– by New Deal democrat Personal income and spending have become one of the two most important monthly reports I follow. This is in large part because the big question this year is whether the contractionary effects of Fed tightening have just been delayed until this year, or whether the fact that there have been no rate hikes since last summer mean that the expansion will strengthen. Because real personal spending on services for the past 50 years has generally risen even during recessions, the more leading components of this report have to do with spending on goods. Additionally, there are several components that form part of the NBER’s “official” toolkit for determining when and whether a recession has begun, including real spending minus

Topics:

NewDealdemocrat considers the following as important: Income and spending, May 2024, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

Personal income and spending have become one of the two most important monthly reports I follow. This is in large part because the big question this year is whether the contractionary effects of Fed tightening have just been delayed until this year, or whether the fact that there have been no rate hikes since last summer mean that the expansion will strengthen.

Because real personal spending on services for the past 50 years has generally risen even during recessions, the more leading components of this report have to do with spending on goods. Additionally, there are several components that form part of the NBER’s “official” toolkit for determining when and whether a recession has begun, including real spending minus government transfers, and real total business sales.

Let’s look at each of them in turn. Note that in all graphs below except for YoY comparisons, and the personal saving rate, is normed to 100 as of just before the pandemic.

Real income and spending

In April, nominally income rose 0.3%, while nominal spending rose 0.2%. Since prices as measured by the PCE deflator increased 0.3% for the month, in real terms income was unchanged and spending declined -0.1%. Since the pandemic recession, real spending is up 10.9% and real income is up 6.9%:

On a YoY basis, the PCE price index is up 2.7%, the third month in a row higher than January’s three year low of 2.4%. While n the previous 16 months, the YoY measure had been declining at the rate of 0.25%/month, suggesting that it would hit the Fed’s 2.0% target this spring, that trend has stopped, there is no indication at this point that the inflation rate is actually increasing either:

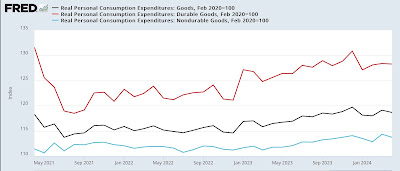

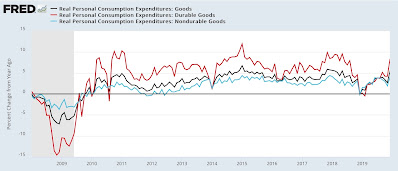

As I have been noting for the past few months, for the past 50+ years, real spending on services has generally increased even during recessions. It is real spending on goods which declines. Last month real services spending rose 0.1%, while real goods spending declined -0.4% (black in the graph below), only partly reversing March’s revised 0.9% gain.

Breaking goods spending down further, in April spending on consumer durables (red) declined -0.1%, vs. a larger -0.5% decline in real spending on non-durables (blue). In the past, spending on durables has tended to turn down before spending on non-durables. Here’s the current update:

On a YoY basis, all three series are running close to 2% higher, which has been typical since the turn of the Millennium, as shown prior to the pandemic:

As you can see, spending on durable goods is particularly volatile. So the stall in that spending, while not good, is not particularly foreboding either.

Savings

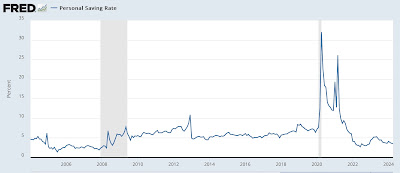

Another important metric for the near future of the economy is the personal savings rate. The sharp declines of a combined -0.9% In February and March were revised to only -0.5%, and in April it remained unchanged at 3.6% (vs. the original 3.2% last month). This longer term look shows how the present compares with the all time low rate of 1.4% in 2005:

Historically this is nevertheless a very low rate, only exceeded to the downside by 2005-07 and 2022, indicating continued vulnerability to an adverse shock. One of my forecasting models uses such a shock as a recession warning indicator. In any event, there is no such shock indicated at the moment.

Important coincident measures for the NBER

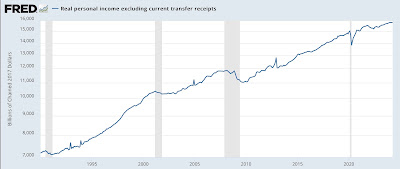

Also as indicated above, the NBER pays particular attention to several other aspects of this release. Real income excluding government transfers (like the 2020 and 2021 stimulus payments) was unchanged for the month. This metric had been in a rising trend since November 2022, but has stalled since January. Before 1990 a pause such as this over at least three months had almost always been associated with recessions. Since then, as shown in the above graph, they have been much more frequent. So at the moment, this is not significant:

Finally, the deflator in this morning’s report is used to calculate, with a one month delay, real manufacturing and trade sales. This declined -0.1% in March, and for the third month in a row is below its November and December 2023 readings:

Like real personal income ex-government transfers, before 1990 a decline like this typically was associated with recessions or within a year before. Since then, there have been many such pauses without it being significant in the longer term.

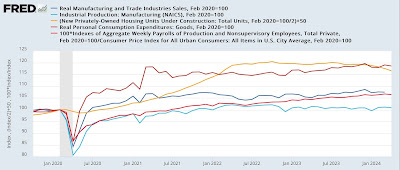

Still, let me update the graph I ran on Wednesday showing 5 important producer and consumer series:

With today’s data, 4 of the 5 series are either flat or down significantly. The 5th, real aggregate payrolls for nonsupervisory workers, will be updated in next week’s jobs report.

Summary

This was not a good report. But to repeat a theme noted several times above, it wasn’t a bad report either. Basically a flat report. The pause of the past several months is consistent with both a renewed upturn, or a turn to the downside.

Especially with the downturn in the past several months of the leading sector of housing under construction, what it does do is give a higher level of importance to next week’s ISM manufacturing and services reports. I will be looking to see if the weighted average of the two is trending higher, lower, or flat. Since the ISM manufacturing report in particular has a long history of leading the economy, should that weighted average decrease below its equipoise point of 50, that would mean that both leading sectors of the goods producing economy are forecasting further weakness ahead.

The Bonddad Blog

Another strong personal income and spending report, but beware the uptick in inflation, Angry Bear by New Deal democrat