In May of 2023 The Billion Scam At The Heart Of Medicare Advantage, PNHP, Matthew Cunningham-Cook and Andrew Perez, Lever News, May 2023. Health insurance company Humana enjoyed a banner year in 2022. Humana made .8 billion in profits in 2022, while paying out 8 million in dividends to shareholders, and paying more than million in compensation to its CEO. One of the main inputs to those earnings was the federal government’s .5 billion in overpayments to Humana and other private Medicare Advantage insurers. These private MA manage their insurance plans on behalf of seniors and people with disabilities. If not for the CMS authorized overpayments, Humana could have suffered an ~ 0 million loss in 2022 (Lever Analysis). Humana

Topics:

Angry Bear considers the following as important: Healthcare, Medicare Advantage, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

In May of 2023 The $20 Billion Scam At The Heart Of Medicare Advantage, PNHP, Matthew Cunningham-Cook and Andrew Perez, Lever News, May 2023.

Health insurance company Humana enjoyed a banner year in 2022. Humana made $2.8 billion in profits in 2022, while paying out $448 million in dividends to shareholders, and paying more than $17 million in compensation to its CEO.

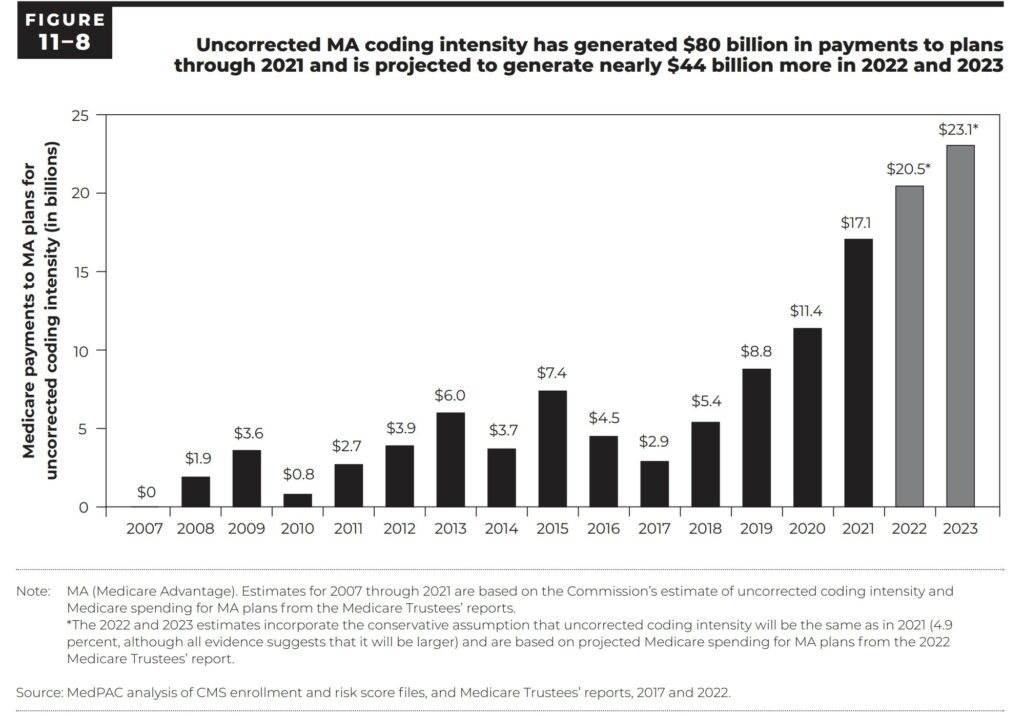

One of the main inputs to those earnings was the federal government’s $20.5 billion in overpayments to Humana and other private Medicare Advantage insurers. These private MA manage their insurance plans on behalf of seniors and people with disabilities. If not for the CMS authorized overpayments, Humana could have suffered an ~ $900 million loss in 2022 (Lever Analysis).

Humana is an example of how insurers built a major cash cow out of systematically overbilling Medicare Advantage. Much of the overbilling was the result of over coding, denial of services, delay of care, etc. plus the CMS percentages added to the charges by the Medicare Advantage plans. The overpayments are symptomatic of a broader profit-driven policy agenda seeking to privatize Medicare. Corporate entities like Humana advertise special programs such as healthcare clubs, dental and eye care, etc. at similar costs to which CMS adds a percentage to the charges to compensate for the additional services. Services which are not allowed for Medicare to offer.

Medicare Advantage plans have higher claim denial rates and more prior authorization restrictions than traditional Medicare plans. Last year, regulators found that nearly one in five payment requests rejected by Medicare Advantage plans in 2018 were wrongfully denied, representing an estimated 1.5 million claims.

MedPAC March 2023 Report to the Congress: Medicare Payment Policy

Industry-Wide and Sponsor-Specific Estimates of Medicare Advantage Coding Intensity, Richard Kronick, F. Michael Chua :: SSRN

2023-Annual-Report.pdf (chiamass.gov)

MedPAC, March 2023 Report to the Congress: Medicare Payment Policy, Page 354 (graph)

The federal government spent $20.5 billion overpaying Humana and other private insurers for the Medicare Advantage plans they manage on behalf of seniors and people with disabilities. If not for those overpayments, Humana could have suffered a nearly $900 million loss in 2022, according to a Lever analysis.

Humana is the most prominent example of how insurers have built a major cash cow out of systematically overbilling Medicare Advantage, the private Medicare program operated by private interests. These overpayments are symptomatic of a broader profit-driven policy agenda that seeks to completely privatize Medicare, one of the nation’s most popular social programs, and lock program recipients into subpar private insurance plans, even when they get sicker and need the best care possible.

Humana sues feds over Medicare Advantage risk adjustment changes, fiercehealthcare.com, Paige Minemyer, Sep 1, 2023 (below).

Humana has filed suit against the feds, saying the Biden administration’s bid to claw back overpayments in Medicare Advantage (MA) is built on “shifting justifications and erroneous legal reasoning.”

Earlier this year, the Centers for Medicare & Medicaid Services (CMS) finalized a hotly anticipated rule that would overhaul risk adjustment data validation (RADV) audits, which determine whether MA plans were overpaid. In a win for insurers, the agency elected not to backdate these audits beyond 2018.

However, CMS did nix the so-called fee-for-service adjuster, which payers argued was critical to ensuring parity between traditional Medicare and MA. The adjuster accounted for errors in Medicare data that the industry argued could lead MA plans to be underpaid.

CMS determined in the initial pitch for a RADV overhaul, proposed in 2018, that the adjuster was not necessary. It maintained that stance in the final rule, arguing that it was backed up by a 2021 court decision that said the adjuster had no mathematical basis.

Lots or reading and references. Enough said. . .