By Bill McBride Calculated Risk Single-family serious delinquencies increased slightly in August, and multi-family serious delinquencies decreased slightly. Freddie Mac reported that the Single-Family serious delinquency rate in August was 0.52%, up from 0.51% June. Freddie’s rate is down year-over-year from 0.55% in August 2023. This is below the pre-pandemic lows. Freddie’s serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.Fannie Mae reported that the Single-Family serious delinquency rate in August was 0.50%, up from 0.49% in July. The serious delinquency rate is down year-over-year from 0.53% in August 2023. This is also below the pre-pandemic

Topics:

Angry Bear considers the following as important: Calculated Risk, Delinquency Rate, Single Family, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

by Bill McBride

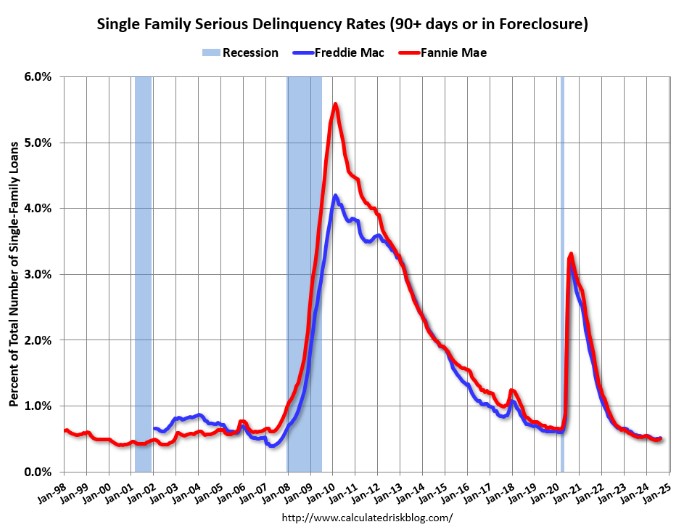

Single-family serious delinquencies increased slightly in August, and multi-family serious delinquencies decreased slightly.

Freddie Mac reported that the Single-Family serious delinquency rate in August was 0.52%, up from 0.51% June. Freddie’s rate is down year-over-year from 0.55% in August 2023. This is below the pre-pandemic lows.

Freddie’s serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

Fannie Mae reported that the Single-Family serious delinquency rate in August was 0.50%, up from 0.49% in July. The serious delinquency rate is down year-over-year from 0.53% in August 2023. This is also below the pre-pandemic lows.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

These are mortgage loans that are “three monthly payments or more past due or in foreclosure”. Mortgages in forbearance are being counted as delinquent in this monthly report but are not reported to the credit bureaus.

For Fannie, by vintage, for loans made in 2004 or earlier (1% of portfolio), 1.45% are seriously delinquent (up from 1.43% the previous month).

For loans made in 2005 through 2008 (1% of portfolio), 2.11% are seriously delinquent (up from 2.06%).

For recent loans, originated in 2009 through 2023 (98% of portfolio), 0.44% are seriously delinquent (up from 0.43%). So, Fannie is still working through a handful of poor performing loans from the bubble years.

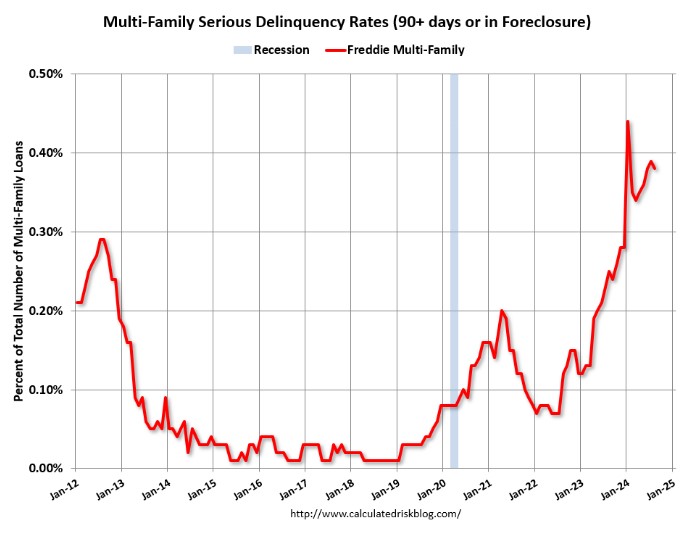

Multi-Family Delinquencies Decreased, but Elevated

Freddie Mac reports that the multi-family delinquencies rate decreased to 0.38% in August, down from 0.39% in July, and down from the recent peak of 0.44% in January.

This graph shows the Freddie multi-family serious delinquency rate since 2012. Rates were still high in 2012 following the housing bust and financial crisis.

The multi-family rate increased following the pandemic and has increased recently as rent growth slowed, vacancy rates increased and borrowing costs increased sharply. The rate surged higher in January and has moved mostly sideways at an elevated level since then.