Nothing new under the sun here. Maintaining profits has been a matter of fact for decades. It became more popular under Pres. Reagan. Deere Reports Strong Profits Amid Layoffs of Workers Across Iowa, Des Moines Register August 13, 2024 and Kevin Baskins at the Des Moines Register reports on the Deere & Company layoffs across the state of Iowa. Layoffs happen when the economy turns down, companies make mistakes, or when a new competitor hits the market. Just about anything can prompt a company to cut labor. Easiest thing in the world to do with Labor even though a company may have to kick into the Iowa’s unemployment funding for its present 22,000 employees. Neither are there plans to move Deere outside of the North American continent.

Topics:

Angry Bear considers the following as important: John Deere, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Nothing new under the sun here. Maintaining profits has been a matter of fact for decades. It became more popular under Pres. Reagan.

Deere Reports Strong Profits Amid Layoffs of Workers Across Iowa, Des Moines Register

August 13, 2024 and Kevin Baskins at the Des Moines Register reports on the Deere & Company layoffs across the state of Iowa. Layoffs happen when the economy turns down, companies make mistakes, or when a new competitor hits the market. Just about anything can prompt a company to cut labor. Easiest thing in the world to do with Labor even though a company may have to kick into the Iowa’s unemployment funding for its present 22,000 employees. Neither are there plans to move Deere outside of the North American continent. Technically, John Deere will remain in North America. However, it will open up a facility in Ramos, Mexico for production of mid-frame skid steer loaders and compact loaders.

Janet Yellen likes to call this type of move “friend-shoring.” I am sure labor would disagree with her.

Gov. Kim Reynolds in 2023 signed a revisionary law reducing unemployment benefits to 16 weeks from 26 weeks. The new law requires affected workers to accept lower-paying jobs sooner. The outcome for X-Deere workers more likely anyway as Deere is near the top of the wage scale for Iowa manufacturing employers. It is adding insult to injury as Labor is more than likely not the cause of the loss of business or lower profits.

Speaking of which . . .

“For the third quarter, Deere reported net income of $6.29 per share, compared with an estimate from analytics firm LSEG of $5.63, while net sales and revenue decreased 17% to $13.2 billion. CFRA Research analyst Jonathan Sakraida . . .

‘Deere’s pricing power was reflected well in Q3 as price helped to dampen impacts from contracting volumes.’

Though sales in one of Deere’s agriculture segments, which includes larger farm equipment, fell 25% to $5.1 billion due to lower shipment volumes, the impact was partially offset by better pricing.

Deere said it expects an improved favorable price realization in its agriculture segments in 2024 compared to its previous targets. CEO John C. May . . .

‘In response to weak market conditions, we have taken steps to reduce costs and strategically align our production with customer needs.'”

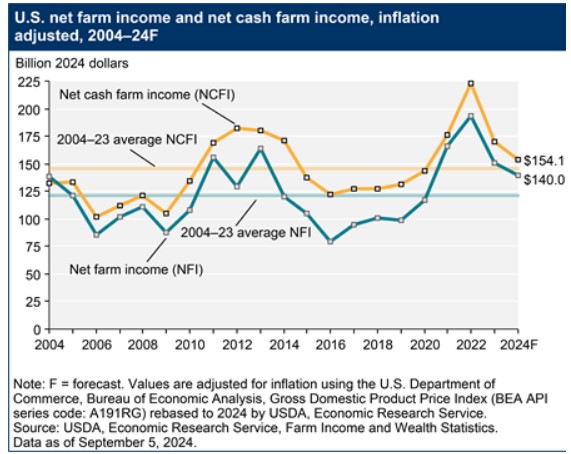

Deere did maintain its 2024 net income around $7 billion. This even as U.S. farm incomes are forecast to plunge (USDA) in 2024. This is due to a sharp decline in prices of commodity crops such as corn and soybeans, heightened production costs and shrinking government support.

Iowa state Rep. Jerome Amos Jr. of Waterloo the location for Derre’s main tractor plant, spent 33 years working there. He said he wasn’t surprised the company maintained its profitability by making deep job cuts. Adding . . .

“That’s what they do (cut workforce) when profits are down. It’s not pleasant, but it is the John Deere way.” Amos experienced a three-year layoff from the company in the nineteen-eighties.

“John Deere is going to do what it needs to do to maintain profits and shareholder value,” he said.

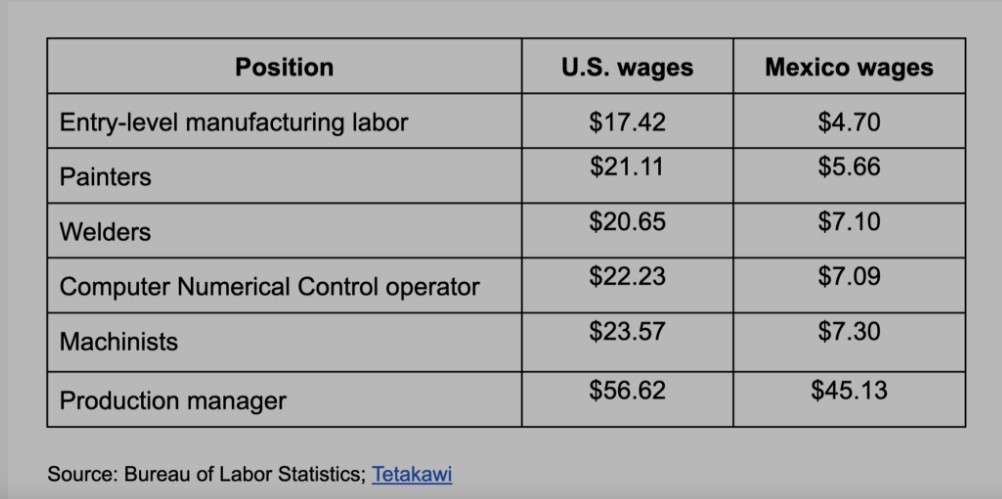

The battle for US v Foreign Labor usually boils down to benefits and who pays what.

Mexican wages are expressed as a daily pay rate based on a 365-day calendar year. The daily pay rate includes certain benefit entitlements like health insurance. In the US healthcare benefits are at least three times more expensive in the U.S.

U.S. companies pay an average $22,000 each year per employee for health insurance. In Mexico, healthcare is covered by a blend of subsidized and employer-sponsored insurance. An American product manager, for example, sent to Mexico to work instead of Iowa would cost the company around $5,900 annually for health insurance (according to Mexico-based management offshoring consultancy Tetakawi).

For example: Employers in Mexico pay social security on wages and deduct social security contributions from employee paychecks which is similar to the same way U.S. companies operate. In Mexico, these contributions cover all basic healthcare, so employers do not have to offer their own healthcare plans.

It is not the Labor wage killing US jobs, it is the Overhead. As a Supply Chain consultant, we would explain this to US companies. One approach to lowering Overhead costs would be for Medicare for All or something similar. If you believe going to China, Philippines, Thailand, Malaysia (all countries I have been in), it is less costly. At a minimum you own inventory you can not touch for six or so weeks before it is in your possession. If were smart, which most companies are more cost conscious than smart; hiring well educated supply chain personnel would cut their costs deeply

John Deere: Shrinking In Iowa, But Set To Grow In Mexico, Coalition For A Prosperous America