Decoding Medicare Advantage by Andrew Sprung xpostfactoid Can STAT’s exposure of UHC’s exhortations to goose Medicare Advantage enrollees’ risk scores spur action to reduce MA overpayment? Load these Codes It is beyond reasonable doubt that the federal government’s payments to Medicare Advantage plans are grossly inflated by the plans’ gaming of the program’s risk adjustment system, designed to deter plans from cherry-picking health enrollees. The risk adjustment program pays plans more for enrollees with higher “risk scores,” calculated on the basis of enrollees’ diagnosed medical conditions. Plans have various means of inflating enrollees’ risk scores — most notoriously, home risk assessments and chart reviews — a retroactive

Topics:

Angry Bear considers the following as important: Healthcare, Medicare Advantage, United Healthcarew

This could be interesting, too:

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes RFK Jr. blames the victims

Joel Eissenberg writes The branding of Medicaid

Bill Haskell writes Why Healthcare Costs So Much . . .

Decoding Medicare Advantage

by Andrew Sprung

xpostfactoid

Can STAT’s exposure of UHC’s exhortations to goose Medicare Advantage enrollees’ risk scores spur action to reduce MA overpayment?

Load these Codes

It is beyond reasonable doubt that the federal government’s payments to Medicare Advantage plans are grossly inflated by the plans’ gaming of the program’s risk adjustment system, designed to deter plans from cherry-picking health enrollees. The risk adjustment program pays plans more for enrollees with higher “risk scores,” calculated on the basis of enrollees’ diagnosed medical conditions. Plans have various means of inflating enrollees’ risk scores — most notoriously, home risk assessments and chart reviews — a retroactive combing of the enrollee’s medical record to add new diagnoses.

The upcoding has been so egregious for so long that CMS’s is required by statute to cut the plans’ risk scores across the board by 5.9%. It’s not enough. In its March 2024 report to Congress, the Medicare Payment Advisory Commission (MedPAC) estimated that in 2022 MA risk scores were about 18% higher than scores for similar FFS beneficiaries due to higher “coding intensity” — the polite term for inflated risk scores. MedPAC forecast that in 2024, the coding intensity gap would increase to 20%. For the 2024 report, MedPAC adapted the methodology (see Ch.13) of former CMS official Richard Kronick, who estimated in 2021 that risk adjustment overpayments would total $600 billion from 2023 to 2031 if not adjusted.

For many years, MedPAC has recommended cutting MA plans’ risk adjustment payments by various means, the most straightforward being to increase the 5.9% across-the-board haircut to plans’ risk scores — a minimum imposed years ago by Congress. But cutting payments to Medicare Advantage plans, which now cover slightly more than half of Medicare enrollees, is politically difficult. This year, CMS cut back for the second year running on another source of overpayment — payment bonuses based on quality ratings, which had been boosted by a pandemic measure — resulting in some plans paring extra benefits and others discontinuing service in some regions. Republicans are certain to demagogue these reductions as Medicare Open Enrollment kicks off.

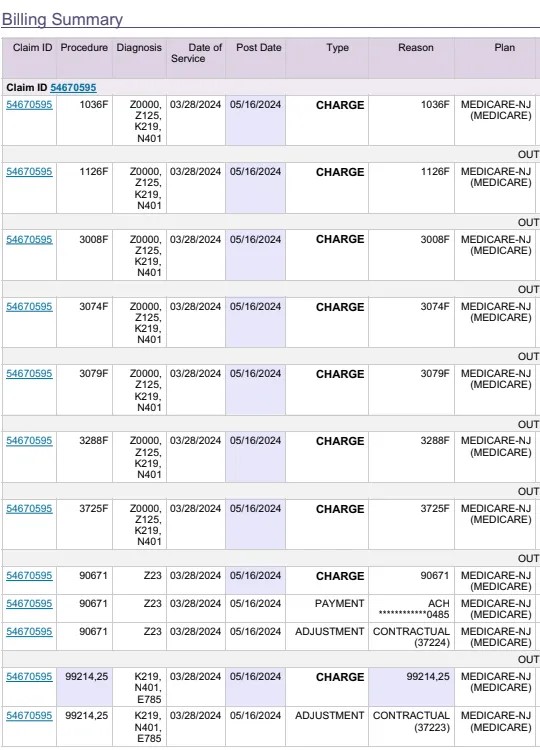

Compelling statistical evidence that coding intensity is steadily increasing MA overpayment has been manifest for years and hasn’t spurred much corrective action. A STAT* exposé this week of pressure exerted on physicians to increase diagnoses (“upcode”) by UnitedHealth Group, the largest MA insurer, could provide more impetus for change than a bevy of quality statistical studies, as it evidence of intentional, incentivized upcoding. As UnitedHealth also owns physician practices employing 10% of U.S. physicians, it’s in a particularly strong position to pressure doctors to upcode — a win-win for the company on both the provider and insurer side.

STAT obtained emails from UnitedHealth executives to physicians in one UHC-owned practice exhorting them to diagnose chronic condition.

The “#1 PRIORITY” became documenting older patients’ chronic illnesses to generate more revenue from the federal government, the emails show.

UnitedHealth shared with doctors in the practice a dashboard comparing the percentage of chronic diseases they found among their Medicare Advantage patients to other practices within the company. Those who completed the most appointments with older patients got a “SHOUT OUT!!” in the messages and were eligible for up to $10,000 in bonuses. “We can do this!!” another email said, encouraging doctors who were falling behind.

One focus of the documents obtained by STAT was the Medicare annual wellness visit, a free preventive service that, like home-based health risk assessments, can be used as an opportunity to pile on diagnoses:

One document ranked clinicians based on how many annual wellness visits they had completed with Medicare Advantage patients, and cheered those in the lead. “TOP 10 IN AWVs TOTAL!! SHOUT OUT!!,” the email blared, listing the doctors with the most visits. The message also listed bonuses for conducting more visits and explained the weekend clinics were a “win” for patients and providers because they helped increase coding of chronic conditions such as peripheral artery disease, or PAD, a narrowing of the arteries that bring blood to the arms and legs…

The documents show that UnitedHealth’s doctors diagnosed PAD in 47% of their Medicare Advantage patients — three to four times the estimated prevalence of the condition in older Americans. Each diagnosis generates about $3,000 a year in extra payments from Medicare [the STAT reporters have a prior article about UnitedHealth goosing PAD screening].

In 2023, CMS proposed and then passed in somewhat watered-down form adjustments to the risk adjustment program designed to curb “coding intensity” by removing some 75 diagnosis codes “where there is wid[e] variation in diagnosing and coding” — i.e., more opportunity for upcoding. Richard Kronick, perhaps the most trenchant critic of the MA risk adjustment program deemed the adjustments “baby steps,” though he told me, ““I am delighted that CMS has its nose in the tent.” My May 2023 conversation with Kronick delves into the history of MA risk adjustment, the effects, and various proposed solutions, including adjusting the annual haircut to reflect the full extent of coding intensity as calculated by his methodology, which MedPAC subsequently adopted, albeit with adjustments enabled by their unique access to “complete enrollment, demographic, and risk-score data (beneficiary-level risk-score data are available to the Commission but not generally available to researchers) for MA and FFS beneficiaries with both Part A and Part B.”**

– – –

* The story is by Stat News reporters Tara Bannow, Bob Herman, Casey Ross, and Lizzy Lawrence. Casey and Herman are recent Loeb Award winners (and Pulitzer finalists) for a prior exposé of UnitedHealth subsidiary NaviHealth’s use of algorithms to deny post-acute care to patients in MA plans. Increase diagnoses, reduce expensive treatments: that’s MA’s winning formula.

** Limiting the risk comparison on the FFS Medicare side to enrollees who are enrolled in Medicare Parts A and B (omitting those enrolled in only one of the two) is important and reduces the coding intensity estimate significantly, because enrollees in Part A alone in particular tend to be healthier than the vast majority who enroll in both parts (many Part A-only enrollees are still employed). See this post for a look at two views of the effects of excluding single-part Medicare enrollees from the risk calculation.