Revisions cause initial claims, the last positive leading indicator, to capitulate – by New Deal democrat Initial and continuing claims underwent some serious revisions with this week’s release. Rather than attempt an explanation myself, here is the nub of the BLS’s own explanation: Beginning … [this week], the methodology used to seasonally adjust the national initial claims and continued claims reflects a change in the estimation of the models. Seasonal adjustment factors can be either multiplicative or additive. A multiplicative seasonal effect is assumed to be proportional to the level of the series. A large increase in the level of the series will be accompanied by a proportionally large seasonal effect. In contrast, an additive

Topics:

NewDealdemocrat considers the following as important: BLS, initial claims and continued claims, politics, Revisions, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Revisions cause initial claims, the last positive leading indicator, to capitulate

– by New Deal democrat

Initial and continuing claims underwent some serious revisions with this week’s release. Rather than attempt an explanation myself, here is the nub of the BLS’s own explanation:

Beginning … [this week], the methodology used to seasonally adjust the national initial claims and continued claims reflects a change in the estimation of the models.

Seasonal adjustment factors can be either multiplicative or additive. A multiplicative seasonal effect is assumed to be proportional to the level of the series. A large increase in the level of the series will be accompanied by a proportionally large seasonal effect. In contrast, an additive seasonal effect is assumed to be unaffected by the level of the series….

Prior to the pandemic, the unemployment insurance claims series used multiplicative models to seasonally adjust the claims. Starting with March 2020, Bureau of Labor Statistics (BLS) staff, who provide the seasonal adjustment factors, specified both of the UI claims series as additive. After the large effects of the pandemic on the UI series lessened, the seasonal adjustment models were once again specified as multiplicative models. Statistical tests show that the UI series should, in normal times, be estimated using multiplicative adjustments.

The revisions go all the way back to June 2021. As a result, the all-time lows in both the weekly and 4 week average of initial claims that were reported last spring got vaporized: the all-time lows revert back to the 1960s. Continuing claims were also revised substantially higher for last spring. All three series were also revised substantially higher beginning with the weeks of late January. All of the sub-200,000 readings since then have been erased. Instead, claims have steadily risen to close to 250,000, and continuing claims have gradually risen to over 1.8 million.

Including those revisions, this week initial claims rose 18,000 to 246,000. The 4 week average declined 4,250 to 242,000. Continuing claims with a one week delay rose 6,000 to 1,823,000.

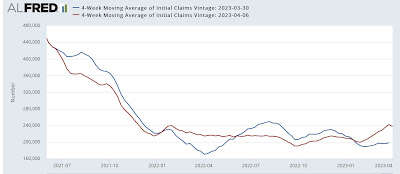

Here is what those revisions to weekly initial claims look like:

Here are the revisions to the 4 week average:

And here are the revisions to continuing claims:

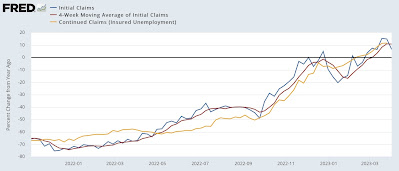

Finally, here are the YoY% changes to all three:

Because the revisions go back more than a year, the YoY% change in the numbers did not change very much compared with last week. Including the revisions, initial claims are now up 6.5% YoY (vs. 15.8% as reported last week), and continuing claims are up 11.6% (vs. 12.2%). The more important 4 week average is up 10.8% (vs. 11.0%).

Last week I wrote that the 4 week average of initial claims had crossed the 10% threshold for a yellow flag caution. I require two months in a row, and would need to see an increase to 12.5% YoY or above to warrant the actual red flag recession warning.

But even if initial claims improve somewhat from here, with these revisions the last positive leading indicator has capitulated.