Prices of existing homes have probably peaked By now you may already know that existing home sales declined further in July, to an 8 year low (excluding the pandemic lockdown months: This is roughly a 30% decline from their peak, and is certainly a recessionary level. But perhaps more importantly at the moment, it appears that the prices of existing homes have now peaked. Here is the one year graph from FRED: Since there is no seasonal adjustment for prices, YoY is the only real way to measure, and YoY prices are up 10.7%. Here is a longer term look at the YoY% change in prices (excluding this month), via Mortgage News Daily: My rule of thumb is that when a metric that can’t be seasonally adjusted declines by more than 1/2 of

Topics:

NewDealdemocrat considers the following as important: existing home sales, Prices peaked, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Prices of existing homes have probably peaked

By now you may already know that existing home sales declined further in July, to an 8 year low (excluding the pandemic lockdown months:

This is roughly a 30% decline from their peak, and is certainly a recessionary level.

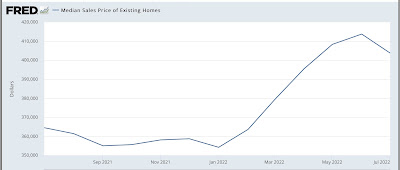

But perhaps more importantly at the moment, it appears that the prices of existing homes have now peaked. Here is the one year graph from FRED:

Since there is no seasonal adjustment for prices, YoY is the only real way to measure, and YoY prices are up 10.7%.

Here is a longer term look at the YoY% change in prices (excluding this month), via Mortgage News Daily:

My rule of thumb is that when a metric that can’t be seasonally adjusted declines by more than 1/2 of its YoY peak in the past 12 months, it has probably peaked. One year ago, prices increased over 23% YoY. Since 10.7% is less than half of that, prices have probably passed their peak.

I have frequently pointed out that the sequence in the housing market is that sales peak first, and prices peak afterward. Since new home prices declined on a seasonally adjusted basis beginning last month, if existing home prices have now joined them, that means that the pattern has now been fulfilled. We should expect inventory to continue to increase from here, adding to the pressure of price declines.