Medicare Advantage Plans are funded by Traditional Medicare which is slowly being depleted. Much of what MA does which proves to be so costly is due to MA up coding of its patients. It is estimated this will cost an ~ billion in 2024. This is up from billion in 2023. Studies have found evidence of upcoding and favorable selection of patients are driving significant overpayments to MA plans. MedPAC also said the program’s quality bonus system isn’t a good measure of plan quality, joining other research groups who say the program needs reform. Yet, major payers in MA are pushing back against regulatory changes which could upset their golden goose. (MA can be twice as profitable for insurers than other types of plans). Think United

Topics:

Angry Bear considers the following as important: Healthcare, Mecicare Advantage

This could be interesting, too:

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes RFK Jr. blames the victims

Joel Eissenberg writes The branding of Medicaid

Bill Haskell writes Why Healthcare Costs So Much . . .

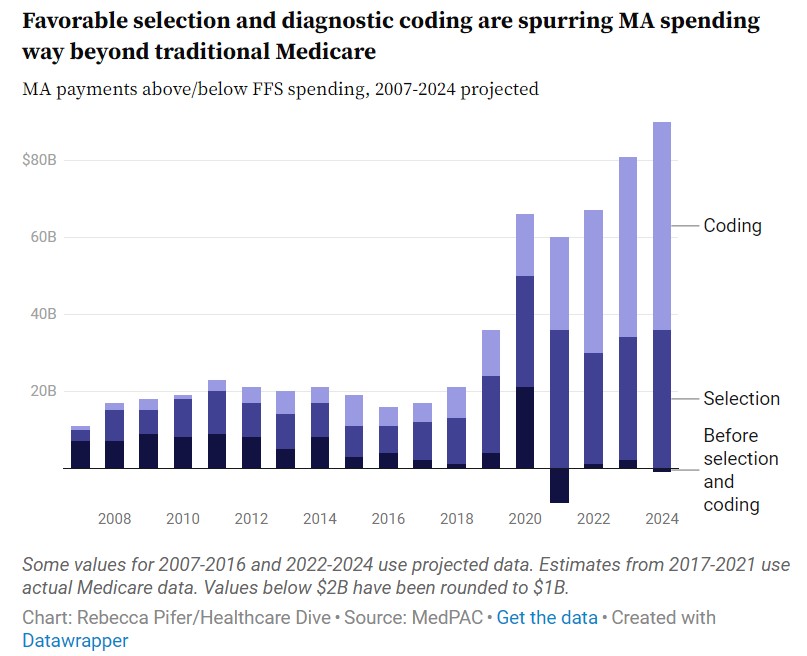

Medicare Advantage Plans are funded by Traditional Medicare which is slowly being depleted. Much of what MA does which proves to be so costly is due to MA up coding of its patients. It is estimated this will cost an ~$88 billion in 2024. This is up from $80 billion in 2023.

Studies have found evidence of upcoding and favorable selection of patients are driving significant overpayments to MA plans. MedPAC also said the program’s quality bonus system isn’t a good measure of plan quality, joining other research groups who say the program needs reform.

Yet, major payers in MA are pushing back against regulatory changes which could upset their golden goose. (MA can be twice as profitable for insurers than other types of plans). Think United Healthcare.

How Affordable is Medicare Advantage?

Healthcare insurance provider Elevance is suing the federal government to stop changes to how MA calculates quality bonus ratings, while Humana is suing to halt payment audits.

The affordability of health care services has become a major issue for insured Americans because of limitations on coverage. Despite their guaranteed public coverage, people with Medicare also face affordability concerns. A full 19% of Medicare beneficiaries are considered underinsured, meaning they spend at least 10% of their income on health care expenses other than premiums.1 Indeed, 1 of the apparent reasons for the popularity of Medicare Advantage (MA) plans, which now enroll more than half of Medicare beneficiaries, is that they promise to make care more affordable for their enrollees.2 With the majority of beneficiaries enrolled in MA today being individuals with a low income, the affordability of care in MA is even more important. However, several recent surveys raise questions about whether MA is succeeding in this regard.

MA plans assist with the affordability of care through several mechanisms. Unlike traditional Medicare (TM), MA plans must cap out-of-pocket expenses under Parts A and B of Medicare. They must also use their federal rebates to reduce enrollees’ expenses, either directly through lower premiums and cost-sharing or indirectly by providing supplemental benefits that could reduce the costs of dental, vision, and other services that TM does not cover. Together with extra payments for quality, favorable selection, and intensive diagnostic coding, these additional payments result in MA plans costing the federal government approximately $2500 more per beneficiary in 2024 than what it would have cost to cover similar beneficiaries in TM.3

However, multiple surveys of Medicare beneficiaries indicate that the proportion of beneficiaries who find their care affordable is no greater in MA than in TM. In a 2022 survey of 1604 Medicare beneficiaries aged 65 years and older, 41% of MA enrollees said they had problems accessing health care due to its costs, compared with 35% of beneficiaries in TM.1 This lack of significant differences between MA and TM persisted after stratifying by beneficiaries’ income. Similar results were found in other studies.4

In fact, some evidence indicates that MA enrollees may have more problems affording health care. A 2024 survey of 3280 Medicare beneficiaries found a significantly larger proportion of enrollees in MA than in TM said they could not afford health care they needed because of co-payments or deductibles (12% vs 7%).5 A significantly larger share of older adults in MA than in TM reported problems paying medical bills and paying off medical debt (21% vs 14%), which was particularly true for older adults with middle incomes (27% vs 16%).1 MA enrollees are also significantly more likely than beneficiaries in TM to report delays in accessing services because of the need for pretreatment approval, such as prior authorization (22% vs 13%).5

One exception to this pattern is among people with low incomes who are dually eligible for Medicare and Medicaid. A larger share of dually eligible beneficiaries in TM than those in MA said they delayed care due to its costs (10% vs 6%).6 Yet, by other affordability metrics, including problems paying medical bills and trouble getting needed care, the share of dually eligible beneficiaries facing challenges affording needed care is similar between MA and TM.6

Survey results also raise questions about whether the coverage of supplemental services offered by MA plans is making those services more affordable. Although coverage for dental care is available in virtually all MA plans and not in TM, older adults in MA are just as likely as those in TM to say they did not use dental services because of the costs (30% vs 24%), a finding confirmed in other research.5,7 Likewise, dually eligible beneficiaries in MA were as likely as those in TM to say they could not get needed dental care (20% vs 18%).6 However, this may not be true for other supplemental services since dually eligible beneficiaries in MA were significantly less likely than those in TM to say they could not get needed vision (7% vs 12%) or hearing (4% vs 8%) care.6

Several factors could explain these findings. Of TM enrollees with both Medicare Parts A and B, 41% have Medigap plans, which significantly assist with the costs of Medicare deductibles and co-pays.3 Beneficiaries who either cannot afford Medigap coverage or cannot obtain this coverage because of underwriting and preexisting conditions may find health care more affordable under MA plans. Beneficiaries with disabilities aged 65 years or younger, who typically have lower incomes than other beneficiaries, are one of the groups most affected by underwriting because most states do not have guaranteed issue rights for Medigap until beneficiaries turn age 65 years.

When accessing supplemental services, MA enrollees may be incurring associated, unexpected out-of-pocket costs. Unfortunately, there are scant available data on the generosity of coverage available for supplemental benefits within MA, the networks or conditions that must be met for the benefit to be covered, or the proportion of enrollees who incur out-of-pocket expenses in using them. Whether due to an inability to afford and access the benefit or lack of need for it, 30% of MA enrollees report not using supplemental benefits of any type.5

Restrictions on the providers used by beneficiaries in MA may cause more beneficiaries to seek out-of-network services for which they have little or no coverage. TM patients do not face such restrictions.

Denials or delays in coverage resulting from requirements for prior authorization under MA could cause more MA patients to pay out of pocket for denied or delayed services. Here again, prior authorization is generally not required for services covered by TM.

Caps on out-of-pocket expenses in MA plans under Parts A and B of Medicare are high enough in most plans that only a small proportion of enrollees exceed them. Thus, few MA enrollees benefit from this plan requirement.3

Unmeasured patient characteristics and expectations could factor into the survey results. Favorable selection into MA and the marketing of plans as more affordable may result in MA enrollees having different baseline expectations and perceptions of affordability than beneficiaries in TM. Since a larger share of people with low incomes are enrolled in MA, the survey results of MA enrollees may reflect the greater challenges that this population faces in affording care. Yet, even among people with low incomes, the survey results show few differences in the affordability of care between MA and TM.

Any shortcomings of MA plans in solving the affordability problem should not obscure their strong points. Survey respondents in TM and MA report similar levels of overall satisfaction with their coverage.5 For those who use them, the supplemental services available under MA plans may have important health and quality of life benefits. Evidence also suggests that MA plans may be making some supplemental services more accessible for dually eligible beneficiaries.

Nevertheless, given the higher costs of MA, and the requirement under federal law that plans use those extra funds to reduce enrollees’ expenses, one might expect the perceived affordability of care under MA to be greater than under TM. Further research should identify the reasons for this finding, and what the federal government and health plans can and should do to fulfill MA’s promise to make care more affordable for its patients.

1. Leonard F, Jacobson G, Collins SR, Shah A, Haynes LA. Medicare’s affordability problem: a look at the cost burdens faced by older enrollees. Commonwealth Fund. September 19, 2023. Accessed July 3, 2024. https://www.commonwealthfund.org/publications/issue-briefs/2023/sep/medicare-affordability-problem-cost-burdens-biennial

2. Leonard F, Jacobson G, Haynes LA, Collins SR. Traditional Medicare or Medicare Advantage: how older Americans choose and why. Commonwealth Fund. October 17, 2022. Accessed July 3, 2024. https://www.commonwealthfund.org/publications/issue-briefs/2022/oct/traditional-medicare-or-advantage-how-older-americans-choose

3. Medicare Payment Advisory Commission. Report to the congress: Medicare payment policy. March 2024. Accessed July 3, 2024. https://www.medpac.gov/wp-content/uploads/2024/03/Mar24_Ch12 MedPAC_Report_ To_Congress_SEC.pdf

4. Jacobson G, Cicchiello A, Sutton JP, Shah A. Medicare Advantage vs. traditional Medicare: how do beneficiaries’ characteristics and experiences differ? Commonwealth Fund. October 14, 2021. Accessed July 3, 2024. https://www.commonwealthfund.org/publications/issue-briefs/2021/oct/medicare-advantage-vs-traditional-medicare-beneficiaries-differ

5. Jacobson G, Leonard F, Sciupac E, Rapoport R. What do Medicare beneficiaries value about their coverage? Commonwealth Fund. February 22, 2024. Accessed July 3, 2024. https://www.commonwealthfund.org/publications/surveys/2024/feb/what-do-medicare-beneficiaries-value-about-their-coverage

6. Sutton J, Jacobson G, Leonard F. The health care experiences of people dually eligible for Medicare and Medicaid: comparing traditional Medicare and Medicare Advantage. Commonwealth Fund. June 27, 2024. Accessed July 3, 2024. https://www.commonwealthfund.org/publications/2024/jun/health-care-experiences-people-dually-eligible-medicare-medicaid

7. Simon L, Cai C. Dental use and spending in Medicare Advantage and traditional Medicare, 2010-2021. JAMA. 2024;7(2):e240401. doi:10.1001/jamanetworkopen.2024.0401 Article PubMed Google Scholar