Aggregate payrolls vs. total withholding taxes paid: which one has been telling the truer tale? – by New Deal democrat The drought in new data continues for today. So I wanted to take a further look at the two measures of total payrolls I discussed on Friday, one of which has been of some concern. One is total aggregate payrolls, which is part of the Establishment survey portion of the jobs report each month, and the other is total tax withholding, which is the actual aggregate number reported daily by the Department of the Treasury. Since these measure similar things – total payrolls and the taxes withheld from total payrolls – with the exception of tax law changes and updated bracketing, they should tell similar stories. And normally for

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Aggregate payrolls vs. total withholding taxes paid: which one has been telling the truer tale?

– by New Deal democrat

The drought in new data continues for today. So I wanted to take a further look at the two measures of total payrolls I discussed on Friday, one of which has been of some concern. One is total aggregate payrolls, which is part of the Establishment survey portion of the jobs report each month, and the other is total tax withholding, which is the actual aggregate number reported daily by the Department of the Treasury.

Since these measure similar things – total payrolls and the taxes withheld from total payrolls – with the exception of tax law changes and updated bracketing, they should tell similar stories. And normally for the past 20+ years, they have.

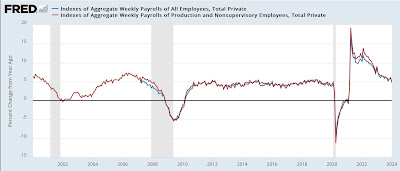

To cut to the chase, here is the YoY% change in aggregate payrolls for all private jobs (blue), which started to be kept in 2007, and aggregate nonsupervisory payrolls (red):

And here is Matt Trivisonno’s long term graph of the YoY% change in the full 365 day increments of withheld taxes, covering the same period except for the last 90 days:

By and large, the two tell similar stories, although tax withholding has been somewhat more volatile. Aggregate payrolls generally varied between +4% to +6% YoY during the end of the 1990s expansion and the two expansions afterward. In the 2021-22 Boom, they peaked at just under +20% YoY. Meanwhile tax withholding varied between +2% and +9% during the previous expansions, but averaged in the +4% to 6% range. In early 2022, they were higher by more than 20% YoY.

For most of 2023 they were more seriously out of synch. Aggregate payrolls gradually decelerated from +7.5% YoY to 5% as of last month. Meanwhile tax withholding decelerated sharply from a similar 7.5% level to only about 1% as of mid-November.

Because this is public data updated daily by Treasury, it is easy enough to get updated numbers for year end 2023 and through January of this year. Using the same formula, we can see there has been a rebound, as for all of 2023 and for the 12 months ending in January 2024 tax withholding payments were up 3.2%.

This is still significantly less than the +5% in the jobs report last month. Since much of the discrepancy happened during earlier months of 2023, the comprehensive QCEW report for last July through September, which totals 97% of all firms, and which will be published one week from this Wednesday, should give us much more visibility into whether the monthly jobs report numbers from the Establishment survey have been too optimistic or not.

Income tax withholding payments stumble again, Angry Bear, by New Deal democrat.