rate falls below about 9.0% (we’re at 7.3% now, the lowest except for the late 1990s tech boom and during 2019):

The result is that, as the rate of job openings for each hire has completely blown through prior highs almost every month in the past year, wage growth has responded by similarly spiking to the upside, to nearly 6% YoY.

So long as the shortfall in available workers to fill openings persists, potential employers will have to continually offer more compensation to attract applicants. In other words, wages will continue to rise until the potential employer can no longer make any profit off the potential employee for that job.

For the past several months, I have speculated that, in order for the situation to resolve, the first thing I want or expect to see is a further increase in monthly hiring. At the same time, or shortly thereafter, I would expect to see a significant decline in voluntary quits.

But this increase in hiring is only going to occur if potential employees feel safe returning to work. And that hasn’t happened with Omicron raging, and it won’t happen until more people feel the pandemic is abating. Until then, no dice.