CRFB’s FINAL ANALYSIS OF 2023 SOCIAL SECURITY TRUSTEES REPORT Analysis of the 2023 Social Security Trustees’ Report, Committee for a Responsible Federal Budget, Social Security Dale Coberly: I reported a few days ago on CRFB’s “preliminary analysis” of the 2023 Social Security Trustees Report. I hoped to show then that though CRFB reported “true” facts, they surrounded those facts with misleading language intended to promote hysteria and ill-considered policy changes that would destroy Social Security as meaningful retirement insurance. I said then that I would look at their final report. I have. It is essentially the same as the preliminary report: True facts designed to mislead. I won’t have time for a complete discussion

Topics:

Angry Bear considers the following as important: CRFB 2023, Dale Coberly, politics, social security, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

CRFB’s FINAL ANALYSIS OF 2023

SOCIAL SECURITY TRUSTEES REPORT

Analysis of the 2023 Social Security Trustees’ Report, Committee for a Responsible Federal Budget, Social Security

Dale Coberly:

I reported a few days ago on CRFB’s “preliminary analysis” of the 2023 Social Security Trustees Report. I hoped to show then that though CRFB reported “true” facts, they surrounded those facts with misleading language intended to promote hysteria and ill-considered policy changes that would destroy Social Security as meaningful retirement insurance.

I said then that I would look at their final report. I have. It is essentially the same as the preliminary report: True facts designed to mislead.

I won’t have time for a complete discussion of their analysis today, but I’d like to point at a couple of things that hit me in the eye.

First, they have a Social Security “reformer tool”: The Reformer: An Interactive Tool to Fix Social Security (crfb.org). You can enter your own proposals to fix SS shortfall and it will tell you how well it reforms Social Security in terms of closing the long term projected actuarial deficit. [Note the is an actuarial deficit and not a real deficit or debt, and it has nothing to do with the Federal Budget deficits and debt. CRFB does not tell you that,]

But he calculator limits your choices. In particular it does not allow a gradual increase in the payroll tax rate. We have shown that a one tenth of one percent increase (about a dollar per week) per year would make SS solvent forever after a few years while real wages are expected to go up over one full percent per year. So, like George W Bush’s Social Security Commission, everything is on the table except what works.

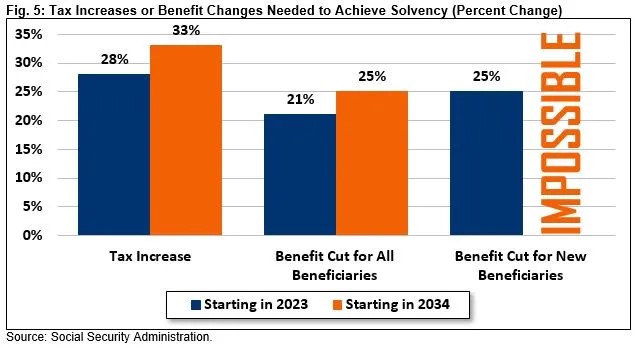

Second, they produce a chart* which shows that the tax increase that would be needed is 38%.link But this is 38% of a 6% tax (for the worker) or about a 2% increase in the tax as a percent of wages. An amount already shown to go unnoticed by almost all workers.

Moreover they do not bother to point out that this is not a real tax. It is an increase in the amount of money you need to put aside for your own retirement… and would need to put aside whether there was a Social Security tax or not. But with Social Security you are guaranteed to get it back, .about three times over, when you need it most…, due to the automatic “interest” that comes from pay as you go financing [other things being equal the next generation paying for its own future retirement, pays at the same tax rate, an amount automatically adjusted for inflation and growth in the economy. This is NOT “the young paying for the old” it is just where money comes from in any financial instrument that takes in money today and pays out with interest later.]

That means that if you pay a 10% tax on a 50 k income, or about 5k per year, by the time you retire in 35 or 40 years, the guy paying for his own retirement at the same tax rate of 10% but on an income that would be about three times yours, or about 150k, would pay about 15k into Social security, which is where your benefits would come from. in this case about 30k per year.

Note the doubling of what he pays in to calculate your yearly benefit comes from the fact that there are two workers per beneficiary, or, what is the same thing: the fact that you will live in retirement about two years for every year you worked.

Note this is only an example I maded up to demonstrate how pay-go works. The real situation is a little more complicated.

As I said above this is only a quick take from CRFB’s “analysis” which utterly fails to provide an honest analysis of what the Trustees Report actually means to the average worker. I should have more to say about it in the fairly near future.

CRFB: “Delaying action until 2034 would make the needed tax increases or benefit reductions about one-fifth larger than if action were taken today. According to the Trustees, 75-year solvency could be achieved with a 28 percent (3.4 percentage point) payroll tax increase today but would require a 33 percent (4.2 percentage point) increase in 2034. Similarly, Social Security solvency could be achieved with a 21 percent across-the-board benefit cut today, which would rise to 25 percent by 2034….”

I will leave it to you to decide if this, while true, is intended to mislead…like pulling a red handkerchief out of your pocket “33% tax increase” while saying fast and low “(4.2 percentage point)”. I am more than a little jaded myself from reading CRFB reports over the years and then seeing how people “understand” them.