A relatively long piece on Carbon Capture by Vox. It does touch on every topic concerning capture and storage. Oil companies sold the public on a fake climate solution — and swindled taxpayers out of billions by Amy Westervelt Vox This spring, Democrats wrapped up a nearly three-year investigation into the fossil fuel industry’s role in climate disinformation and asked the Department of Justice to pick up where they left off. In House and Senate Democrats’ final report and hearing, investigators concluded that major oil companies had not only misled the public on climate change for decades, but also were continuing to misinform them about the industry’s preferred climate “solutions”— particularly biofuels and carbon capture. Sen.

Topics:

Angry Bear considers the following as important: carbon capture, climate change, Education

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Joel Eissenberg writes The Trump/Vance Administration seeks academic mediocrity

Bill Haskell writes Study Shows Workers Fleeing States With Abortion Bans

Angry Bear writes The Impact of Debt Interest Payments

A relatively long piece on Carbon Capture by Vox. It does touch on every topic concerning capture and storage.

Oil companies sold the public on a fake climate solution — and swindled taxpayers out of billions

by Amy Westervelt

Vox

This spring, Democrats wrapped up a nearly three-year investigation into the fossil fuel industry’s role in climate disinformation and asked the Department of Justice to pick up where they left off. In House and Senate Democrats’ final report and hearing, investigators concluded that major oil companies had not only misled the public on climate change for decades, but also were continuing to misinform them about the industry’s preferred climate “solutions”— particularly biofuels and carbon capture.

Sen. Sheldon Whitehouse (D-RI) and Rep. Jamie Raskin (D-MD), who spearheaded the investigation, also accused oil companies of “obstructing” the investigation, submitting few documents, and redacting much of what they did send. One ExxonMobil employee who spoke with Drilled and Vox under condition of anonymity for fear of retaliation described what the company sent as “a truly random assortment of unimportant documents.”

But there was at least one notable exception in the form of a report detailing the company’s projections for the future of carbon capture technology.

If you’ve read the New York Times recently, or seen this ad on Politico’s website or heard it on one of its podcasts, or listened to the Planet Money podcast, you may have noticed the industry’s relentlessly positive marketing of carbon capture, which aims to collect and store CO2 emissions from power plants and industrial and fossil fuel extraction facilities, so they don’t add to global warming. The Intergovernmental Panel on Climate Change (IPCC) has said carbon capture might be necessary to reduce the emissions of certain “hard to abate” sectors like steel, concrete, and some chemical manufacturing, but noted that in the best-case scenario, with carbon capture technology working flawlessly and deployed at large scale, it could only account for a little over 2 percent of global carbon emissions reductions by 2030.

That hasn’t stopped major oil companies from claiming that carbon capture and storage “will be essential for helping society achieve net-zero emissions,” that they are delivering “carbon capture for American industry,” working on reducing emissions in their own businesses (also referred to as “carbon intensity”), and delivering “heavy industry with low emissions.” But internal documents obtained during the federal investigation, as well as information that industry whistleblowers shared with Drilled and Vox, reveal an industry that is decidedly more realistic about the emissions-reduction potential of carbon capture and storage technology, or CCS, than it presents publicly.

Companies touted the potential of CCS publicly, as they downplayed the technology internally

In 2018, the oil and gas company Shell released an updated energy scenario, a forecast that served as a standard for the rest of the oil industry, in which it laid out what the Washington Post called a “radical” new approach on climate. Beginning in 1965, Shell pioneered the now-common practice of “scenario planning” for oil companies: mapping out what the industry and the world are likely to look like in the future; other oil companies will still often compare their scenarios to Shell’s.

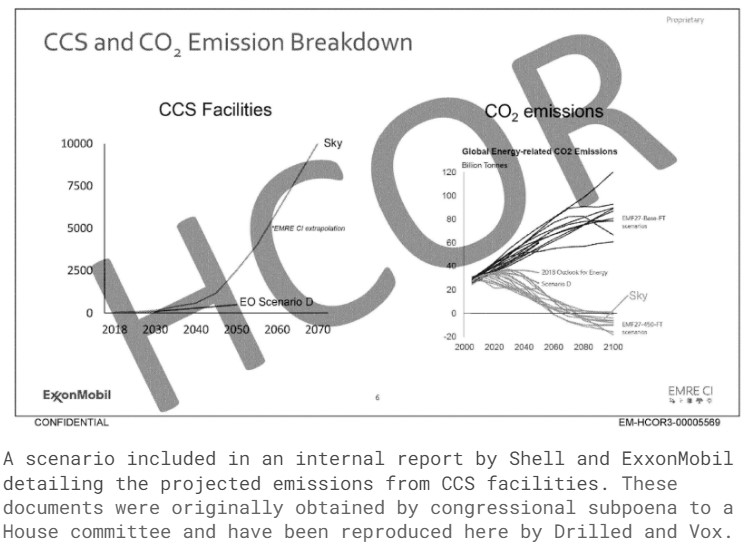

Exxon’s own internal 2018 scenario comparison was included in the most recent batch of documents handed over to Senate and House investigators. In it, ExxonMobil compared its future projections with Shell’s rosiest forecast for the energy transition. Buried in a chart in that projection is ExxonMobil’s belief about the global potential for CCS.

Even without the massive stamp on this page marking it as part of a set of documents obtained by congressional subpoena, these graphs would be difficult to read. The one above compares the projected number of CCS units in Shell’s scenario versus the number projected by ExxonMobil, while the graph on the right compares the two companies’ forecasts for future CO2 emissions.

While Shell’s optimistic projection envisions 10,000 large-scale CCS facilities operational by 2070, with more than 2,500 facilities by 2050, Exxon predicts somewhere between 250 and 500 facilities by 2050. Elsewhere in the scenario, Exxon also envisions that “global scale is limited” for CCS and hydrogen tech by 2050.

Exxon’s past projections were much more in line with what critics of CCS have been saying for years. The IPCC, for example, has said that even if realized at its full announced potential, CCS would only account for about 2.4 percent of the world’s carbon mitigation by 2030. In its fact sheet on CCS, the Institute for Energy Economics and Financial Analysis (IEEFA), a nonprofit, nonpartisan think tank in Ohio that produces market-based research on the energy transition, states: “It’s worth noting that not one single CCS project has ever reached its target CO2 capture rate.”

Stanford University researcher Mark Jacobson said that because it also requires energy and materials to function, CCS attached to a fossil-fueled power plant is still worse for the climate than replacing fossil energy with renewables. “They actually increase carbon dioxide emissions by doing this, in addition to increasing air pollution,” he said, referencing a study he conducted in 2019 quantifying the lifecycle CO2 emissions of various carbon capture scenarios. Even when CCS is powered by wind, Jacobson said it’s not worth doing, from a climate perspective. “If you just used wind to replace coal in the first place, you’d get a higher reduction in CO2 emissions,” he said.

And oil giants themselves have been hedging on the technology for years, despite marketing its potential. When the Environmental Protection Agency proposed requiring that power plants install CCS in its rules for power plants, for example, both fossil fuel companies and utilities expressed far less faith in the technology in their public comments on the rule than they have in their ads about carbon capture. In Exxon’s public comment, the company encouraged the agency to reduce its requirements around capture efficiency from 95 percent to 75 percent, which is more in line with the actual performance of existing CCS projects.

“Last year, when the first EPA power plant rule was released, it was going to mandate either using CCS on a power plant in order to reduce greenhouse gas emissions or to take some action that would be equivalent to adding CCS, and the response from industry was ‘Hey, the tech is really not proven,’” said David Schlissel, director of resource planning analysis for IEEFA. “Many, many comments from oil companies and utilities, in response to both the initial EPA rule and the current one, were saying this tech really doesn’t work.”

Exxon’s low internal projections for CCS back in 2018 map to the company’s own experience with the technology, too. To date, the only “successful” carbon capture project Exxon points to in its materials is its LaBarge Shute Creek gas facility in Wyoming. The Shute Creek facility is often referenced by the industry in general as a successful large and longstanding CCS project. On paper, LaBarge is responsible for around 40 percent of the total carbon emissions ever captured in the world. But the details tell a different story.

According to Exxon’s own disclosures and an analysis conducted by IEEFA in 2022, only around 3 percent of the carbon captured there (roughly 6 million tonnes) has been permanently sequestered underground. Of the rest of the 240 million tonnes of carbon emitted over the facility’s first 35 years in operation, half has been sold to various oilfield operators for enhanced oil recovery, or EOR — a process by which oil companies inject carbon underground to get more oil out — and approximately 120 million tonnes has been vented into the atmosphere.

When asked to comment for this story about its 2018 scenario plan and overall record on CCS, ExxonMobil sent the following statement by email: “False narratives that downplay our CCS efforts deliberately fail to recognize the strides we’re making in our Low Carbon Solutions business. Referencing one possible scenario from over six years ago does not represent our business outlook. We continuously evaluate our business plan based on market conditions.”

Exxon pointed to its public-facing 2023 Global Outlook as its most current thinking on the potential of carbon capture. That report states: “Carbon capture and storage is a proven and safe technology that reduces emissions from manufacturing and power generation.”

But in commenting on its scenario plan, Exxon’s spokesperson spoke only to “market conditions” and its shifting “business outlook,” not to the technology itself. The business outlook and market conditions for CCS have changed because of an increased tax credit for CCS that oil companies, including Exxon, lobbied for — and, according to the documents subpoenaed by federal investigators, heavily influenced — and that Sen. Joe Manchin (D-WV) introduced in 2021 as part of the negotiations that saw the Biden administration’s proposed “Build Back Better” legislation morph into the Inflation Reduction Act. That’s thanks to major changes to the CCS tax credit known as 45Q, which started out in 2008 paying $10 for every metric ton of carbon sequestered and now pays as much as $85 per metric ton, and up to $60 per ton stored and then used for EOR. Suddenly, EOR is CCS and CCS is profitable.

“There is no cap on 45Q and stored emissions are entirely self-reported,” Carolyn Raffensperger, executive director of the Science and Environmental Health Network, said.

The credit nominally requires companies to verify their claims. Aside from some specific requirements to ensure condensed CO2 doesn’t wind up in groundwater, the EPA is not verifying how much carbon is actually sequestered by these projects.

When asked about verification of carbon stored under the 45Q tax credit, the EPA told Drilled and Vox that it “does not implement the Section 45Q tax credit program and is not privy to taxpayer data,” and that questions about how tax claims are verified should be directed to the IRS. The IRS confirmed that it ensures companies claiming the credit have filed paperwork outlining their claims, including a lifecycle analysis, but that it does not have the scientific or technical expertise to verify that the amount of carbon claimed is actually being permanently sequestered.

“What the IPCC actually said in its mitigation report was that carbon capture might be necessary for hard-to-abate industries, but that it’s one of the most expensive options and it only equates to small emissions reductions,” said Paul Blackburn, an environmental lawyer and advisor to the Bold Alliance, a nonprofit network of frontline communities focused on protecting land and water. “So we’re doing the most expensive, least applicable thing first rather than cheapest, easiest things first, at great expense to taxpayers and with no analysis of net climate benefit.”

But even before the creation of a remarkably generous tax credit, and despite their own internal projections or challenges with the technology, major oil companies painted a rosy picture of CCS. Emails obtained by federal investigators show that Shell pulled together an “Alliance of Champions” to promote CCS, and BP worked with the Oil and Gas Climate Initiative to develop what it called “CCS enabling narratives,” while Exxon began promoting itself as a leader in carbon capture.

In the last five years, Exxon has produced multiple pro-CCS brochures and ads, comparing the carbon capture potential at industrial plants to the carbon sequestration of actual plants and trees. An NPR sponsorship from 2018, for example, describes ExxonMobil as “the company that believes that carbon capture technologies are critical for lowering global CO2 emissions.”

The company even worked on a series of kids’ videos touting CCS. In one subpoenaed email, Exxon executives asked the creative team working on the kids’ series to steer away from the idea that carbon is bad or that carbon capture is difficult. “De-emphasize concept that catching carbon is difficult or hard,” the feedback reads.

Yet that is precisely the company’s experience with CCS, according to several current and former Exxon staffers who agreed to speak with Drilled and Vox on condition of anonymity for fear of retaliation. Some of them were involved in the early days of researching CCS as a potential climate solution at Exxon, which they said only began in earnest in 2018, the same year that the 45Q tax credit first increased (from $10 for every metric ton of sequestered carbon to about $50 per metric ton).

The company’s experience before then, the sources said, was entirely focused on enhanced oil recovery — the process of injecting CO2 into a separate well to increase enough pressure in a reservoir to push additional oil out of a production well. While enhanced oil recovery, or EOR, does sequester carbon — some of it stays underground after it’s been injected — experts say the process could release 40 percent of the CO2 back into the air, and the oil it helps to get out of the ground also generates CO2 emissions when it’s burned.

Exxon is not the only one that embraced EOR for years before repositioning it as a climate solution. The industry has known for decades that compressed carbon works really well to vacuum up any remaining oil from porous rock, but it’s expensive to store and transport carbon. The industry’s embrace of natural gas helped drive down costs a bit, because while the finished product might be “low carbon,” gas often comes out of the ground bringing quite a bit of CO2 with it. That CO2 needs to be stripped out to make natural gas, a process called “gas sweetening,” leaving companies with excess CO2.

Still, the process of storing and transporting it remained expensive, so it didn’t always make financial sense to do EOR. Now, with investor-owned oil companies like Exxon, Chevron, BP, and Shell hurtling toward an inevitable decline in production rates — an inflection point referred to as “peak oil” — they need EOR more than ever. By rebranding it as a climate solution and tying it to a tax credit, they’ve not just made the process cheaper, they’ve created a new revenue stream — called Low Carbon Solutions at Exxon and Shell, Gas & Low Carbon Energy at BP, and Lower Carbon at Chevron.

The 45Q tax credit revenue will also make it feasible for these new business units to supply carbon capture where it might genuinely be needed, on facilities with hard-to-abate emissions, like concrete, steel, and ammonia plants. But the vast majority of carbon that US taxpayers are paying oil companies to capture will either be going toward generating more oil, or would have greater emissions reductions benefits had the companies opted not to drill for gas in the first place.

Clouded in carbon complexity

According to the International Energy Agency, using “naturally occurring” carbon — the CO2 that comes up with methane as part of natural gas, for example — for EOR as opposed to “anthropogenic CO2,” the emissions captured from a facility like a power plant or factory, “clearly provides no benefit in terms of emissions intensity.” That’s because absent the drilling in the first place, there would be no CO2 or methane emissions in those cases.

In the United States, more than 70 percent of the CO2 injected underground as part of the EOR process is from natural sources. That’s true of Exxon’s showcase facility — the Shute Creek facility in LaBarge, Wyoming — as well. The CO2 source there is the gas that’s being drilled. ExxonMobil calls this “anthropogenic CO2,” but when pressed, a spokesperson told Drilled it’s generated by the separation process, or gas sweetening. In other words, absent the gas drilling, there would be no CO2 emissions at the site in the first place.

Despite that, when ExxonMobil talks about itself as the “global leader” in CCS, pointing to its “more than 30 years capturing and storing carbon dioxide,” and the fact that it has captured more CO2 than any other company in the world, it is referring to LaBarge, which has been in operation since 1986.

According to a case study from MIT, where Exxon has long funded research on CCS and other industry-friendly “climate solutions,” from 1986 to 2008, LaBarge reinjected about 400,000 tonnes of CO2 a year back into the reservoir from which it came and vented 180 million cubic feet of CO2 per day from the facility’s smokestacks. In 2008, it was ordered by Wyoming’s Oil and Gas Conservation Commission to reduce its vented CO2 emissions, which it did by building out a carbon capture system that redirected CO2 into pipelines for enhanced oil recovery.

In 2022, a study from IEEFA found that LaBarge was selling half of its captured carbon for enhanced oil recovery and venting the rest. This means that millions of tonnes of carbon the company claimed to have “captured” were ultimately emitted.

Climate scientists say CCS connected to fossil fuel use or production delivers little benefit when it comes to tackling climate change, period.

“It doesn’t make sense to use CCS to prolong our use of fossil fuels, especially to produce electricity,” said David Ho, professor at University of Hawaii and senior researcher at Columbia University. “The argument in favor of enhanced oil recovery is often that if they weren’t using this captured CO2, they’d be using some other CO2, but I don’t think you can call anything where you’re getting more oil out of the ground to burn a climate solution.”

Yet, so far, major oil companies have struggled to deploy CCS technology in any other capacity. “When we talk about the failure of CCS, we generally talk about capturing, not storage, but when you look at capacity and how much has actually been sequestered, it’s very little,” Ho said.

That’s not just concerning from a climate perspective, but from a public health perspective as well. Raffensperger notes that the pipelines built to transport condensed carbon from oil fields to storage facilities, or to other oil fields for EOR, are surrounded by “kill zones.”

“These are not your grandmother’s pipelines,” Raffensperger said. “They could be lethal. We talk about the kill zone or a fatality zone around a CO2 pipeline. We don’t talk about that with oil and gas pipelines. These are uniquely dangerous and underregulated.”

Following a 2020 CO2 leak and explosion in Satartia, Mississippi, that abruptly stopped cars on roadways, caused widespread dizziness and nausea, and sent several residents to the hospital, the federal Pipeline and Hazardous Materials Safety Administration began looking into rules for CO2 pipelines. They were set to finalize that rule this summer, pending review by the Office of Management and Budget and the Office of Information and Regulatory Affairs, but that deadline has been extended to fall 2024. The lack of finalized safety regulations has not stopped the permitting of CO2 pipelines, though. The Summit pipeline, a massive project that would carry carbon across five states, just got the go-ahead in June for the first step of its construction process in Iowa: seizing land through eminent domain to make way for the pipeline.

Carbon capture and storage is a fantasy — and taxpayers are footing the bill

According to current and former Exxon employees, the company’s efforts to explore the “S” part of the CCS equation — storage, or sequestration — only began when it pulled together a team of technical experts to look for weaknesses in a 2018 US Geological Survey assessment that showed enormous potential for CCS.

“They thought the USGS was overly optimistic [about the potential of CCS] and they wanted us to basically bring industry technical expertise in to tell them their projections were overblown,” one Exxon staffer said. The team brought together to study CCS was then tasked with running an experiment to see if it was even possible to permanently store captured carbon. When the study showed that it was indeed possible, current and former Exxon staffers told Vox and Drilled the company’s executives were “surprised.”

To truly sell CCS as a climate solution, Exxon had to show that storage at scale was feasible. Former employees told us that at the end of the last decade, executives came up with a prioritized list of the company’s export and import terminals and refineries where it might be relatively easy to attach CCS. As of this year, none of those projects have been built (though the company did publicly announce in late 2023 that it was working on a fuel-cell-powered carbon capture and hydrogen project at its Rotterdam refinery, one of the options on that list).

While it hasn’t managed to build commercial-scale carbon storage itself, Exxon did acquire enhanced oil recovery company Denbury in 2023, which brought 1,300 miles of CO2 pipelines and 15 onshore carbon storage sites under Exxon’s control. Again, this system is focused on enhanced oil recovery.

“CCS is a proven and safe technology that experts agree is pivotal to achieving net zero,” an ExxonMobil spokesperson said in response to a request for comment for this story. “We’re making progress in our Low Carbon Solutions business, with current plans to capture and permanently store more CO2 than any other company.”

Fatih Birol, executive director of the International Energy Agency, has called the industry’s plan to offset its emissions with carbon capture “fantasy.”

But the US government is all in on that fantasy now.

“[The carbon capture tax credit] 45Q is not based on net climate benefit or net CO2 reductions, it’s based on gross CO2 capture,” Blackburn, the environmental lawyer, said. “Why would you think making carbon a commodity would reduce CO2 emissions? It’s like the opposite of carbon tax, we’re actually paying them to produce more of it.”