A story . . . Supplier working relationships were always tough in automotive. A lot of politicking going there, lunches, dinners, etc. Kind of difficult to walk a straight line with them and maintain an ethical standard. Yet, I did and was known for doing what I said I would do. I worked for several Tier 1 companies making components for Ford and Chrysler mostly and a bit for GM. There are no good guys here. Whatever they want, they get it. You will do what is necessary in the US or Mexico to get it to them. Getting containers of parts overseas was fun too. The last economic crisis in 2008 was when Wall Street blew themselves up, and, and Main Street paid the price. Automotive did not maintain their orders and the Tiers went into

Topics:

run75441 considers the following as important: automotive, manufacturing, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

A story . . .

Supplier working relationships were always tough in automotive. A lot of politicking going there, lunches, dinners, etc. Kind of difficult to walk a straight line with them and maintain an ethical standard. Yet, I did and was known for doing what I said I would do.

I worked for several Tier 1 companies making components for Ford and Chrysler mostly and a bit for GM. There are no good guys here. Whatever they want, they get it. You will do what is necessary in the US or Mexico to get it to them. Getting containers of parts overseas was fun too.

The last economic crisis in 2008 was when Wall Street blew themselves up, and, and Main Street paid the price.

Automotive did not maintain their orders and the Tiers went into hibernation. The Semi-conductor business did the same and we were chasing them till about 2010. Pricing changes came because they could do it not because costs went up. Here we are again in 2023 with perceived and some real supply chain problems and similar pricing corruption. This time corporations learned how to play the market and they did. Lets take a look at what is happening today with OEMS as reported.

Survey: Toyota, Honda, GM Place 1-2-3 in Supplier Working Relationships, DBusiness Magazine, Tim Keenan.

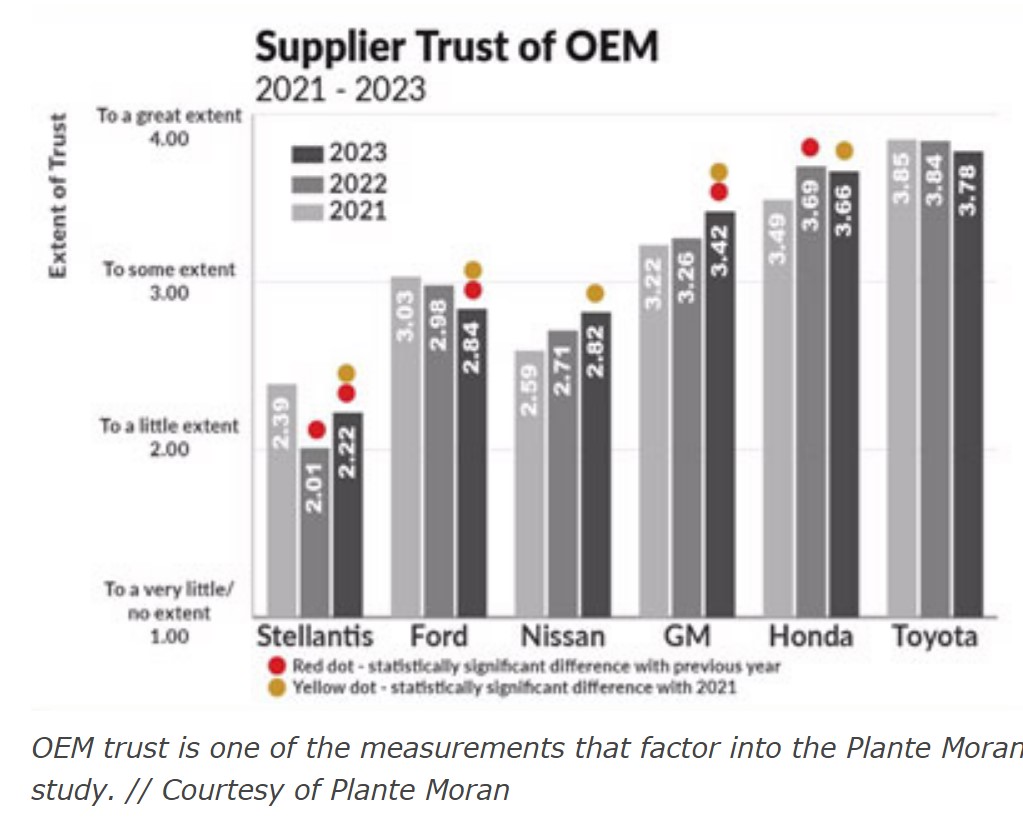

Toyota Motor North America in Texas, Honda in California, and General Motors Co. in Detroit placed 1-2-3 in the 23rd annual North American Automotive OEM-Supplier Working Relations Index published today by Plante Moran in Southfield.

Toyota had a score of 338, Honda posted a score of 331, and GM came in with 297. Nissan was fourth with 225, Ford Motor Co. in Dearborn was next with 219 and Stellantis posted 145.

AB: How do my suppliers trust OEMs? Part of the problem when I was doing this was the lead times for their selected suppliers with whom we had to work with were longer than the lead times we were given which covered inventory, In effect, we were carrying an inventory liability of the OEM creation. The risk and cost shifted to us. If prices increased from an OEM supplier, they might not accept 100% of the increase. This cut into profit. If you want the business you pay a price.

The Working Relations Index measures the total commercial relationship, which is a function of perceived trust, timely communication, mutual profit opportunity, assistance, and a reduction in friction in dealings with automakers.

According to Plante Moran, the results of the study show rising tension over increased risk related to short-term cost-recovery issues, production scheduling, and supply chain disruptions as the industry transitions to electric vehicles. These are compounded by long-term strategic issues suppliers have related to adequate insight into the automakers’ EV strategy and timing so they can effectively plan for the transition in terms of adequate capital, acquisitions, and staffing investment.

Dave Andrea, principal in Plante Moran’s Strategy and Automotive and Mobility Consulting Practice.

(AB: That is just too long of an introduction. Just say consultant.)

“The industry continues to face unprecedented challenges in the shift to EVs that unless effectively addressed will only get worse. During COVID, adopting a ‘war room’ approach quickly resolves critical issues. That approach is what auto manufacturers need to maintain during the transition to EV technologies. The industry needs that level of collaboration, even without the pressure of a crisis.”

AB: I know Ford and GM have split their companies into two parts. One for introduction of EVs. The people here are the winners. And the other part for the old technology of gasoline fueled engines. Potentially, the losers are here if EVs are successful. More than likely there will be bouses and buyouts. In 2006-8, similar buyouts occurred.

Overall, GM, Nissan, and Stellantis improved their WRI scores while Toyota and Honda dropped slightly, and Ford fell significantly. Stellantis showed the greatest improvement with a gain of 17 points, followed by GM’s 10-point gain and Nissan’s six-point uptick. Nissan took over fourth place from Ford which dropped 23 points — the largest drop by an OEM this year. Toyota lost seven points and Honda declined by three points.

With the industry undergoing major changes in the shift to EVs, suppliers identified several common issues critical to OEM success:

- There cannot be a disconnect between OEM senior management’s words and front-line buyers’ actions.

- OEMs need to ensure purchasing staffs have the experience and training to understand new EV technologies, and internal relationships to engage with engineering and manufacturing as the OEMs conduct staff reductions and reorganizations.

- OEM’s product plans and technology requirements need to be articulated and communicated to suppliers for suppliers to know where they and their products fit into long-term strategies.

- OEM decision-making locations need to be located near and reinforce where supplier sourcing and manufacturing occurs.

Plante Moran says the OEMs have improved their supplier relations by incorporating the Working Relations Index findings in their personnel performance metrics, corporate strategic planning processes, and communication strategies allowing them to better leverage their suppliers.

AB: I do not know what “improve their relationship” means. Maintaining a relationship meant getting the OEMs the components and product they scheduled in less lead-time than the mandated suppliers provided. So, you carried inventory. This makes for good story. I do not believe much has changed. If you want the business, you meet OEM demands.

Strong supplier working relations are more than external relations with suppliers. An improving WRI reflects improved OEM cross-functional internal relations and indicates how well purchasing, engineering, and manufacturing are working together, the researchers say, a critical need to achieve faster product development.

AB: Purchasing does play a role here; however, it is not what Plante is claiming. It has very little authority when negotiating with suppliers. Selection starts with Engineering and specifications. The selection is made according to what is needed with little said on how it is supplied, the after-thought. Purchasing and materials end up between manufacturing/engineering and the supplier.

Other takeaways include:

- New market conditions, such as supply chain disruptions and new technologies that change product plans and manufacturing strategies, require short- and long-term forecasts and production schedules to be more accurate and to be communicated in a more-timely fashion with suppliers.

- Cost recovery mechanisms should not be judged in isolation. Inflation-driven cost increases and adjustments need to be addressed in a timely manner that is consistent, tested, and institutionalized and supported by OEM and supplier cost reduction efforts.

- OEMs that effectively address these issues are generally stronger customers of choice for suppliers and rate them better on perceived trust, supplier business return on investment, and rewarding suppliers for high performance.

Dave Andrea . . .

“The automakers will have to continue building on these fundamentals to survive near-term parts shortages, rising costs, and high risk to truly deepen supplier relations to support their transition to electric vehicles.”

AB: How about starting to ask the supply questions in the beginning. Questions such as if my demand increases how quickly can you react. Can your tooling for those molded parts meet an increased demand or do we need new tooling which has a normal 12-16 week leadtime? If you have not been there, it is kind of hard for you to lead.