More on Pharmacy Benefit Managers and their influence on costs In case you forgot who the PBMs are? The FTC said in its interim report, the “increasing vertical integration and concentration enables the six largest PBMs to manage nearly 95 percent of all prescriptions filled in the United States.” Those six are Caremark Rx, LLC; Express Scripts, Inc.; OptumRx, Inc.; Humana Pharmacy Solutions, Inc.; Prime Therapeutics LLC; and MedImpact Healthcare Systems, Inc. ~~~~~~~~ Pharmacy Benefit Managers Overpay Their Own Pharmacies to the Detriment of Insurers and Taxpayers MedPage Today Pharmacy Benefit Managers (PBMs) often reimburse their own affiliated pharmacies at higher rates than they do independent pharmacies, to the disadvantage

Topics:

Angry Bear considers the following as important: Healthcare, MedPage Today, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

More on Pharmacy Benefit Managers and their influence on costs

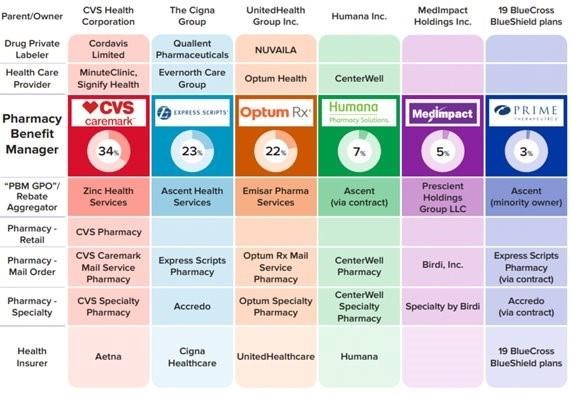

In case you forgot who the PBMs are? The FTC said in its interim report, the “increasing vertical integration and concentration enables the six largest PBMs to manage nearly 95 percent of all prescriptions filled in the United States.” Those six are Caremark Rx, LLC; Express Scripts, Inc.; OptumRx, Inc.; Humana Pharmacy Solutions, Inc.; Prime Therapeutics LLC; and MedImpact Healthcare Systems, Inc.

~~~~~~~~

Pharmacy Benefit Managers Overpay Their Own Pharmacies to the Detriment of Insurers and Taxpayers

Pharmacy Benefit Managers (PBMs) often reimburse their own affiliated pharmacies at higher rates than they do independent pharmacies, to the disadvantage of insurers as well as taxpayers according to the Federal Trade Commission (FTC). Suzie Jing of the FTC’s Office of Policy Planning, presented interim results from the agency’s report on PBMs at a commission meeting Thursday.

“We see evidence PBMs pay their own pharmacies inflated prices. For example, she said, in the case of generic abiraterone (Zytiga) for prostate cancer, it costs $229 to buy the drug, but the big three PBMs pay their affiliated pharmacies about $6,000 per month on average. That’s double the price paid to unaffiliated pharmacies … This means that the PBM is overpaying itself at the expense of — first, private insurance plans, which can lead to higher patient insurance costs; and second, at the expense of taxpayers who pay for Medicare.”

Jing noted that the top six PBMs manage 94% of pharmacy claims. In addition, “based on our review to date, we find that there’s often no negotiation for contract terms,” she said. “The PBMs’ internal memos reference ‘unilateral’ or ‘passive’ contracts, which are more like notifications — often sent via fax — outlining terms that take effect automatically, without the need for affirmative consent or signature. Reimbursement rates in these contracts can be unfavorable and potentially untenable, especially for local community pharmacies.”

The FTC also found examples in which the PBMs’ rebate contracts with drug manufacturers “are designed to limit access to affordable drugs and will exclude generic drugs from formularies … this is disturbing,” Jing said.

The report was quickly criticized by an industry representative. “Unfortunately, the interim report falls far short of being a definitive, fact-based assessment of the PBM industry,” Austin Ownbey, spokesman for the Pharmaceutical Care Management Association, a trade group for PBMs, said during the meeting’s public comment portion. “It’s devoid of empirics and built entirely around unsupported assertions. It also overlooks the volume discounts provided by the PBMs that demonstrate the value that they provide to America’s healthcare system by reducing prescription drug costs and increasing access to medications.”

On the other side of the issue, several independent pharmacy owners testified that PBMs’ business practices had hurt their business or even forced them to close. “My wife and I were owners of four pharmacies in central Ohio, [but we] closed all four locations in February of this year,” said Joe Craft. “The interim report insights are exactly in line with what I’ve witnessed over my 29 years as a pharmacist.”

“To put it simply, PBM abuses, of which there are many, put us out of business,” he continued. “We owned four stores, and we were having the same problem at each location — we weren’t making enough to cover our cost of operations because of low reimbursement. The PBMs dictated what we were paid and stole from us so we could not succeed no matter how busy we were.” In three of the closed locations, there were no other pharmacies in that same ZIP code, so “the PBMs have created pharmacy deserts where we closed,” he added.

Mallika Kopalle, who operates four independent pharmacies in Utica and Syracuse in New York State, said she also was having financial difficulties. “As we speak, [one large PBM] is taking $21,000 from our small pharmacy,” she said, adding that the PBM’s explanation was that the action was a result of something that happened in 2021. “This is on top of hundreds of thousands of DIR [direct and indirect remuneration] fees which were charged to us. They won’t give us an explanation and they won’t give us any further markdown . . . We need PBM reform sooner rather than later.”

One speaker told a darker story. “We lost our 22-year-old son to the tactics and greed of PBMs,” said William Schmidtknecht of Windsor, Wisconsin. “My son went into a pharmacy to fill a routine prescription that he would have paid less than $70 for in 2023; 10 days into 2024 he went in there to get his prescription at a pharmacy, and his price was changed to over $500.”

His son was unable to fill the prescription due to the high cost; “he got rushed to the ER on the 15th of January with cardiac arrest due to asthma and died 6 days later,” Schmidtknecht said. “My son’s death is just one of many out there … The reality is the greed, the tactics, the deception, is killing people in this country. You guys can fix that. We need your help.”

On the other side of the issue, several business owners said PBMs had allowed them to offer good health benefits to their employees. “PBMs helped me offer top-notch prescription drug coverage for my employees and kept us competitive in the job market,” said Coby Cullins, a former business owner in Missouri. “The report completely ignores Big Pharma’s use of anticompetitive [tactics that cost] taxpayers billions of dollars in savings. By only focusing on PBMs, the FTC is shifting the blame away from the big drug companies and on to the only market entity successfully lowering the price of prescription medications.”

“PBMs are instrumental in helping employers like me be able to offer prescription drug benefits,” said Alicia Cantrell of Houston. “They provide us with the flexibility and options we need in order to design the best benefits for our business so our employees and their families can stay healthy.” Like Cullins, Cantrell also criticized pharmaceutical companies, saying that they “undermine competition in the prescription drug marketplace by constantly engaging in anticompetitive practices so they can extend the monopolies on drugs . . . They have engaged in baseless claims to encourage policymakers to narrowly focus on PBMs instead of others in the prescription drug supply chain.”