By Dean Baker Commerce Department reported that GDP grew at a 1.6 percent annual rate in the first quarter, some-what lower than had generally been predicted. However, the headline number was held down by slow inventory accumulation, which subtracted 0.35 percentage points from growth, and a big rise in the trade deficit, which lowered growth by 0.86 percentage points. Pulling out these factors, final sales to domestic producers grew at a strong 2.8 percent annual rate. While it is not always reasonable to pull out these factors in assessing the underlying strength of the economy when they seem like part of a trend, this does not appear to be the case here. The pace of inventory accumulation was just .4 billion at an annual rate, below its

Topics:

Angry Bear considers the following as important: 1st Qtr, 2024, CEPR, GDP, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

by Dean Baker

Commerce Department reported that GDP grew at a 1.6 percent annual rate in the first quarter, some-what lower than had generally been predicted. However, the headline number was held down by slow inventory accumulation, which subtracted 0.35 percentage points from growth, and a big rise in the trade deficit, which lowered growth by 0.86 percentage points.

Pulling out these factors, final sales to domestic producers grew at a strong 2.8 percent annual rate. While it is not always reasonable to pull out these factors in assessing the underlying strength of the economy when they seem like part of a trend, this does not appear to be the case here.

The pace of inventory accumulation was just $35.4 billion at an annual rate, below its recent average. It seems far more likely to rise than fall in future quarters. Similarly, the jump in the trade deficit followed a fall in the fourth quarter. There is little reason to believe that there is any ongoing trend towards larger deficits.

Inflation Came in Higher Than Expected

The Personal Consumption Expenditure (PCE) deflator rose at a 3.4 percent annual rate in the quarter, up from just a 1.8 percent rate in the fourth quarter. The core index rose at an even more rapid 3.7 percent rate.

We will get a fuller breakdown with the release of March PCE data tomorrow, but one big factor was an 11.0 percent inflation rate for financial and insurance services. This is striking since this is a net measure that picks up operating costs and profits. It is not affected by the money paid out in claims. This is especially notable in the case of auto insurance where the PCE measure had been running well below the CPI measure, which does include money paid out in claims.

Consumption Grows at a 2.5 Percent Rate, Led by a 4.0 Percent Growth Rate for Services

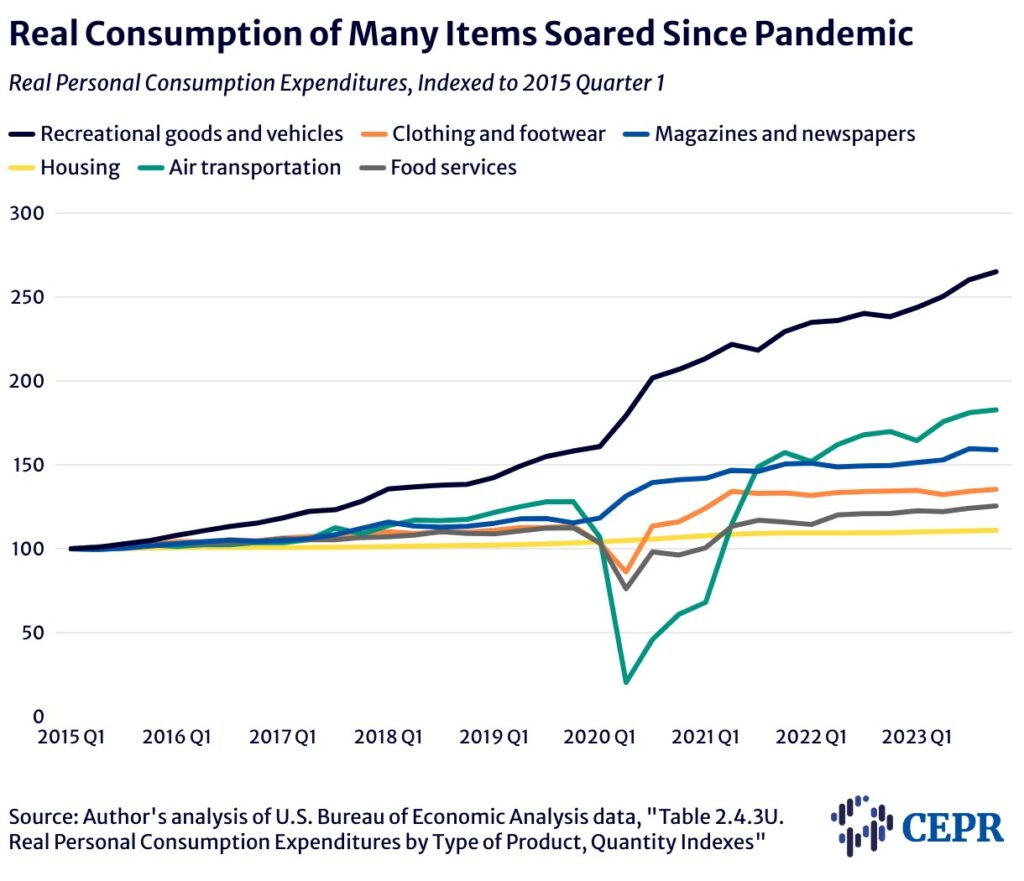

Strong growth in consumption was the biggest factor in first quarter GDP growth, adding 1.68 percentage points to the quarter’s growth. The whole story here was the service sector, which grew at a 4.0 percent rate. Consumption of nondurables was flat, while consumption of durable goods fell at a 1.2 percent rate. Motor vehicle sales were the biggest part of that story, falling at an 8.0 percent rate, the fourth consecutive quarterly decline. This subtracted 0.25 percentage points from the quarter’s growth.

On the service side, the biggest factors were a 5.5 percent increase in real health care services and a 7.9 percent rise in financial services and insurance. These added 0.59 and 0.37 percentage points to growth, respectively. It is worth noting that much of the rise in financial services is an imputation that is associated with a rising stock market. This is true for the inflation measure in the PCE deflator as well.

Housing Investment Rises at a 13.9 Percent Rate

Residential construction along with mortgage refinancing, plunged after the Fed started raising interest rates in March 2022. After three consecutive quarters of double-digit declines, the pace of growth slowed in 2023, and we actually saw modest gains in the second half of 2023. The jump in the first quarter, which added 0.52 percentage points to GDP, is the largest since the last quarter of 2020 and is not likely to be repeated. Unfortunately, it is primarily in the construction of single-family units, as construction of multifamily units actually fell slightly, but still stands more than 30 percent above pre-pandemic levels.

Structure Investment Edges Down after Four Quarters of Double-Digit Growth

After achieving extraordinary gains through 2023, structure investment edged down slightly in the first quarter, as modest drops in other categories outweighed another increase in factory construction. Factory construction grew at a 14.2 percent annual rate in the quarter, continuing its extraordinary growth rate following the passage of the CHIPS Act (Creating Helpful Incentives to Produce Semiconductors) and the IRA (Inflation Reduction Act). It now stands at more than twice its pre-pandemic level.

Other Investment Components Show Modest Gains as Fixed Investment Rises 2.9 Percent

Investment in equipment rose at a 2.1 percent rate, while investment in intellectual products rose at a 5.4 percent rate. On the equipment side, the big increases were in computers and industrial equipment, while spending on transportation equipment actually fell. With intellectual products, almost all the gains were in software, presumably associated with the Artificial Intelligence boom.

Government Spending Grew at a 1.2 Percent Pace, Slowest Since Second Quarter of 2022

Federal government spending fell at a 0.2 percent rate while state and local spending, which accounts for the bulk of government expenditures, rose at just a 2.0 percent rate. The drop in federal spending was the result of a 0.6 percent decline in defense spending. This category is always erratic and the decline is likely to be reversed in future quarters.

The slower pace of state and local spending reflects a tightening of budgets, as most of these governments have exhausted federal pandemic funding. We are likely to see growth in this area roughly in line with growth in the overall economy.

Imports Rise at a 7.2 Percent Rate, Pushing Trade Deficit Higher

The rise in the trade deficit in the first quarter was driven by an unusually large rise in imports, accompanied by a weak 0.9 percent increase in exports. This is not likely to be an ongoing trend. While the US economy is growing faster than our major trading partners, the gap is not so large that we should expect the deficit to expand substantially. The dollar has edged higher in recent months, but not likely enough to have a notable impact on the deficit.

One interesting aspect of the trade data was a 9.0 percent increase in service imports. This turns out to be entirely driven by a surge in Americans traveling abroad, which is now almost 30 percent above pre-pandemic levels.

Mixed Report: Strong Growth but Concerns About Inflation

It is reasonable to look past the headline number here and focus on the solid 2.8 percent increase in final sales to domestic producers. There is no story here of markedly slowing and the economy sliding towards recession.

However, we are seeing a reversal of the good inflation news from 2023. It’s not clear whether this is an ongoing trend or simply a bounce back from better-than-trend numbers in 2023. It is worth noting that wage growth has slowed to near the pre-pandemic pace by most measures. (We get new data next week.)

Unless we are seeing a trend for continually rising profit margins, we can’t tell a story where inflation is markedly above the pre-pandemic path. That is especially true if we are on a path of faster productivity growth, although the Q1 numbers weaken the case here.