– by New Deal democrat August CPI, with the conspicuous exception of shelter, continued to come in tame. And the list of other “problem children” decreased by 1, as only food away from home (restaurants) and transportation services (motor vehicle insurance and repairs) remain. Let’s get the headlines out of the way: – Headline CPI continued increased 0.2% for the month, and decelerated to 2.6% YoY, its best showing since February of 2021. – energy inflation remains non-existent – there was no inflation at all excluding shelter, as prices were unchanged, and are up 1.1% YoY, the 16th month in a row the YoY change has been below 2.5%. – shelter inflation was the only negative surprise, as it remained very elevated, up 0.5% for the

Topics:

NewDealdemocrat considers the following as important: August 2024 CPI, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

August CPI, with the conspicuous exception of shelter, continued to come in tame. And the list of other “problem children” decreased by 1, as only food away from home (restaurants) and transportation services (motor vehicle insurance and repairs) remain.

Let’s get the headlines out of the way:

– Headline CPI continued increased 0.2% for the month, and decelerated to 2.6% YoY, its best showing since February of 2021.

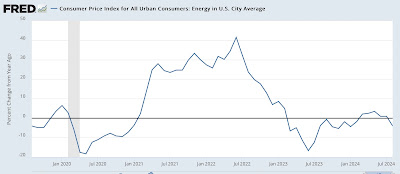

– energy inflation remains non-existent

– there was no inflation at all excluding shelter, as prices were unchanged, and are up 1.1% YoY, the 16th month in a row the YoY change has been below 2.5%.

– shelter inflation was the only negative surprise, as it remained very elevated, up 0.5% for the month and 5.2% YoY, the highest YoY change in three months.

– core inflation, which includes shelter but excludes gas and food, therefore remained elevated, up 0.3% for the months and 3.2% YoY.

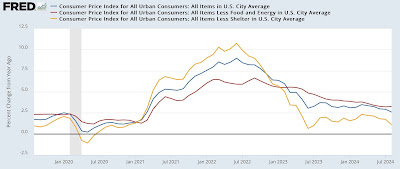

Let’s break this down graphically to better show the trends.

Here are headline (blue), core (red), and ex-shelter (gold) inflation YoY:

To repeat what I have said for months, the only reason for the Fed not to treat inflation as well within its target zone is shelter.

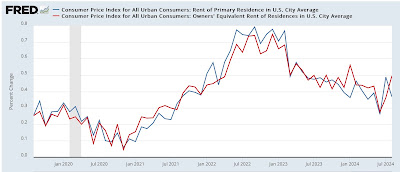

Turning to the big remaining issue of shelter. The upside surprise appears to be due to an upward spike in owners’ equivalent rent (red), which spiked higher by 0.5% in the month, vs. actual rent (blue), which increased 0.37%, and so was rounded up to 0.4%:

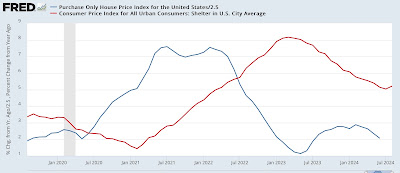

As a result, shelter on a YoY basis increased YoY, here shown vs. the FHFA Index YoY (blue), which has rolled back over:

This was an unpleasant surprise, but may be a quirk of unresolved post-pandemic seasonality or a one-month wonder, as the leading indicators for shelter inflation all continue to point towards continued deceleration.

With gas prices down for the month, energy showed -0.8% *deflation* and is down -4.0% YoY:

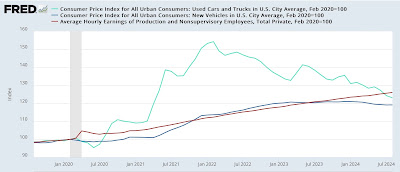

The former problem children of new (dark blue) and used (light blue) vehicle prices were unchanged and down -1.0% for the month, are are down -1.8% and -10.4% YoY respectively (shown as the change since right before the pandemic, below). I also show average hourly nonsupervisory wages (red) for comparison, showing that wage growth has actually outpaced vehicle prices (meaning the remaining problem there is interest rates for financing):

Note that used vehicle prices have given back over 50% of their post-pandemic gain.

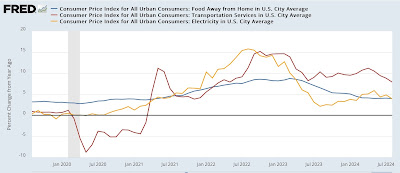

Electricity (gold) also ended its run as one of the remaining problem children, as it declined -0.7% for the month and is up 3.9% YoY. That leaves food away from home (blue), up 0.3% and transportation services including vehicle maintenance, repair, and insurance (red), up 0.9%. On a YoY basis they remain up 4.0%, and 7.9% respectively, although even those two items are trending downward:

As I have previously pointed out, the last item is a typical delayed reaction to the previous big increase in vehicle prices.

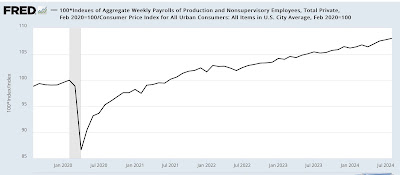

Finally, the CPI release allows me to update the very important metric of real aggregate nonsupervisory payrolls, which once again made a new record high:

Ordinary workers have more spending money, in real terms, than they have ever had before. There has *never* been a recession without that turning down first.

In conclusion, the Fed has really had all the ammunition it has needed to cut interest rates for months. With the sharp YoY deceleration in the headline rate in August, it has even more. If we remove shelter from the core index, that too is only up 1.8% YoY. The outstanding question is whether the Fed has waited too long, and a recession will occur before lower interest rates turn around the now-tepid labor market.

The Bonddad Blog

July CPI: almost everything except fictitious shelter costs are getting close to the Fed’s comfort range, Angry Bear, by New Deal democrat