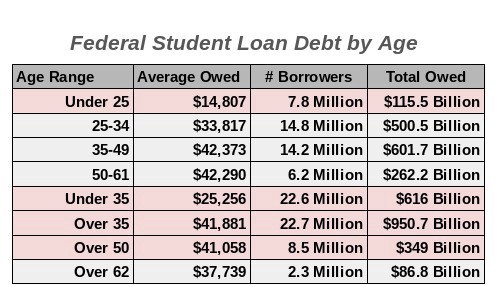

I have known Alan Collinge of Student Loan Justice for multiple years now. He has been prompting some type of relief for those who will never be able to payback these loans or are in default. Portfolio-by-Age.xls (live.com) as taken from here: Federal Student Loan Portfolio | Federal Student Aid The information in the chart above is from EOY 2020 and the Federal Student Loan Portfolio, Federal Student Aid, “Portfolio by Age” The General Link and which Chart (link) the data is taken from to back up my numbers is also above. For the over 62, tack on another billion for EOY 2022. Three hundred- thousand more people are in this category. The average amount of time to pay back was 15 -17 years at 0/month. From over 50 and above, these debts

Topics:

Angry Bear considers the following as important: Alan Collinge, Education, politics, Student Loan Justice Org, Student Loan Portfolio

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

I have known Alan Collinge of Student Loan Justice for multiple years now. He has been prompting some type of relief for those who will never be able to payback these loans or are in default.

The information in the chart above is from EOY 2020 and the Federal Student Loan Portfolio, Federal Student Aid, “Portfolio by Age” The General Link and which Chart (link) the data is taken from to back up my numbers is also above.

For the over 62, tack on another $20 billion for EOY 2022. Three hundred- thousand more people are in this category. The average amount of time to pay back was 15 -17 years at $250/month. From over 50 and above, these debts will never be paid 100%.

Much of this is Joe Biden’s fault from his opposing Student Loan relief since 1990.

“The Government makes a Profit on Defaulted Student Loans,” Student Loan Justice Org., Alan Collinge

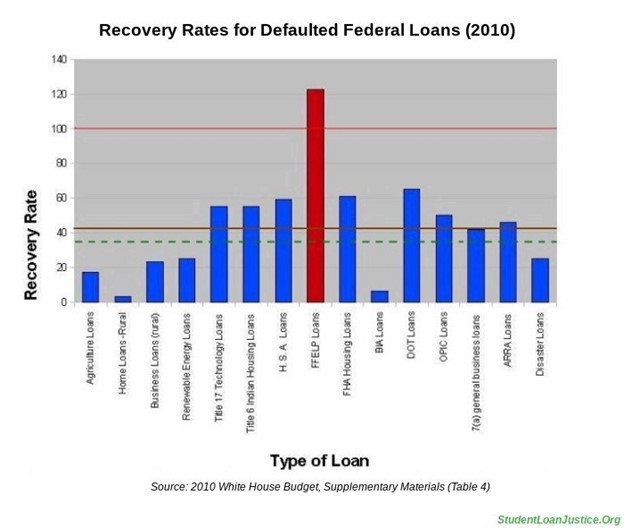

In 2010, we found the federal government was making a profit, not a loss, on defaulted student loans. This is a claim no other lender for any other type of loan (including governmental loans) can make. More recent White House Budget data shows that this is still true today The profitability of student loan defaults is certainly far greater today than in 2010. Making a profit on defaulted loans is a defining characteristic of a predatory lending system. Citizens everywhere should be concerned.

The 2010 White House Budget reported a recovery rate on defaulted FFELP (federally guaranteed) loans of 122%. All other loans the government made or insured that year had an average recovery rate of about 34%. No other loan types exceeded a 100% recovery rate, or even came close. At the time, the large majority of all federal student loans were of this category, where the government does not make, but rather guarantee.

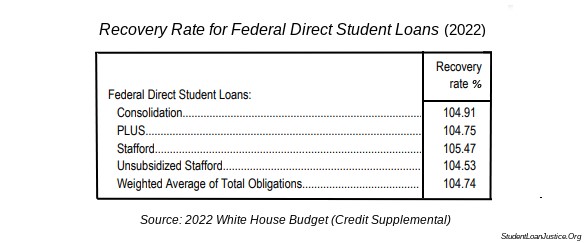

More recent White House Budget Data (2022), shows that this trend has continued for the Direct Loan Program (where the government makes and holds the loans, rather than just guarantee them), with an average recovery rate of over 100%. Similar to the 2010 data, student loans were the only type of loan that could be found in the federal portfolio for which the recovery rate exceeded 100%.

Recovery Rate for Defaulted, Direct Student Loans, 2022

Importantly: Unlike the older, FFELP (federally guaranteed) loans, Direct Loan recoveries are far more profitable than FFELP loans because the interest is built into Direct Loans.

For defaulted FFELP loans, the government, makes no interest on the loan prior to default. The claim amounts to the entire balance of the loan at the time of default, which includes both unpaid principal and interest.

For Direct Loans the government paid a much smaller principal when the loan was originally made. Whereas the value of the loan at the time of default typically includes a large amount of interest and accrues to the government rather than a private lender. The recovery rate for both is calculated by comparing the amount recovered to the balance of the loan at the time of default.

So while the recovery rate for Direct loans are lower than that for defaulted FFELP loans, the profitability of these recoveries is inherently far, far greater. There is no other lending system in existence in this country where the lender can claim to be making a profit on defaults.

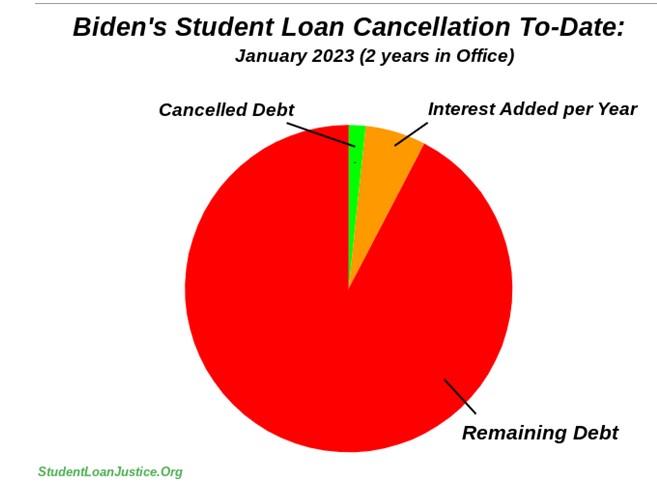

Student Loan Portfolio Accumulate Interest from Default

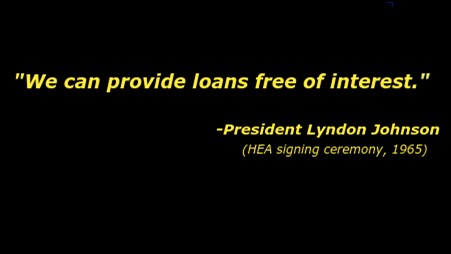

A loan portfolio which accrues nearly $100 billion in annual interest, where loans in default are actually profitable and very few loans are being cancelled as is the case with the federal student loan program. It is literally impossible to lose money on these loans. The program can only be making money from the defaults and a lot of it. All of this profit for loans, President Lyndon Johnson said would be “free of interest” when he signed the Higher Education Act into law in 1965.

Default profits depicted . . . .

What is most disturbing: The default rate for people leaving school in 2004 is estimated to be 40%, and is likely a low figure since the estimates were based on voluntary surveys. Many borrowers in default are inherently unlikely to fill out. The class of ’04, however, was only borrowing about a third of what students are borrowing today. Moreover, even before the pandemic, 85% of all federal student loan borrowers were underwater (ie not paying, or paying but with an increasing balance) on their loans, and nearly 60% weren’t making payments.

With 3 years of nearly universal non-payment due to the pandemic, this non-payment rate will escalate when repayment is again demanded from the borrowers. It is not at all unreasonable to expect that 70% or more of these borrowers will wind up in default on their federal loans when the system is turned back on. The student loan default is many multiples of the sub-prime home mortgage default rate of 20% in comparison. So, by all rational metrics, this lending system is in catastrophic failure.

Seventy Percent of Borrowers will be in Default

We believe it to be not at all unreasonable to expect that 70% or more of borrowers will wind up in default on their federal loans when the lending system is turned back on.

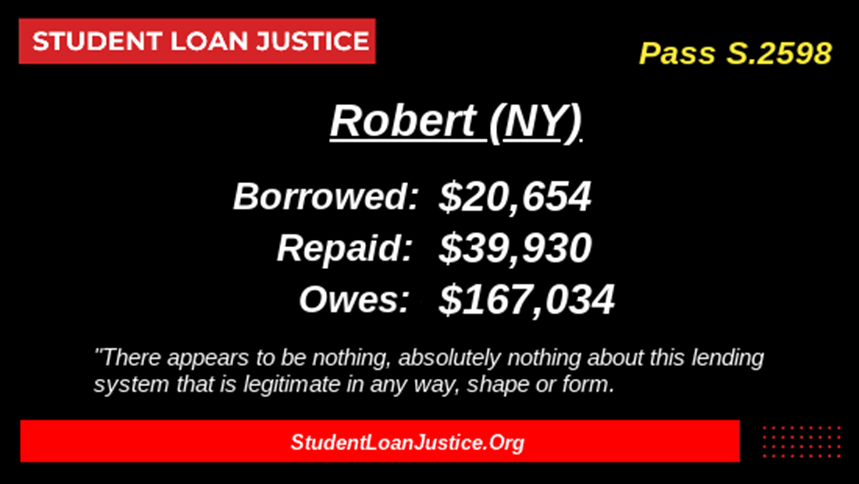

Unprecedented, and unwarranted of both bankruptcy rights, and statutes of limitations lie at the core of the student loan problem. In the absence of these protections, the lending side (up to and including the Department of Education) can- and does use this power to extract vast sums of wealth ruining the lives of borrowers, (one example below). The human cost of the predatory lending system has been massive. The harm that is poised to be exacted on the citizenry is incalculable.

One example of the people who have been harmed by these loans:

This cannot and should not continue. At a minimum, constitutional bankruptcy rights must be returned to these loans. The catastrophic proportions of this failure, however, are such that it probably would be best to simply cancel the loans, end the lending system, and replace it with a more rational, rationally priced, and fair higher education funding plan.

If you agree, please sign this petition.