March total business sales strongly suggest that real total sales have entered a downturn – by New Deal democrat Today’s final significant economic report was total business sales for March. This is a nominal figure; the “real” number won’t be updated until personal income and spending is reported for April in two weeks. And here, the report was a clear negative. Not only did total March sales decline -1.1%, but January was revised down by -0.1% and February down by -0.3% (blue below, vs. real sales in red): This will make real manufacturing and trade sales for January unchanged from December, deepen February’s decline, and because producer inflation for March was down on average about -0.3% and consumer inflation increased slightly, the

Topics:

NewDealdemocrat considers the following as important: US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

March total business sales strongly suggest that real total sales have entered a downturn

– by New Deal democrat

Today’s final significant economic report was total business sales for March. This is a nominal figure; the “real” number won’t be updated until personal income and spending is reported for April in two weeks.

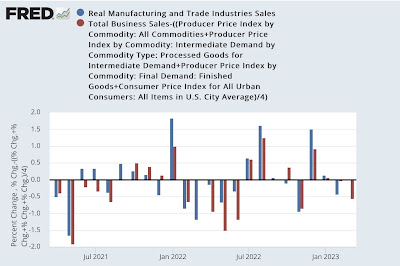

And here, the report was a clear negative. Not only did total March sales decline -1.1%, but January was revised down by -0.1% and February down by -0.3% (blue below, vs. real sales in red):

This will make real manufacturing and trade sales for January unchanged from December, deepen February’s decline, and because producer inflation for March was down on average about -0.3% and consumer inflation increased slightly, the March “real” number when reported is likely to be negative on the order of -0.9%, as shown in the below graph which estimates the real number by averaging producer and consumer price deflators:

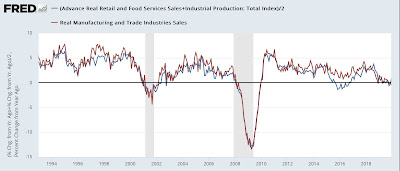

For April real sales, which won’t be reported until the end of June, we can at least create an opening estimate by averaging real retail sales (which are about 1/3rd of the total sales number) and industrial production. This estimate misses wholesale sales completely and also doesn’t account for manufacturing inventory changes, so is less reliable – but as indicated, it’s a start. The long term YoY view shows that it captures the trend about 90% of the time, even if it misses the mark monthly often:

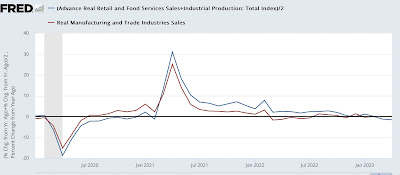

Here’s a close-up on the YoY change since the pandemic, again showing that this method captures the trend if not the exact monthly number:

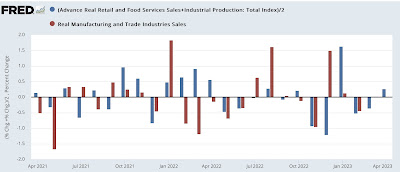

And here’s the monthly view for the past 2 years:

This method also forecasts a significant decline in March, and a small increase in April.

Taken all together, this morning’s three reports suggest that both manufacturing and real sales have turned down since late or the end of last year, respectively. If so, then the producer side of the economy has begun a mild recession. We will have to await April’s personal income and spending report in two weeks to see if real consumer income has also begun to trend down.

Real manufacturing and trade sales probably rose to a new record high in February; may have declined in March, Angry Bear, New Deal democrat