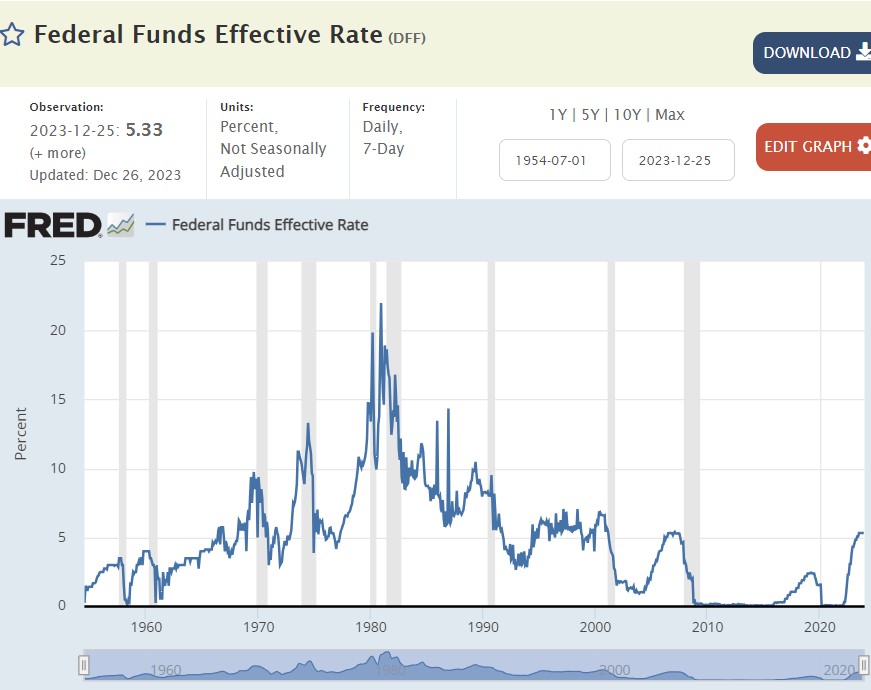

I promised a second entry in the series, Soft Landing this time it’s monetary. The question is why didn’t the FED’s monetary tightening cause a recession. There certainly was tightening, the Federal Funds rate rose from 0.07% to 5.33% There certainly were people who predicted a recession in 2023 (hey they still have 4 days so I am giving a hostage to fortune). Indeed some forecasters put the probability at 100%. Why ? First there was the view that a soft landing would be more unique than rare. The FED was clearly determined to fight inflation, and examination of all such determined fights against inflation so far include the resulting recession. This means that they guessed that, if 5.33% wasn’t enough to cause a recession, it

Topics:

Robert Waldmann considers the following as important: Education, politics, US EConomics, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

I promised a second entry in the series, Soft Landing this time it’s monetary. The question is why didn’t the FED’s monetary tightening cause a recession. There certainly was tightening, the Federal Funds rate rose from 0.07% to 5.33%

There certainly were people who predicted a recession in 2023 (hey they still have 4 days so I am giving a hostage to fortune). Indeed some forecasters put the probability at 100%.

Why ?

First there was the view that a soft landing would be more unique than rare. The FED was clearly determined to fight inflation, and examination of all such determined fights against inflation so far include the resulting recession. This means that they guessed that, if 5.33% wasn’t enough to cause a recession, it would not be enough to cause inflation to fall from 6% to 3% and so the FED would raise the rate more. This brings us back to the last post about how inflation fell without a recession.

Others looked at the sharp increase in the Federal Funds rate, either directly or letting some other numbers and a regression convince them. The other numbers are the medium term interest rate which was lower than the short term interest rate (this happens whenever the Fed fights inflation). Such a yield curve inversion has always been followed by a recession (here “Such” is a qualifier and weasel word). This comes out of a time series probability model, but it is really just the facts that the Fed is fighting inflation and there wasn’t such a soft landing in the past with another number added and a regression noting what is easily seen with the human eye.

OK so can I explain why there hasn’t been a recession (yet) ? Not really, but I will try. One thing is clear from the graph, 5.33% is not a punishingly high Federal Funds rate (it was higher during the roaring 90s). The conviction that, in 2023, it would cause a recession is based either on a reasonable argument or something silly. The reasonable argument is that r* the expected real interest rate required for low unemployment and stable inflation (say for 4% unemployment and 2% inflation) has become very low and, in fact, negative. A variant is that it is higher than 0% only during bubbles, such as the .com bubble of the 90s and the housing bubble of the 00s. The case is mostly based on the very sluggish recovery from the great recession. r* is supposed to depend on things like population growth and productivity growth, neither of which has shifted.

I think I have to discuss how r affects the economy. In some standard macro models it works by affecting consumption savings choices with the rate of growth of consumption depending on r. There is essentially almost exactly zero evidence that this occurs in the real world. In a closed economy, that basically leaves investment, of which there are many different types only one or two of which depend on r.

First investment is fixed capital invesment plus inventory investment. Inventory investment can be very important if there is a recession and a recovery. However, it does not respond to interest rates.

Fixed capital investment is (in official data) divided into investment in equipment (often transportation equipment and other equipment are distinguised) and structures which are residential or non-residential. Equipment investment is about half of fixed capital investment, but it does not respond much to interest rates — the cost of owning equipment is interest plus depreciation which is almost all depreciation. I am thinking of putting up with this computer for another year or buying a new one (really). If I wait a year I have to put up with a really irritating computer for another year but I can get interest on the money I would have spent (this is negligible and neglected) also if I wait a year to buy it, I won’t spill coffee on my new computer (given my record and the reason this computer is very irritating this should not be neglected but I neglect it). But mostly in a year a computer will cost about 30% less or have much greater capacity. The key cost is technological obsolescence. This is striking true of laptop computers, but it is generally the big issue with equipment. It is not affected by Fed policy and neither is equipment investment ((if *I* buy a computer it will be called consumption which is unfair).

That leaves structures. There is clearly, usually, a huge effect of monetary policy on residential investment via the mortgage interest rate, the sales price of houses, and the profitability of building new houses. This has been the main way in which monetary policy affects US GDP. The question is why has residential investment held up given the increase in the mortgage interest rate. I am tempted to hand the mike to NewDealDemocrat. I note that the relative price of housing (Case and Shiller index divided by CPI) has never been this high (also not in 2006). This could be the same process which cause high rent inflation (work from home means want more home to work from) or might be another bubble (so full employment only with a bubble again). In any case it explains why residential investment is about as high as it was pre-Covid.

Non residential structures investment is mostly office buildings and retail (shopping centers) not factories (large but cheap). Interest rates matter here, but it is hard to collect data as the loans are deals between builders and banks and not a standard 30 year fixed interest rate mortgage.

It happens to be the case that the relatively small amount spend on constructing manufacturing structures is twice what it used to be. This is an effect of the subsidies in the CHIPs act and the (oddly named) Inflation Reduction Act. This brings up fiscal policy which is still stimulatory. Another source of fiscal stimulus is the huger than before national debt which is someone’s assets. This should not affect demand, but it does. Fiscal stimulus is a reason for (temporarily) high r*.

I’d be about 49/49 on whether fiscal policymakers saved us or whether a new housing bubble delayed the recession (the 2% is that it was due to the stimulatory effect of the Taylor Swift “Eras” tour).

appendix

I have left two things open. One is that I wrote “in a closed economy”. In the real world monetary policy affects exchange rates which affect net exports. It happens that there wasn’t much action there (as far as I know) largely because lots of central banks are fighting inflation so interest rates are high lots of places.

The other is the silly reason to predict that 5.33% federal funds rate will cause a recession. Many pay a huge amount of attention to the change in interest rates not the level. They include Fed policy makers who often insist on many small increases (or decreases) rather than shifting to the interest rate which they think is consistent with low unemployment and price stability. I do not see much logic in this. I think the reason is that bond traders make and lose huge amounts of money based on the change in interest rates and they watch the Fed and the Fed watches them. I think it shows how monetary policy discussions are dominated by the financial elite and not — well the goals stated in the Federal Reserve Act.