First the US poverty gap is on the order of 0 billion per year. That is the sum over all households with income under the poverty line of the amount that household’s income is below the poverty line. That is a small amount of money compared to US GDP or even US Federal Government spending. This uses the official poverty line which is very low (and the official pretax cash income which leaves out the earned income tax credit and SNAP (the program formerly known as foodstamps). What is the problem (please don’t ruin my punchline by shouting “Joe Manchin”). First just bringing income up to the poverty line would imply all people who are currently poor would face a 100% tax rate — more market income implies a one for one cut in benefits and

Topics:

Robert Waldmann considers the following as important: eliminate US Poverty, Healthcare, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

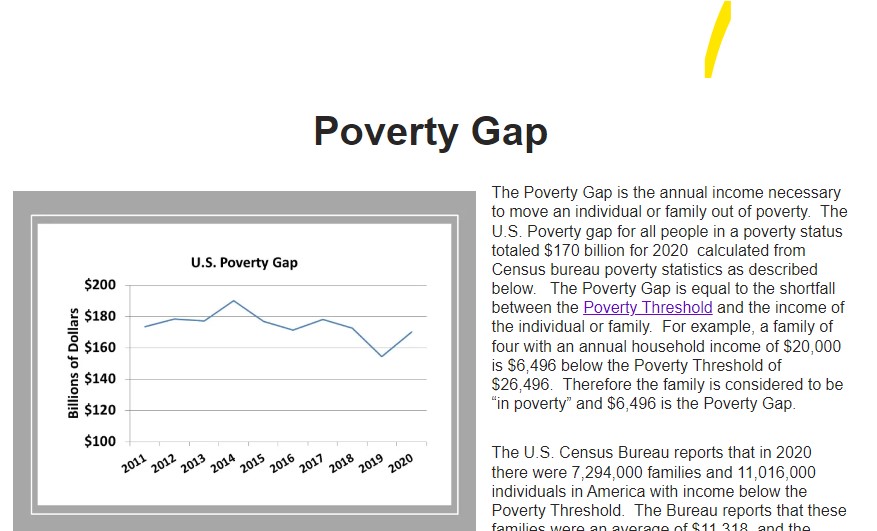

First the US poverty gap is on the order of $180 billion per year. That is the sum over all households with income under the poverty line of the amount that household’s income is below the poverty line. That is a small amount of money compared to US GDP or even US Federal Government spending.

This uses the official poverty line which is very low (and the official pretax cash income which leaves out the earned income tax credit and SNAP (the program formerly known as foodstamps). What is the problem (please don’t ruin my punchline by shouting “Joe Manchin”).

First just bringing income up to the poverty line would imply all people who are currently poor would face a 100% tax rate — more market income implies a one for one cut in benefits and no increased total income. That would seriously distort incentives. This means the benefits would have to phase out (I think a 50% rate is fine others might insist on phasing out slower). This means the total cost to the Treasury would be higher say about $300,000 billion a year. This is not a true social cost –the additional spending goes to the working near poor who really could use the money. It can come from the rich (or middle class) who don’t need the money so much. That’s not the problem.

It may be that there really were bad effects of AFDC before it was slashed into TANF (I am not convinced). If so (I am quite sure the old academic literature did not reach a conclusion certainly not one which corresponded to the widespread passionate hatred of AFDC). If so, I think it was due to two very silly aspects. One was the effective marginal tax rate was 70% (if I recall correctly and I think I do). The other is that the program was barely available at all to unemployed couples so the marriage penalty was huge (interestingly it was available to poor couples with childred in 25 states which were *not* the ones where people talk about family values, then in a reform extended to 50 but with a duration as low as 60 months so really like extended unemployment insurance (with a tiny benefit).

One can ask about the long term indirect effects of welfare on the culture of poverty. I think recent research makes it clear (pdf warning) that means tested programs cause lower pre-benefit poverty about 20 years later. I am not expert, but this is now a fairly large literature and, I think, an expert consensus is approaching (again I am not an expert). I think the argument that welfare has perverse effects is simply not valid for reasonably designed welfare programs (meaning reasonably slow tapering of benefits).

The cost to the not poor or near poor is not huge (we are talking about roughly 1% of GDP). There would be no need to raise taxes on the lower 99% to fund it.

So what is the problem ? OK Joe Manchin (also Kyrsten SInema on funding it). Also mostly I think ideology [cough]racism[cough]. I am pretty sure the proposal would not be popular. I think there is hatred of the idea that someone might choose not to work but rather live on welfare which is totally out of proportion to the cost of supporting them, the number who would make that choice, or the long term effects of kids seeing people who made that choice.

The debate is reopening. it is true that there was majority support for build back better which would have gotten us about half the way there (for families with children and maybe more 40% of the way towards eliminating child poverty). It is also true that public support for permanent expansion of the expanded fully refundable child tax credit was limited.

I think the debate is open (like everything it depends on Democrats keeping the house (538 prob 29%) and getting at least 52 Senators (538 probability 40% (I counted the blue dots)). Highly correlated so prob of both close to 29%.

I think it clear that some editors think the debate is active. The New York Times has officially joined the struggle (note this is about the decline in child poverty through 2019 *not* the additional huge decline due to Covid relief bills. The Center on Budget and Policy Priorities is, as usual, fighting the good fight. They note that the according to the Supplemental Poverty Measure (the only reasonable measure) “child poverty fell sharply in 2021 and reached a record low of 5.2 percent.” also “As recently as 2018, 13.7 percent of children were below the SPM poverty line, ” This shows we can do it (in spite of high unemployment). “The expanded Child Tax Credit alone kept 5.3 million people above the annual poverty line” it costs about $105 billion per year (pdf warning)