Real wages continued to stall in January, portending a consumer slowdown, but don’t reverse Let me follow up on yesterday’s post about the January CPI by talking about “real” wages. Since both average real hourly wages and consumer inflation increased in January by 0.6%, real hourly wages for non-supervisory workers were flat month over month: Real wages have been essentially flat since June 2020, with the exception of last winter and September. That isn’t good, but it isn’t recessionary either. Now let’s turn to real aggregate payrolls, which are an overall measure of consumer health. These declined by -0.3% for the month. But, due to the annual revisions in the household survey from which they are derived, December 2021 was their new

Topics:

NewDealdemocrat considers the following as important: Real Wages, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Real wages continued to stall in January, portending a consumer slowdown, but don’t reverse

Let me follow up on yesterday’s post about the January CPI by talking about “real” wages.

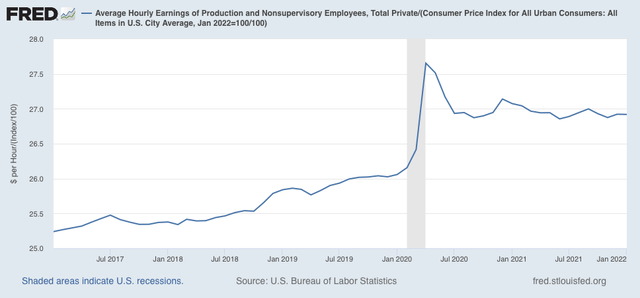

Since both average real hourly wages and consumer inflation increased in January by 0.6%, real hourly wages for non-supervisory workers were flat month over month:

Real wages have been essentially flat since June 2020, with the exception of last winter and September. That isn’t good, but it isn’t recessionary either.

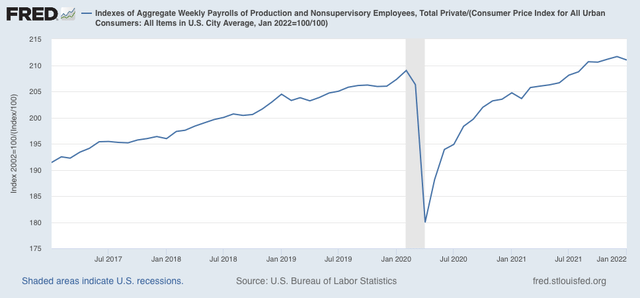

Now let’s turn to real aggregate payrolls, which are an overall measure of consumer health. These declined by -0.3% for the month. But, due to the annual revisions in the household survey from which they are derived, December 2021 was their new all-time high:

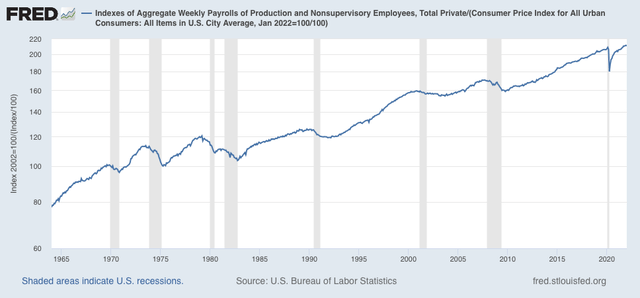

For the past 50+ years, only when aggregate real wages have retreated from peak for 3 to 9 months, has recession typically followed:

So, a blip, but not bad news.

The conclusion I have written for the previous 2 months continues to be true now, with only slight modifications: while real wage growth has halted, depending on which measure we use, it has not gone into reverse. This is consistent with taking a near term recession off the table for now. On the other hand, we certainly are at a point where a deceleration beginning with the consumer sector of the economy is more likely than not.