After Decades of Costly, Regressive, and Ineffective Tax Cuts, a New Course Is Needed, Center on Budget and Policy Priorities Part 2 Steps to Creating a Better Tax System (a given) Instead of doubling down on the flawed trickle-down path of the Bush and Trump tax cuts, there are opportunities to work toward a tax code that raises more needed revenues, is more progressive and equitable, and supports investments that make the economy work for everyone. A crucial first step is allowing the 2017 tax law’s provisions primarily benefiting high-income households to expire. Additional steps include scaling back the 2017 law’s large corporate tax cuts, ensuring that more income of very wealthy households faces annual taxation, and limiting other tax

Topics:

Angry Bear considers the following as important: 2024, politics, tax breaks, Taxes/regulation, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

After Decades of Costly, Regressive, and Ineffective Tax Cuts, a New Course Is Needed, Center on Budget and Policy Priorities Part 2

Steps to Creating a Better Tax System (a given)

Instead of doubling down on the flawed trickle-down path of the Bush and Trump tax cuts, there are opportunities to work toward a tax code that raises more needed revenues, is more progressive and equitable, and supports investments that make the economy work for everyone. A crucial first step is allowing the 2017 tax law’s provisions primarily benefiting high-income households to expire. Additional steps include scaling back the 2017 law’s large corporate tax cuts, ensuring that more income of very wealthy households faces annual taxation, and limiting other tax breaks primarily benefiting high-income households.

Reforming the 2017 Law’s Costly and Regressive Corporate Provisions

The 2017 law’s permanent corporate provisions are in favor of large corporations and their shareholders, who are disproportionately wealthy. Cutting corporate taxes costs significant revenue, and evidence is sorely lacking that the benefits have trickled down. Executives, disproportionately wealthy corporate shareholders, and highly paid employees have reaped virtually all the economic gains from the corporate rate cuts, research suggests.[37]

Reforming the corporate tax by partially reversing the law’s deep rate cut to 28 percent, or halfway between the pre-2017 law 35 percent and the current 21 percent rate would make the tax code more progressive while generating substantial revenue to fund national priorities.

The 2017 law’s international tax rules also require reforms to more effectively deter costly profit shifting and to better align with the global minimum tax agreement.[38] The 2017 law exempted certain foreign income of U.S. multinationals from U.S. tax and added several provisions, including the global intangible low tax income (GILTI) minimum tax, to try to limit incentives for foreign profit shifting. These provisions have serious design flaws, however, and leave significant room for multinationals to avoid taxes by shifting their profits to low-tax countries.[39]

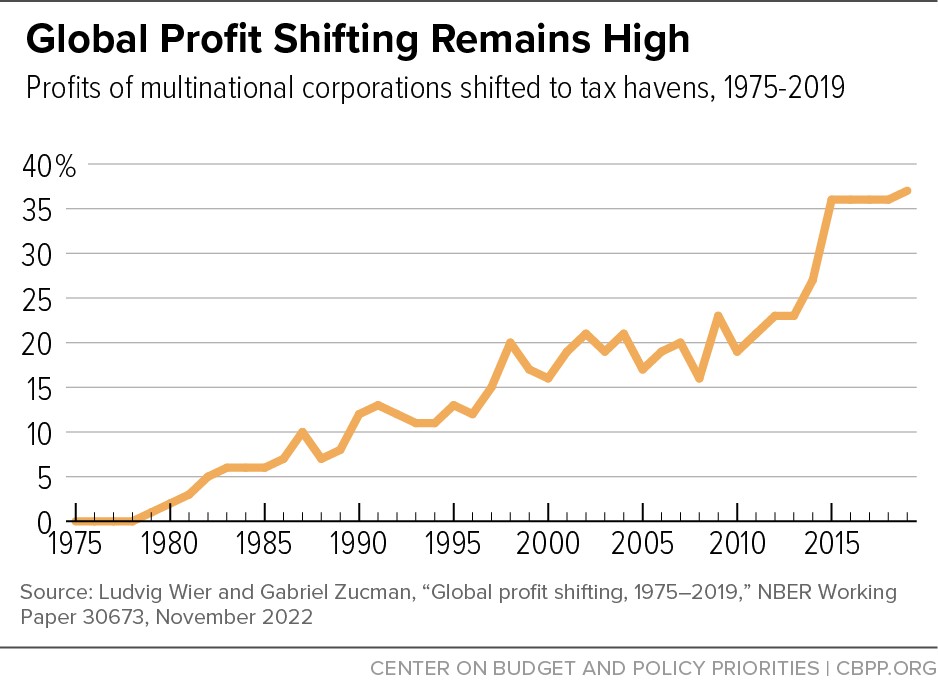

Two years after the 2017 tax law was in place, economists Ludvig Wier and Gabriel Zucman found “no discernible decline in global profit shifting or in profit shifting by U.S. multinationals.”[40] (See Figure 4.) This profit shifting costs significant revenue: globally, multinational corporations shift to tax havens about 36 cents of every dollar they make in profits, research suggests.[41]

Strengthening international tax rules by aligning them with the recent multilateral minimum tax agreement would increase the taxes multinationals pay to the United States. It would do so by ensuring U.S. multinationals’ foreign profits are taxed at a rate closer to what applies to domestic profits. Also that more foreign profits are subject to the tax, which would greatly reduce the tax savings from reporting income offshore. It would also penalize foreign multinationals that operate in the U.S. if they earn profits in a country that does not impose adequate taxes. On the other hand, failing to update our rules would mean that another country could levy extra taxes on a U.S. multinational operating within its borders, tax revenue that should be flowing to the U.S.[42]

There is little evidence of previous corporate tax cuts delivering the economic growth proponents promised, particularly for lower- and middle-income workers. There is no reason to believe the partially unwinding those cuts by reducing the large cut in the corporate tax rate and restructuring international tax provisions to adhere to the global minimum tax agreement would significantly harm the economy. Moreover, using the revenue from corporate tax increases to finance high-return public investments can boost growth. For example, compelling research finds that infants in families with lower incomes who receive more support from child-related tax benefits go on to have higher test scores, high school graduation rates, and earnings into young adulthood, all of which support a strong economy.[43]

More Income of Very Wealthy People Faces Annual Taxation, Reducing Special Breaks

Despite accumulating large capital gains as their assets appreciate, wealthy households won’t owe income tax on those gains until they sell their assets. And if they never sell, neither they nor their heirs will ever owe income tax on those gains. This makes taxes on capital gains largely voluntary for many of the nation’s wealthiest people.

Moreover, even when wealthy households do pay tax, they benefit from special low tax rates on capital income and other tax breaks that reduce their taxes. As a result of these policies, the progressive federal income tax breaks down at the very top of the income distribution.[44]

To address this dynamic, policymakers could institute a tax similar to the 25 percent minimum tax on multimillionaires in President Biden’s 2023 budget proposal. The proposal would treat unrealized capital gains as taxable income for the wealthiest people in the country and includes several helpful features to mitigate concerns about liquidity or losses due to stock market declines.[45]

In addition, policymakers could end the “stepped-up basis” loophole by taxing capital gains of affluent households when assets are transferred to heirs. This would prevent the wealthy from permanently avoiding income tax on massive amounts of their income, helping to counter income and wealth inequality[46] and generating significant revenue that our nation needs.

Policymakers should also consider rolling back other special tax breaks primarily benefiting high-income households. One of the simplest ways to do so is by taxing income from capital gains and dividends. Capital gains and dividends which are highly concentrated at the top at the same rates as wage and salary income. Other proposals include closing a loophole that allows certain pass-through business owners to avoid a 3.8 percent Medicare tax that others pay;[47] ending the “carried interest” loophole, which lets private equity executives treat their compensation as capital gains;[48] and repealing the “like-kind” exchange tax break, which lets real estate developers avoid capital gains tax even when they sell buildings and receive profits.[49]

Critics of increasing taxes on high-income and high-wealth households often argue that doing so would stifle economic growth by reducing the return to capital investment and discouraging economic activity. Yet this belief, which has been subject to extensive research and analysis, does not fare well under scrutiny.[50]

These proposed reforms to the corporate and high-income provisions of the tax code in addition to letting the 2017 law provisions benefiting affluent households expire as scheduled belong at the center of future tax debates. They would generate substantial progressive revenue that the U.S. could use to fund new investments or address long-term fiscal challenges, benefiting workers, families, and businesses.

Footnotes can be found at the bottom of the page here at cbpp.org.