Some Points . . . Healthcare services slight increases as a share of total consumer spending in the quarter, rising from 15.9 percent to 16.0 percent of total consumption and down from 17+ percent. Hopes are healthcare stays at that rate. Structure investment increases at a 9.7 percent annual rate after growing at a 15.8 percent annual rate over two qtrs. Driven by factory construction growing at a 94.0 percent annual rate. Equipment investment growing at a 10.8 percent annual rate after falling in the prior two quarters. Those drops were likely from continuing supply chain problems with cars and semiconductor chips. The rest you can read. GDP: Soaring Structure Investment Makes Up for Slowing Consumption, as GDP Grows at 2.4 Percent in Q2,

Topics:

Angry Bear considers the following as important: CEPR, Dean Baker, First two Qtrs 2023, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

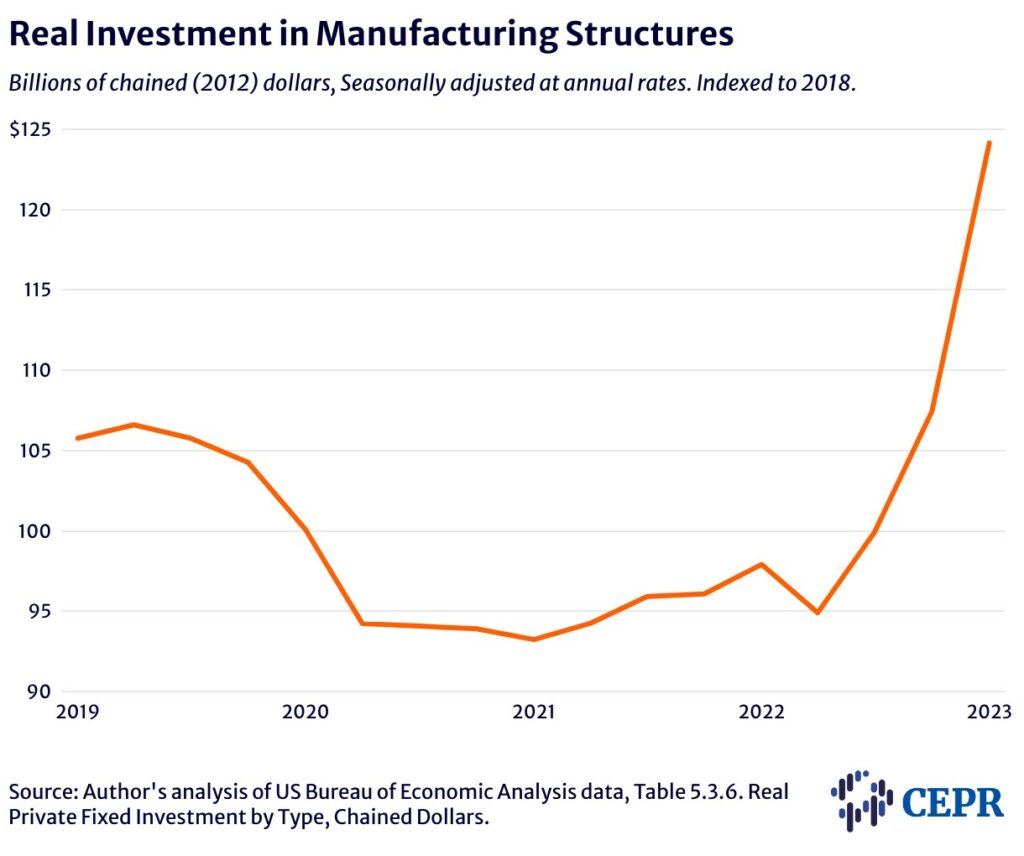

Some Points . . . Healthcare services slight increases as a share of total consumer spending in the quarter, rising from 15.9 percent to 16.0 percent of total consumption and down from 17+ percent. Hopes are healthcare stays at that rate. Structure investment increases at a 9.7 percent annual rate after growing at a 15.8 percent annual rate over two qtrs. Driven by factory construction growing at a 94.0 percent annual rate. Equipment investment growing at a 10.8 percent annual rate after falling in the prior two quarters. Those drops were likely from continuing supply chain problems with cars and semiconductor chips.

The rest you can read.

GDP: Soaring Structure Investment Makes Up for Slowing Consumption, as GDP Grows at 2.4 Percent in Q2, Center for Economic and Policy Research, Dean Baker

The economy grew at a 2.4 percent annual rate in the second quarter, as strong investment growth offset slower consumption growth. Consumption spending grew at just a 1.6 percent annual rate, down from a 4.6 percent rate in the first quarter. However, non-residential investment grew at a 7.7 percent rate. Investment accounted for 0.99 percentage points of the growth in the quarter, only slightly less than the 1.12 pp attributable to consumption.

Soaring Factory Investment Continues to be a Major Factor Driving Growth

All the categories of investment showed healthy growth in the quarter, with equipment investment growing at a 10.8 percent annual rate after falling in the prior two quarters. Those drops were likely driven largely by continuing supply chain problems with cars and semiconductor chips.

Structure investment increased at a 9.7 percent annual rate after growing at a 15.8 percent annual rate the last two quarters. This is driven by factory construction growing at a 94.0 percent annual rate. This is the clean energy and chip boom, resulting from the Inflation Reduction Act and CHIPS Act.

Investment in intellectual products grew at a modest 3.9 percent rate. The weakness is partly attributable to the writers’ strike, as investment in the entertainment category fell at a 1.2 percent rate after growing at a 5.5 percent rate in the first quarter.

Service Consumption Drives Growth in the Quarter

There was a huge surge in vehicle sales in the first quarter, which led to a 16.3 percent growth rate for durable goods. Vehicle sales fell somewhat in the second quarter, resulting in a modest 0.4 percent growth rate for durable goods. This was offset by a healthy 2.1 percent growth rate in consumption of services.

This is a sustainable pace, similar to the growth rate we were seeing before the pandemic. It is also encouraging that the pace of growth in healthcare spending seems to be relatively tame. Nominal spending on healthcare services did increase slightly as a share of total consumer spending in the quarter, rising from 15.9 percent to 16.0 percent of total consumption. However, this is down from 17.1 percent before the pandemic.

If healthcare spending remains contained, this will leave a lot more room for other areas to grow. However, an important caution is that nominal spending on prescription drugs rose at a 11.7 percent rate in the second quarter, after rising at a 10.9 percent rate in the first quarter. If this rapid pace of growth continues, it will be a problem.

Housing Continues to Contract at Modest Pace

Residential construction fell at a 4.2 percent rate in the second quarter after falling at a 4.0 percent rate in the first quarter. This subtracted 0.16 percentage points from growth in the quarter. Housing construction fell at double-digit rates in the last three quarters of 2022, subtracting an average of 1.18 pp from growth in these quarters.

Residential investment is likely to be a modest negative in the rest of this year. Mortgage refinancing, the costs of which get counted in residential investment, fell off sharply in the last three quarters of 2022, but has little room to fall further. However, there will be some continued slowing as the falloff in housing starts we saw since the Fed began raising rates, shows up in a drop in homes under construction. This effect has been delayed by the large backlog of unfinished homes created by pandemic supply chain issues.

Government Spending Grows at a 2.6 Percent Rate

The growth of government spending slowed to a 2.6 percent annual rate after growing at a 5.0 percent rate in the first quarter. The first quarter’s growth was driven by a 10.5 percent rise in non-defense federal spending. Spending in this category tends to be erratic, it fell at a 1.1 percent rate in this quarter. State and local spending grew at a 3.6 percent rate, down somewhat from the 4.4 percent rate in the first quarter.

Inventories Grew by Just $9.3 Billion in the Second Quarter

The rate of inventory accumulation plunged to just $3.5 billion in the second quarter, a drop from $136.5 billion in the fourth quarter. That falloff subtracted 2.14 pp from the quarter’s growth. The patterns in inventory accumulation have been even more erratic than usual in the pandemic and recovery due to supply chain issues.

The second quarter pace is still unusually low. A more normal pace would be in the neighborhood of $60 billion. This means we are likely to see some acceleration in inventory accumulation in the second half, which will be a modest boost to growth. However, this is offset by the fact that a large share of inventories comes from imports, which means that a rising trade deficit will be a drag on growth.

Healthy Q2 Growth Implies Strong Productivity Growth in the Quarter

The index of aggregate hours from the establishment survey data was essentially flat in the second quarter, while self-employment was down from the first quarter. Value-added in the non-farm business sector (the numerator in the productivity calculation) grew at a 2.4 percent rate in the second quarter. This means that we should see a very strong productivity figure for the quarter.

That follows a reported decline of 2.1 percent for the first quarter. Quarterly, productivity data are always erratic, but have been even more erratic than usual in the pandemic recovery. The growth rate of productivity we are likely to see for the second quarter should put the post-pandemic productivity growth path somewhat ahead of the 1.0 percent rate we saw in the decade before the pandemic. If we see the promised benefits of AI, we would expect to see a faster growth rate.

Inflation Continues to Slow

The core PCE rose at a 3.8 percent annual rate in Q2, down from a 4.9 percent rate in Q1. It had peaked at a 6.0 percent rate in the second quarter of 2021. With the prices of most inputs now stabilized or falling, and rental inflation slowing sharply, this downward path should continue for the second half of 2023.

On the Whole, a Very Solid GDP Report

There is a lot to like in this report. The economy is growing at a solid sustainable pace, with strong investment growth making up for slower consumption growth. Inflation is slowing and likely to continue to do so. And, we will get a very strong productivity number for the quarter. It would be difficult to envision a better picture at this point in the recovery.