And undermine public health in the process I ran across Merrill at the Washington Monthly writing about Healthcare. This particular article is on the mark in terms of what is occurring in pharmaceutical healthcare today. Kip, Merrill, and I are all hitting similar notes with regard to healthcare and other issues impacting it. Some such as Kip and Merrill more so on the details than I. The costs and prices of Pharma are overstated by the industry. How Wall Street, venture capital drive high drug prices, GoozNews, Merrill Goozner This article also appeared at the Washington Monthly. The pharmaceutical industry is the great white whale of American medicine. No matter how many harpoons activists, progressive politicians, journalists, and

Topics:

run75441 considers the following as important: GoozNews, Healthcare, law, Merrill Goozner, politics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

And undermine public health in the process

I ran across Merrill at the Washington Monthly writing about Healthcare. This particular article is on the mark in terms of what is occurring in pharmaceutical healthcare today. Kip, Merrill, and I are all hitting similar notes with regard to healthcare and other issues impacting it. Some such as Kip and Merrill more so on the details than I. The costs and prices of Pharma are overstated by the industry.

How Wall Street, venture capital drive high drug prices, GoozNews, Merrill Goozner

This article also appeared at the Washington Monthly.

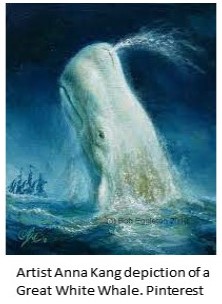

The pharmaceutical industry is the great white whale of American medicine. No matter how many harpoons activists, progressive politicians, journalists, and scholars hurl at its bloated body, it not only survives, it grows fatter by feasting on the patients and payers that are the krill of the U.S. health care system.

The drug price controls in the recently enacted Inflation Reduction Act (IRA)—touted as the first-ever defeat for the drug industry lobby in Washington—offer the latest example of how the industry manages to outrun its harpooners. While the new law finally gives the federal government the power to negotiate drug prices for seniors (who constitute just a third of the nation’s drug spending), intense industry lobbying limited its reach to just 10 drugs starting in 2026, growing to only 20 drugs in 2029.

The law does not apply to drugs purchased by private payers, who cover more than half the population. It does nothing to rein in launch prices for new drugs, which have increased from $1,376 in 2008 to $159,042 in 2021. (The median price for drugs launched in 2022 has reached a staggering $257,000 per year!) And its hard-to-enforce provision giving the government the right to claw back price increases above the inflation rate will undoubtedly be subjected to extensive industry opposition during the rule-making process and eventually in the courts.

The industry’s public posture during the debate leading up to passage of the IRA was little changed from its historic justification for high drug prices. Their argument, reduced to its essence, is a form of blackmail targeting patients with chronic and incurable diseases. PhRMA, the industry’s lobbying group, repeatedly says that without high prices, industry investment in research and development will decline and medical innovation will wither. It is the same argument the industry made in the late 1950s when Senator Estes Kefauver held hearings on the antibiotic cartel; in the early 1990s when the first biotechnology drugs came to market at exorbitant prices; in the mid-1990s when AIDS activists protested the high price of the new medications that turned their death sentence into a manageable disease; and in the early 2000s when President George W. Bush, anxious to eliminate any potential roadblock to his reelection, pushed through a Medicare prescription drug benefit with no constraints on industry’s pricing power.

But while the industry’s public posture hasn’t changed, its behind-the-scenes argument has shifted subtly in the past decade. Without abandoning its false claim to be the fount of innovation, its top executives and their enablers in think tanks, academia, and patient advocacy groups (mostly funded by the industry) have added the assertion that the high prices charged for the latest FDA-approved drugs are justified by the value they bring to patients and the economy.

To back that claim, the industry applies cost-benefit analysis to pharmaceuticals. Using patient outcomes data gleaned from the clinical trials submitted for Food and Drug Administration approval of a new drug, industry economists measure the number of quality-adjusted life years (QALYs) gained by its use, calculate a net present value for all the personal and economic benefits accrued by averting downstream disease, and set a price that is slightly below that total. Voilà. Price justified.

It is that argument, and industry’s claim that its central role in the innovation process justifies their capturing the lion’s share of that value, that Dr. Victor Roy, a post-doctoral fellow at Yale University, effectively demolishes in his new book, Capitalizing a Cure. Roy’s doctoral thesis at the University of Cambridge conducts a deep dive into the development and marketing of Gilead Sciences’ Sovaldi, the hepatitis C drug whose $84,000 price tag for a 12-week course sent shock waves through patients, payers, the press, and the public after it was approved by the FDA in late 2013. Roy convincingly shows through this example how venture capital, Wall Street, and the industry’s top executives have turned small biotechnology firms and Big Pharma corporations into vehicles for extracting wealth from the health care system, even as these ostensibly health-promoting companies deny access to millions of needy people at home and abroad and undermine the financial well-being of patients and payers.

Roy begins his story with a familiar tale: how government-funded academic researchers were largely responsible for the development of the drug sofosbuvir, which Gilead later named Sovaldi. (I say familiar because I published a book on this subject in 2004 that covered medical innovation in the last quarter of the 20th century, which, full disclosure, Roy generously credits.) This government-to-industry development path is, if anything, even more central to the drug development process today than it was two decades ago. Government-funded research lies behind the development of the COVID-19 vaccines; the latest cancer therapeutics, like CAR-T; and new drugs for treating many rare diseases.

Roy also reminds readers that at the dawn of the neoliberal era, it was deliberate government policy to turn the fruits of its research over to private industry without any strings attached. The Bayh-Dole Act of 1980 allowed the National Institutes of Health and universities housing government-funded scientists to patent and transfer (for royalties, of course) their scientific discoveries, research tools, and drug candidates to private developers. The 1982 Small Business Innovation Development Act accelerated the process by creating small business innovation research (SBIR) grants, which primarily went to biotech start-ups to develop these new tools and drugs. The new laws weren’t limited to biomedicine, of course, but surveys of university technology managers show that four out of every five transferred patents and SBIR grants involve medical technologies. That’s not surprising, given that the NIH’s budget—$45 billion in 2022—consistently weighs in at about five times the size of the National Science Foundation, which funds all other sciences.

Hepatitis C is a bloodborne pathogen that causes liver disease. It is primarily found in current or former intravenous drug users and people at risk of sexually transmitted diseases. In the mid-1990s, it became a prime target for academic researchers who had been involved in the hunt for an AIDS cure because the genetic makeup of the two viruses is similar. These researchers included Emory University’s Ray Schinazi, who in 1996 created a biotech company called Triangle Pharmaceuticals to develop an AIDS drug discovered in his university lab called emtricitabine. By 2004, with emtricitabine showing great promise in clinical trials, Schinazi and his partners sold Triangle to Gilead Sciences for $464 million, laying the foundation for that company to become the leading purveyor of AIDS antivirals. Schinazi cleared a third of the $200 million lavished on emtricitabine’s developers through the sale of their start-up’s stock.

He used that capital to launch another company, Pharmasset, to develop drugs for other viral diseases, including a candidate for treating hepatitis C, which had also been developed with government grants. As Roy points out, the company’s name embodied its business strategy. The idea was to develop intangible financial assets—patents on promising drug candidates—that could then be sold to Big Pharma. Less than a decade later, Schinazi became a repeat winner in the biotech sweepstakes when he sold Pharmasset to Gilead for $11 billion, from which he cleared an estimated $440 million.

How could a small biotech company that had only one promising drug for hepatitis C—a disease that infected only 4 million Americans and 15 million people worldwide, only 30 to 40 percent of whom would develop liver disease—sell for that staggering sum? The only existing treatment, interferon, cost over $30,000 for its course of treatment. It only helped about half of patients and had severe side effects. In Pharmasset’s early efficacy trials, sofosbuvir had shown that it could clear the virus in well over 90 percent of patients. It was all but an assured bet for the Big Pharma company that bought it; and, given its greater efficacy and sharply reduced side effects, sofosbuvir could command a price that was more than twice that of interferon.

The drug’s eventual price had nothing to do the cost of development (Roy estimates that the government, Pharmasset, and Gilead spent less than $1 billion over the decade it took to develop the drug); the risks Gilead took; or the value the drug delivered to patients and the broader economy. Roy writes,

Gilead’s senior leadership saw their company as a late-stage acquisition specialist, buying compounds in their final steps of development and thereby taking control of potential future earnings streams just as the compounds neared and then crossed the regulatory finish line …

Gilead’s approach had by then become common across the industry. [Emphasis in original.]

Though from a science and regulatory perspective sofosbuvir was Secretariat, Gilead’s bet paid off like a long shot. Drug purchasers coughed up more than $46 billion in the first three years sofosbuvir-containing products were on the market—four times Pharmasset’s purchase price and 50 times the amount invested in R&D by all parties. “Gilead’s power to project this future drew on two sources: its anticipation of acquiring Pharmasset’s intellectual property and gaining monopoly power over prices; and its confidence that health systems could be compelled to pay more for a better drug,” Roy writes.

Only after Gilead set its price did it turn to the new argument that it reflected good value for payers and patients. For that, the company relied on high-powered health economists whom it funded in academia. Looking at the savings from reduced liver transplants and hospitalizations, one study, funded by Gilead and published in Health Affairs, estimated that giving sofosbuvir-based treatments for hepatitis C could generate $610 billion to $1.2 trillion in value to the U.S. economy and $139 billion in health care cost savings—even though people with advanced liver disease from hepatitis C rarely get liver transplants. Amitabh Chandra of the Kennedy School of Government at Harvard made a similar argument in the Harvard Business Review, where he also disclosed funding from Gilead.

Even as these academics were defending Gilead’s extraordinarily high price, the company was using the largest portion of its windfall to buy back stock, lavishly reward its top executives, and renew its hunt for new drug candidates on Wall Street. Meanwhile, federal agencies like the Veterans Administration, Medicaid, and the nation’s prisons had to ration access to the drug. The denials of care “disproportionately fell on those populations at the most risk for worsening hepatitis C as well as transmission of the infection: low-income patients and those with a history of injection drug use,” Roy writes.

Is there any evidence to suggest that the arrival of Sovaldi created significant value from a health care perspective? After all, it is a miracle drug. It wipes out the infection in almost all patients with only a three-month course of treatment. Yet, according to the Centers for Disease Control and Prevention, there are still anywhere from 2.7 million to 3.9 million people in the U.S. living with hepatitis C, only slightly below where we were a decade ago. Why? There are more than 100,000 new infections every year, in part because access is limited by the drug’s high price. Moreover, there were 9,236 liver transplants in 2021, the highest number ever, according to the United Network for Organ Sharing. The total has gone up in every year since the FDA approved sofosbuvir.

n other words, by allowing publicly funded research to be turned into a privately held financial asset; by allowing venture capitalists and Wall Street to drive up the price of that asset; by allowing a private corporation to set a maximum price point for that asset; and by watching hired economists justify that price point using questionable value metrics, the U.S. health care system has created the ultimate unvirtuous circle. Pricing for value as Wall Street defined it made rationing inevitable and turned a significant breakthrough by medical science into a setback for both public health and fiscal sustainability.

Roy’s book concludes, as all would-be harpooners’ tales must, with an alternative vision for developing innovative medicines. First, reformers must break the cycle that allows academic scientists and their venture capitalist backers from turning publicly financed cumulative knowledge into monetizable assets through the patent system. Once patent control is turned over to biotech start-ups and big drug companies operating as acquisition specialists, the inevitable outcome is a system that maximizes returns to venture capitalists and the big firms’ stockholders and executives even as it ignores the needs of most patients, payers, and public health.

It also debases the scientific process by emphasizing the development of drugs with the greatest revenue potential, which, Roy notes, “reduces companies’ appetite for making the long-run and risk-laden investments needed to create breakthrough medicines.” Instead, too many companies invest their own R&D dollars into me-too drugs that replicate products already on the market. And, even when a breakthrough drug like sofosbuvir comes along, the patent system as presently constructed incentivizes firms to postpone development of improvements until existing patents expire, which in turn leads to the high prices, rationing, and patent gaming that maximize the revenue stream over the drug’s patent life.

Instead, Roy resuscitates a vision for developing innovative technologies that was first articulated by New Deal–era Senator Harley Kilgore of West Virginia. In contrast to the FDR science adviser Vannevar Bush, who thought the government should stick to basic science, Kilgore called for public financing of the entire development process and a patent system that protected government-financed inventions from private-sector profiteering. Roy calls for the creation of a publicly financed Health Innovation Institute that would take responsibility for developing government-funded inventions, all the way from perfecting the molecules to financing final clinical trials. The goal would be pricing them closer to their manufacturing costs so access and affordability were no longer problems.

The idea is not unique to him, nor is it far-fetched. Indeed, there are many examples where government has performed nearly every task involved in a drug’s development. These range from developing the process for mass production of penicillin during World War II to running trials for the earliest AIDS drugs to doing everything from start to finish for the first hormone replacement treatments for genetic mutation-caused rare diseases. Since the 1970s launch of the war on cancer, government has financed an extensive academic network for conducting cancer clinical trials. It remains to be seen if President Joe Biden’s newly created Advanced Research Projects Agency for Health at the NIH will include technology development as part of its mission.

The problem is not skill, it is political will. The one good thing you can say about the financialization of drug development is that it provides a huge incentive for private investors to invest over many years in biotech start-ups. R&D for new drugs takes a long time and, in most cases, does not pan out. To hedge against failure, venture capitalists take a portfolio approach. The gargantuan payoff from the one in 10 drug that succeeds not only pays for the failures, it provides a more than generous return for investors.

A government-run public option alternative would have to take a similar long-term approach—without the promise of huge returns other than improved public health and cheaper medicines. That requires permanent funding (perhaps a surcharge on all drug expenditures, something like the gas tax that funds roadbuilding) and insulation from political manipulation.

It also does not deal with the legacy problem that the public already pays far too much for many drugs. Here, I think, Roy is too dismissive of the nascent price controls in the IRA. The camel’s nose is inside the tent. The political capital needed to create an effective drug development agency is even greater than what it would take to expand the government’s drug price negotiating authority and eliminate patent gaming, two reforms that would provide a more immediate counter to the problem of drug prices that are just too damn high.