As winter has begun to subside (finally) the real flurry of activity has to happen in short time, as in an every ray of sunshine has to be captured kind of thrust into the growing season. This is also the poorest time you will see farmers as they dump their entire wealth into yet another growing season. I can confirm; we’ve been running for a week straight and have committed the kids toothfairy money to compost, with no end in sight. My son will most likely want 25% interest compounded. Last time I wrote about input costs, we focused on the monocrop, thousands of acres corn fields where we can see 0 per acre inputs is about where we come in at. We have had dangerously high inflation this past year with fertilizer and chemicals either

Topics:

Michael Smith considers the following as important: agribusiness, Hot Topics, Michael Smith, small business, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Joel Eissenberg writes How Tesla makes money

NewDealdemocrat writes January JOLTS report: monthly increases, but significant downward revisions to 2024

As winter has begun to subside (finally) the real flurry of activity has to happen in short time, as in an every ray of sunshine has to be captured kind of thrust into the growing season. This is also the poorest time you will see farmers as they dump their entire wealth into yet another growing season.

I can confirm; we’ve been running for a week straight and have committed the kids toothfairy money to compost, with no end in sight. My son will most likely want 25% interest compounded.

Last time I wrote about input costs, we focused on the monocrop, thousands of acres corn fields where we can see $400 per acre inputs is about where we come in at. We have had dangerously high inflation this past year with fertilizer and chemicals either increasing 300% or not available at all. Glyphosate for one, as the chemical companies can’t make Roundup for the next three months. Equipment costs are up 26% making that new tractor a case for next year. On the other hand, we’ve seen corn hit $6 a bushel and soybeans topping $16…and that’s not necessarily where they stop as Brazil crops start coming off the land very, very low in yield.

* * * * *

I want to focus on the small grow operation, the vegetable farmers.

The current 2022 first season input costs are up significantly. In some cases, the season is once a year, others two, as the two season outfits get to realize revenue more than the once a year growers with two growing seasons. Texas, Florida, California and a few southern regions have the benefit of two seasons, everyone else gets one.

Vegetable farms are usually not large 500 acre patches of dirt like most cattle operations or corn fields are. Some can be that large such as California citrus and avocado orchards. Some onion farms can be 50 to 100 acres, potatoes in Idaho about the same. Those outfits are monocrop but directly edible. Their product is released directly into the food supply.

This year our per acre costs have dramatically increased. For example, on our diversified produce operation, seed costs just for the spring croppage came in at $550 an acre, up about $100. General expenses such as irrigation (up $25 a month), seed trays, compost, seed mix, fertilizer (up 3x) and fuel (ever increasing), to name a few. Now, we can still run a modest profit as long as we have a good crop year and no surprises. One acre of tomatoes, for example is going to yield us anywhere from 10-30 pounds of produce per plant and given certain cultivars, we can plant 2,600 to 5,800 plants per acre. The large variance is due to staking, or not, double rowing, cultivar, greenhousing, etc. Here is one farm in Kenya that produces 39,600 pounds per season on his one acre.

My calculations of my acre are a bit different, so here is my math:

One acre of Roma’s at a typical yield of 20 pounds per plant and we are planting 1,900 plants, rowed single, open field. We should yield 38,000 pounds of produce the first season if we are not too hot and get the right amount of rain. Walmart is selling vine ripe tomatoes (which are neither ripe when picked, or still on the vine…vines have roots) for $2 a pound. So if we are going to compete directly with Walmart and can sell all of our tomatoes (most do) we should have net revenue per acre of $76,000. That level of revenue seems rather salivary to most, which is why I always caution folks when they start doing math and get ‘Goldmine Eyes’.

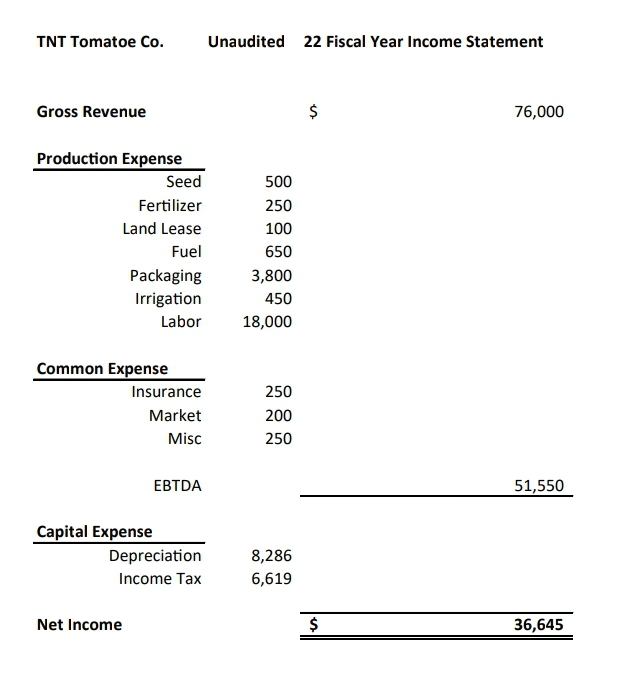

Let’s look at the TNT Tomatoe Company, who grows one acre on rented land and employs three 1099 employees for 40 hours a week for ten weeks at $15 an hour and has the revenue figures from above. Their income statement at the end of the year, assuming they have a great year with plenty of rain, sunshine, sales, and pests don’t spoil the crop:

Per acre return this is immense. We didn’t assume any complications, or things like specific equipment. This is a straight forward look at a single crop year with median expense and average conditions.

Yes, this can become viable income, however this is the best case scenario, and as the operation scales, will be more complicated, and profitable. Yet we also have to calculate your time. If you are running six days a week and averaging ten hours a day, all year round, for 51 weeks a year, you average $12 an hour, which is less than you are paying your employees. This can be a short term, bare bones operation, yet again, as your business scales, capital expenditures rise, labor costs rise, input costs rise, your value largely stays the same. One hiccup and the pencil of doom wields it’s ugly power, but surviving and making a livable income from farming is not only possible, but likely probable in the future. It just takes your time.