This is the second part of the ABC 6 On Your Side web series on hidden reasons for high drug costs, we’ll show you why you may never see that aid. If you had time, you may have read Part One. It covered how Ohio HB 135 lingered till it died by not taking the bill up in the Senate Health Committee. A bill designed to cut drug prices for many Ohioans HB 135 won unanimous approval in the House last year. The bipartisan passed measure with 60 co-sponsors seemed to be good bet to become law. I rewrote much of this to make it easier to understand and also checked the links to see if what was said matched the links. It is a good piece and provides examples of how PBMs are gaming the system. Part 2, Billions meant to help patients afford drugs being

Topics:

Bill Haskell considers the following as important: HB 135, Healthcare, law, Ohio, PBMs, politics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

This is the second part of the ABC 6 On Your Side web series on hidden reasons for high drug costs, we’ll show you why you may never see that aid. If you had time, you may have read Part One. It covered how Ohio HB 135 lingered till it died by not taking the bill up in the Senate Health Committee. A bill designed to cut drug prices for many Ohioans HB 135 won unanimous approval in the House last year. The bipartisan passed measure with 60 co-sponsors seemed to be good bet to become law.

I rewrote much of this to make it easier to understand and also checked the links to see if what was said matched the links. It is a good piece and provides examples of how PBMs are gaming the system.

Part 2, Billions meant to help patients afford drugs being diverted to make higher profits, WSYX, Darrel Rowland

That’s because little-known but powerful middlemen in the drug supply chain called pharmacy benefit managers and their partners are intercepting hundreds of millions of dollars that drugmakers had designated for needy patients – and making a handsome profit doing so.

Pfizer ad offering copay help.

The need for funds from pharmaceutical companies to afford their drugs is widespread. Stephanie Hengst, manager of policy and research for The AIDS Institute . . .

“Whether you have a chronic illness or not, or you’re facing this directly or not, you probably have a family member somewhere who is. Adding . . .

Or, who knows: Tomorrow you could get a diagnosis. And so, I think we all kind of have a stake in it.”

American Cancer Society (July 2022) survey of cancer patients and survivors. Eighty-three percent of those getting help from drug manufacturers say the financial assistance “enables them to get the medication they otherwise couldn’t afford.”

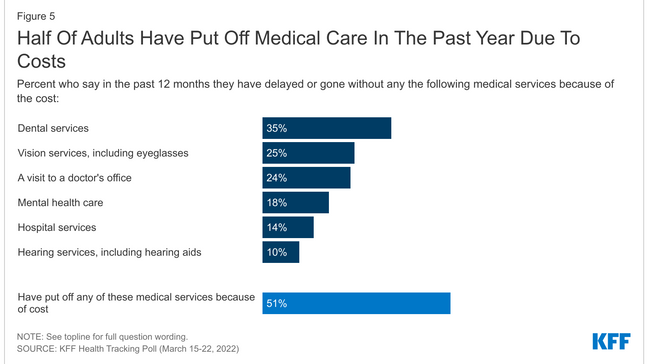

Health care affordability is regularly ranked among the most important issues facing America. A KFF poll shows half of the adults in the U.S. say they or a family member put off medical treatment due to cost.

Stephanie Hengst told ABC 6 she knows of countless people with serious ailments who rely on aid from drugmakers. Why? Because they don’t have adequate insurance to pay for expensive specialty drugs often needed to treat a rare or chronic disease.

“Recently I was with a couple of hemophilia families, and one child who’s I think about 7 years old has severe hemophilia. And he has an average of about $600,000 per year for his medical costs.”

Half-of-adults-have-put-off-medical-care-in-the-past-year-due-to-costs, KFF found.

PBMs typically award themselves 25% in ‘savings’ from little-known drug-pricing tactic

In the past few years, pharmacy benefit managers and their partners diverted billions in drugmakers’ assistance intended for individual patients. They use the cash to set up their own health insurance programs for major employers. And typically taking 25% share of the savings, as shown by court and other public documents.

Boston’s Pioneer Institute (Public Policy Research) in a recent study . . .

“The confiscation of these funds causes higher out-of-pocket obligations for the patient. This in turn causes patients to forgo care. Our estimate is delayed or forgone care which could increase annual health care cost by between $1.3 billion and $2.5 billion.”

Years ago, PBMs essentially were simply claims processors in the prescription drug supply chain. They’ve evolved into corporate conglomerates. Just three handle about 80% of all U.S. drug transactions. Each associates with a Forbes Top 15 company. They are playing a huge role in everything from whether your drug is covered by insurance to how much you will pay for your prescription.

The diversion tactic is so lucrative for PBMs that they offer large corporations and public institutions having self-funded health insurance plans an entire health-coverage package. The plan comes with significant savings and low and sometimes $0 copays for employees.

The 25% left over for PBMs is compounded because it’s typically based on drug’s list prices. Prices which are typically inflated way beyond the actual cost of the medicine to a PBM or health insurer.

Don’t just take our word for it: Here’s part of a transcript from a PBM webinar. Of which a part is in a federal lawsuit by a drugmaker unhappy with the PBMs’ tactics. As explained by a PBM executive of how it works.

“The way this program is set up, in order for us to capitalize on this copay assistance funding, we have to have that inflated copay up front to bill to copay assistance.”

The description is of what’s dubbed a “copay maximizer” and comes from Rachel Harmon. She was a product director at the PBM Express Scripts, a part of America’s 13th-largest company, Cigna.

The webinar for an Illinois company from February 2021 explained the inner workings of a new health-care plan promising $0 copays for many drugs and big savings for the self-insured employer.

Playing the leading role in the new setup: An obscure company named SaveOnSP, which works with the PBM Express Scripts.

Screenshot of SaveOnSP online presentation by Rachel Harmon of its pharmacy benefit partner, Express Scripts, in February 2021. The webinar is now part of a federal court lawsuit.

How categorizing life-saving drugs as ‘non-essential’ is key to this maneuver

Rachel Harmon . . .

SaveOnSP performs “an extensive amount of work,” behind the scenes’ researching drugmakers’ aids programs. All the effort goes to determine one key factor:

Which programs have the most lucrative copay assistance programs to leverage the biggest payout to the company — and PBM?

And now the radical step:

Once those sources of the most generous drugmaker assistance are identified, the health plan eliminates employees’ insurance coverage for many of those particular drugs.

How can they do that?

By deeming them “non-essential” under the Affordable Care Act, sometimes dubbed Obamacare.

Here’s how Harmon explained it:

“This is a key differentiator for SaveOn,” she said. “When you designate the drugs as non-essential, you remove the ceiling for how high you can set the member contribution.”

In other words, there is no longer any limit to the percentage of the cost a patient must pay for, say, a cancer-fighting drug.

For 2023, the Affordable Care Act out-of-pocket limit is $9,100 for an individual and $18,200 for a family. But once SaveOnSP unilaterally declares those drugs “non-essential” (from an accounting, not medical, standpoint) the copay maximizer could require multiple times those amounts.

When Iona University signed up with Express Scripts and SaveOnSP, the New York school found the “non-essential” drug category includes medications treating hepatitis C, multiple sclerosis, psoriasis, inflammatory bowel disease, rheumatoid arthritis, cancer and many others.

Employees may panic when they realize they in effect don’t have insurance coverage for needed medicines that are among the most expensive on the market. But under the twisted logic of this drug-pricing setup, an uninsured patient is viewed as a good thing.

That’s because now this theoretically “uninsured” or underinsured patient is more likely entitled to maximum financial help from the drugmaker — and thus the PBM gets maximum profit.

A scene from Uptown Pharmacy in Westerville. (WSYX/Ryan Taylor)

The heart of it all? PBMs ‘pay’ for pricey prescription drugs, but not wjth a dime of their own

Once employees realize their dilemma and contact their health plan, they will get what Express Scripts describes as a “warm transfer” to SaveOnSP.

The PBM partner will either guide the employee through the process to obtain maximum assistance from the pharmaceutical company or complete the work itself.

But the employee never sees the money, since the drugmaker’s aid goes straight to cover the maximized copay.

This is how the PBM and its partner make the big bucks:

Their insurance plan just “paid” for a very expensive prescription drug – and didn’t use a dime of its own money.

Instead, it was the drug company’s money used to fulfill an obligation normally covered by a PBM/health insurance company.

The cash adds up quickly for the PBM. Rachel Harmon gave an example of the amount made from just one drug:

“(To get drugs to treat) Hepatis C, the average amount of assistance per fill is $6,600. We would literally set the patient copay to $6,600 and you would save that amount on every fill.

The plan gets a maximum cost offset at the point of sale from that manufacturer assistance program.”

So that is $6,600, for one drug, for one patient, and in one plan.

SaveOn says it covers some 300 drugs in health plans across the country. The company regards the list as proprietary.

But even that’s not the end to maximizing profit. Once employees get funding for the specialty drugs they need, the prescription with the already-inflated price must go through Accredo Health Group – Express Scripts’ own specialty pharmacy.

Billions in patient aid from drugmakers kissed off as a mere PR stunt

Asked during the webinar how she justified diverting huge amounts in pharmaceutical manufacturers’ money intended for needy patients. She dismissed the aid as merely a PR stunt by PhRMA. Thus the money is there for the taking.

“We purely view these funds as marketing dollars,” she said. “So PhRMA puts, we estimate, roughly $15 billion in the industry of copay assistance programs today. And they do it under the guise of making drugs more affordable and accessible to the patients that need them.”

An Express Scripts spokesperson emailed this response when ABC 6 asked about the setup:

“The real issue here is drug manufacturers continue to increase the price of medications, and then offer copay (assistance) that research shows inflate health care costs even more. We work with employers, government entities and other health plan sponsors to build custom pharmacy benefits that meet the unique needs of their members and reduce health care costs.”

ABC 6 On Your Side reached out to SaveOnSP multiple times for comment but the company did not reply.

The PBMs’ trade organization gave us a statement from Sean Stephenson, who covers Ohio for the group:

“Drug company (assistance is) a different deal because they steer patients to brand name, more expensive, drugs, and do not have any financial/income requirements. Drug companies just hand them out to people.”

Spokespersons for some of the state’s biggest universities whose workers are covered by plans with copay maximizers say they’re happy with the setup.

For example, even with a large percentage of the savings going to the PBM and its partner, Ohio University employees get $0 copays and saved $40,000 in just the first 10 months of the program. During the same period, the university saved $1.2 million.

Stephanie Hengst, manager of policy & research for The AIDS Institute, working at the national organization’s Tampa office. (Screenshot)

Still, Hengst and other patient advocates say they see sweeping negative impact of the diverted copay assistance.

“There are a couple of patients that I know now that have needed MRIs or other surgeries and they canceled those surgeries.” AB: It is called scamming. I too would have concerns about being a part of it.

Federal government puts PBMs in the crosshairs

Pharmacy benefit managers have been under the microscope for several years by state governments across the U.S. Ohio found PBMs were charging three-to-six-times the going rate in the state Medicaid program. Last year it set up its own state supervised PBM to prevent what state officials said were repeated financial abuses.

Meanwhile, multiple congressional committees and the Federal Trade Commission are probing and pushing reform of PBM business practices.

The House Oversight Committee concluded in May “PBMs engage in self-benefitting, anticompetitive tactics which increase costs for consumers and harm patient care.”

But that’s just one of seven bills under consideration in Washington.

In June, six U.S. senators (three from each party) rolled out the Patients Before Middlemen (PBM) Act to delink the compensation of PBMs from drug prices. In theory, removing an incentive for PBMs to push for higher list prices for drugs.

The Help Ensure Lower Patient (HELP) Copays Act, introduced in April forbids PBMs and insurers from using copay accumulator programs. These programs prevent a patient from counting copay assistance toward an insurance policy’s out-of-pocket maximum.

The FTC has asked major PBMs to supply extensive materials on how they operate.

“Although many people have never heard of pharmacy benefit managers,” Commission Chair Lina Khan said, “these powerful middlemen have enormous influence over the U.S. prescription drug system.”