Resurrecting the metric: initial claims lead the unemployment rate; no recession signal so far Initial jobless claims declined -2,000 to 229,000 last week, vs. the 50+ year low of 166,000 set in March. The 4 week average rose from 4,500 to 223,500, compared with the all-time low of 170,500 eleven weeks ago. Continuing claims rose 5,000 to 1,315,000, which is 9,000 above their 50 year low of 3 weeks ago: Initial claims have been in an uptrend over the past 2.5 months. If this continues until the end of this month, they will no longer qualify as a “positive” in my array of short leading indicators, although they have not risen to levels that would change their rating to a negative. Since the normal DOOOMers are baying that we are already in a

Topics:

NewDealdemocrat considers the following as important: Unemployment, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Resurrecting the metric: initial claims lead the unemployment rate; no recession signal so far

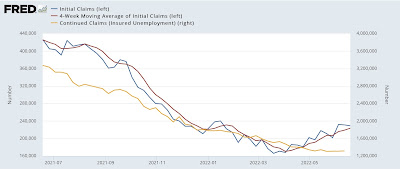

Initial jobless claims declined -2,000 to 229,000 last week, vs. the 50+ year low of 166,000 set in March. The 4 week average rose from 4,500 to 223,500, compared with the all-time low of 170,500 eleven weeks ago. Continuing claims rose 5,000 to 1,315,000, which is 9,000 above their 50 year low of 3 weeks ago:

Initial claims have been in an uptrend over the past 2.5 months. If this continues until the end of this month, they will no longer qualify as a “positive” in my array of short leading indicators, although they have not risen to levels that would change their rating to a negative.

Since the normal DOOOMers are baying that we are already in a recession, now is a good time to resurrect the construct that initial jobless claims lead the unemployment rate.

Why? Well, for example, the Sahm Rule is that when the 3 month moving average of the unemployment rate rises by 0.5% relative to its low in the previous 12 months, you’re in a recession. That’s somewhat conservative. On at least two occasions, 1953 and 1970, the unemployment rate only went up 0.1% for 1 month before a recession started. Paul Volcker started a recession in 1981 where the unemployment rate hadn’t moved up at all!

But in general, while the unemployment rate is a lagging indicator coming out of a recession, it is actually a negatively over-sensitive one, as it is a slightly *leading* one going into recession.

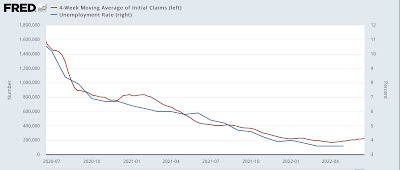

With that in mind, here is the long term graph of initial jobless claims (red) vs. the unemployment rate (blue, right scale):

Typically a uptrend in initial claims leads an uptrend in the unemployment rate by 2-4 months.

Here’s the past two years:

The very mild uptrend in initial claims we’ve had in the past several months is similar to the one at the beginning of 2021 during the first winter wave of the pandemic. That led to a pause in the decline of the unemployment rate a few months later during spring 2021.

At worst, the current uptrend in claims (so far!) is consistent with a potential 0.1% uptick in the unemployment rate going into autumn.

This means, while it’s not impossible, it’s very unlikely that the unemployment rate will signal the onset of a recession during that time.