QUARTZ The ‘Lock-in Effect’ is Easing. Here is What It means for the Housing Market Homeowners are beginning to give up on waiting for lower mortgage rates. That could be good news for potential homebuyers. In the first quarter of this year, six of every seven homeowners, or 86%, have a mortgage rate below 6%, according to a Redfin analysis of the Federal Housing Finance Agency’s National Mortgage Database published Tuesday. That’s down from a record 93% in the second quarter of 2022, a sign that the lock-in effect is easing. And that’s true at every mortgage rate level. The share of homeowners that has held onto their current mortgages has declined in the past two years — even for those enjoying rates below 3%. The so-called “lock-in

Topics:

Angry Bear considers the following as important: housing markets, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

QUARTZ The ‘Lock-in Effect’ is Easing. Here is What It means for the Housing Market

Homeowners are beginning to give up on waiting for lower mortgage rates. That could be good news for potential homebuyers.

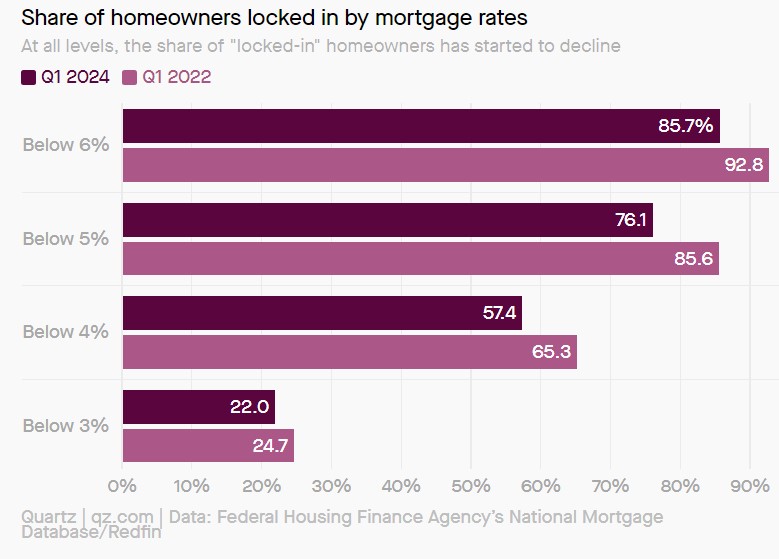

In the first quarter of this year, six of every seven homeowners, or 86%, have a mortgage rate below 6%, according to a Redfin analysis of the Federal Housing Finance Agency’s National Mortgage Database published Tuesday. That’s down from a record 93% in the second quarter of 2022, a sign that the lock-in effect is easing.

And that’s true at every mortgage rate level. The share of homeowners that has held onto their current mortgages has declined in the past two years — even for those enjoying rates below 3%.

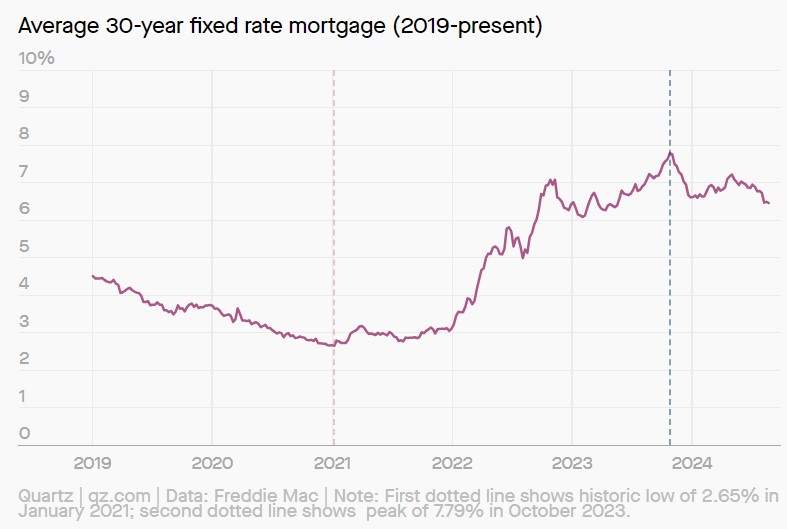

The so-called “lock-in effect” refers to homeowners electing to stay in their homes to hold onto their lower mortgage rates when they otherwise might have considered a move. Much of this was brought on by historically low rates at the height of the pandemic in 2020 and 2021, when they dipped below 3%.

Since then, mortgage rates have more than doubled, driving many homeowners to stay put in anticipation of lower rates and a friendlier housing market. The average interest rate for a 30-year fixed mortgage is currently 6.46%, according to the government-sponsored mortgage provider Freddie Mac (FMCC).

This has left potential homebuyers with fewer and fewer options. Last month, new listings hit their lowest level in a year, according to Redfin (RDFN).

“I have a dozen or so homeowners who would like to sell, but aren’t willing to give up their 3% interest rate for one that’s more than twice as high,” Blakely Minton, a Redfin (RDFN) Premier real estate agent in Philadelphia, said in a statement. “Many of those sellers will list if rates get back down to 5%.”

As a result, the lock-in effect has contributed to the U.S. housing shortage, which is estimated to be between 4 and 7 million homes. The short supply is also pushing up housing prices, which have continued to climb each month. The median sale price hit $439,455 in July, a 4.1% year-over-year increase.

This phenomenon appears to be slowly but surely loosening its grip on the market, however. More and more homeowners are biting the bullet and giving up their low rates, largely out of necessity, according to Redfin. Major life events, like a job change or divorce, are giving people no other choice but to list their homes, regardless of rates.

And with mortgage rates finally starting to trend downwards, the “lock-in” effect could ease at a quicker pace than we’ve seen over the last two years. That said, it still has a ways to go before Americans feel comfortable taking the leap: Just 2% of homeowners surveyed by Bankrate in June said they would purchase a home this year at a mortgage rate of 6% or higher.

Meanwhile, 47% said mortgage rates would need to be below 5% for them to feel comfortable buying a home this year, and 38% said they’re looking for rates below 4%.

While many are dreaming of a return to pandemic-era rates, Bankrate chief financial analyst Greg McBride warned homeowners not to hold their breath.

“The hopes for lower interest rates need the reality check that ‘lower’ doesn’t mean we’re going back to 3 percent mortgage rates,” he said.