Brad DeLong asked me if I had an explanation of how the US economy managed to land softly. He is confident that it is softly landing. This encourages me to actually try to do my job for once and act as a macroeconomist, and also to return to blogging here some. In the spirit of challenging reopening, I will indulge myself by skimping on links, simply asserting things which I could and should back up with a bit of Google. The basic story is that CPI inflation has declined from around 6% to around 3% during a period with unemployment below 4%. This surprised a lot of people who had predicted that inflation fighting would require (or at least cause) a recession. There are two questions. FIrst how did inflation decline without high (or even

Topics:

Robert Waldmann considers the following as important: Education, Featured Stories, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Brad DeLong asked me if I had an explanation of how the US economy managed to land softly. He is confident that it is softly landing. This encourages me to actually try to do my job for once and act as a macroeconomist, and also to return to blogging here some. In the spirit of challenging reopening, I will indulge myself by skimping on links, simply asserting things which I could and should back up with a bit of Google.

The basic story is that CPI inflation has declined from around 6% to around 3% during a period with unemployment below 4%. This surprised a lot of people who had predicted that inflation fighting would require (or at least cause) a recession. There are two questions. FIrst how did inflation decline without high (or even normal) unemployment ? Second how did the FED’s inflation fighting fail to cause a recession as it had 8 times from 1948 through 1981 ?

Here I graph inflation my way with annualized (OK multiplied by 4) percent change in the CPI from one quarter to the next — this gives a graph which is neither all noise nor all moving averaging.

I had meant to look at the more recent past, but then got distracted. In the graph we see a number of things. FIrst ,as noted by everyone, inflation was low from 1983 on. The blip of high inflation in 2021 and 2022 was a huge and unwelcome surprise to kids these days who don’t remember the 70s. Second, as noted by a few (sorry no link I admitted I was going to be lazy) low inflation used to mean 4% or lower. The ultra hawk Volcker’s target was 2% to 4% which meant 4%. Inflation was considered to have been defeated when it was higher than the current level. No one argued that there would be a signficant benefit to inflation below 4%. I don’t think that anyone has ever made that argument (at least I haven’t read it).

Yet the current debate is about whether we will really have a soft landing, defined as 2% inflation without a recession, or not. The possibility that the target should be 4% or 3% has been banished from the discussion. This is a very new development. Back when we were in the liquidity trap, mainstream Keynesians including Olivier Blanchard and Paul Krugman argued for a 4% target. Later then went soft (dry — some meaningless metaphor anyway) and advocated a 3% target. Now they just accept that the target is 2%. They were not always diplomatic (OK Blanchard is always diplomatic and Krugman is never diplomatic). Krugman compared the rigid irrational devotion to the 2% target to the rigid irrational devotion to the gold standard which caused among other things [Monetary Godwin’s law redaction].

Other Keynesian economists Larry Summers and (see above) Brad DeLong argued against the 2% target when it was introduced, predicting that it would prevent the sort of cuts to real interest rates required to fight recessions (that is predicting that the US would hit the zero lower bound long before it did). Oddly they forget (I reminded Brad but the too brilliant John Quiggin beat me to the punch).

Uh oh, that was a long tangent starting looking at 8 years of a 66 year graph. Focus Robert focus.

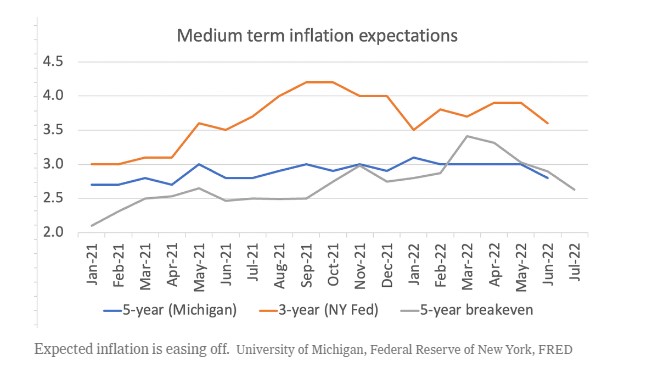

here you see a dramatic decline in inflation with no recession. How could that happen ? The obvious explanation (too many links even if I weren’t so lazy) is that medium term expected inflation stayed lit ow, that is, inflation expectations did not de-anchor. The lesson from the 1970s and the 2020s is that it takes a lot of time and effort to weigh the inflation expectations anchor.

Not unusually, Paul Krugman predicted this . The story is (and has been for decades, really for my entire life) that high unemployment occurs when inflation is lower than expected inflation (the story has not included speculation about the direction of causation for my entire life).

So inflation now is close to expected medium term inflation and, so there is no reason to guess that unemployment must be high. I’m afraid that’s basically it (so this longgggg post is also pointless).

I do want to add two thoughts.

Petroleum prices. The Putin invades Ukraine oil shock was small compared to the OPEC discovers its power during the Arab Oil Boycott shock and compared to the Saddam Hussein invades Iran shock. I think part of the reason is that long term expectations are very very different. Back then, it was assumed that we would run out of petroleum eventually and the price would rise (peak oil meant peak production not peak demand). Now, the guess is that petroleum will be semi-obsolete fairly soon. Long term price forecasts affect current prices so long as assets have long lives and petroleum underground has been there for hundreds of millions of years.

This matters two ways. Independent price taking petroleum producers (who do exist) might decide to invest in petroleum reserves by not pumping. More importantly, cartels depend on the threat of future punishment to prevent current high production. A cartel with no future has no present. It also doesn’t help if major producers are fighting proxy wars and such. The latest oil shock was much smaller than might have been feared and oil shocks are important.

Another issue is people working from home (just raised my hand – but I have been doing it for decades). I think this causes increased labor market frictions which can explain how the unprecedented huge number of vacant jobs did not cause a very large increase in wages. Work from home is an informal arrangement (people don’t have contracts which give them the right to work from home). Informal arrangements tie people together. Roughly, someone who works at home and sees an advertisement for a job like her current job at a higher wage has to wonder about a possible job interview. If one asks to make sure one will be allowed to work from home, one is not likely to get the job (it is a very bad signal). If one doesn’t, one will have to go to some office.

Also people working from home interferes with on the job training. trained people can work together even if they aren’t together but it is very hard to teach at a distance (as demonstrated by standardized test scores). This means that training costs are now greater. It means that the vacancy might imply a search for someone who has experience not just in the sector but doing the exact task they will be hired to do. This means that vacant jobs put less upward pressure on wages.

Finally unions. Back in the 70s trade unions really mattered. Now they don’t matter so much. Think of the UAW strike — I read lots of things about it but I don’t recall reading the warning that a UAW victory would trigger wage increases everywhere and a wage price inflation spiral. I would have read that during the 70s (I read such things during the 70s). It is just assumed that normal workers have no chance to get what UAW workers got. It is true that the long period of low unemployment (and the infuriating inflation and a period of genuinely declining real wages) have resuscitated the labor movement (well more resurected or reincarnated than resuscitated as it was more dead than comatose). However, that takes time (and effort and organizing and more effort and courage).

Now the low wage growth didn’t really mean we dodged a bullet. People always think real wages are declining and always think that inflation, by definition, implies lower real income. But when both are actually true they get mad as hell and threaten to elect Donald Trump.

Next topic (for another post) is why didn’t high interest rates cause a recession.