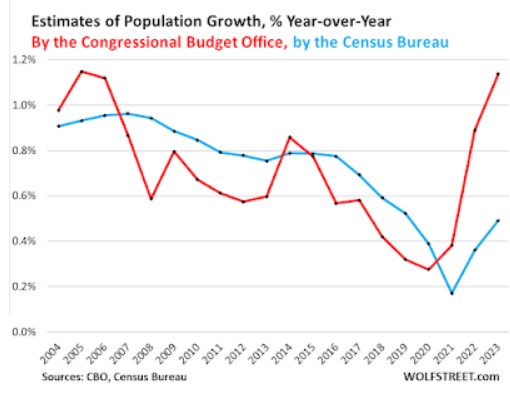

New Deal democrat talked about the issues of the difference in Household and Establishment population numbers here and here (Bonddad Blog) and also on Angry Bear. I also added some detail in two separate posts also. Accordingly, New Deal democrat; “A big current issue with the Household Survey is whether, by relying on Census estimates, it has substantially underestimated population growth, and in particular immigration-driven growth, in the past two years. Here’s a graph from Wolf Street, the source material of which I have verified, that sums it up:” In the past two years through May, according to the Census Bureau, the US population has grown by a little over 1%. But according to the Congressional Budget Office, it has grown slightly over 2%.

Topics:

Angry Bear considers the following as important: immigration, population growth, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

New Deal democrat talked about the issues of the difference in Household and Establishment population numbers here and here (Bonddad Blog) and also on Angry Bear. I also added some detail in two separate posts also. Accordingly, New Deal democrat; “A big current issue with the Household Survey is whether, by relying on Census estimates, it has substantially underestimated population growth, and in particular immigration-driven growth, in the past two years. Here’s a graph from Wolf Street, the source material of which I have verified, that sums it up:”

In the past two years through May, according to the Census Bureau, the US population has grown by a little over 1%. But according to the Congressional Budget Office, it has grown slightly over 2%. That’s over a 3,000,000 difference!

Normally or what I have seen is an adjustment early in the new year. This adjustment is not the result of purposeful, malicious error. It is more the result of how each source defines population growth and an influx of immigrants.

Dean Baker also has an explanation which I have added below.

Mixed Story: What the Revision to the Jobs Data Means, CEPR

I don’t have time to do an exhaustive analysis of the implication of the downward revisions to the jobs numbers today, but I will make a few quick points.

First, the people complaining that this downward revision exposes cooked jobs data in prior months need to get their heads screwed on straight. Let’s just try a little logic here.

If the Biden-Harris administration had the ability to cook the job numbers, do we think they are too stupid to realize that they should keep cooking them at least through November? Seriously, do we think they are total morons? If you’ve been cooking the numbers for twenty months, wouldn’t you keep cooking them until Election Day?

Okay, but getting more serious here, the staff of the Bureau of Labor Statistics (BLS) is a professional outfit that does exactly what we want it to do. They produce the data about the economy as best they can in a completely objective way. And they use methods that are completely transparent.

People can go to the BLS website and read as much as they like about the nature of the survey that produces the monthly jobs number and large revision we saw today. The basic story is that the monthly survey goes to hundreds of thousands of employers who are supposed to be representative of the millions of employers in the economy. Generally, the survey gives us a pretty accurate job count, but it will never be exact.

Every year the BLS adjusts the data from the survey based on state unemployment insurance (UI) filings which have data from nearly every employer in the country. These UI filings are a near census for all payroll employment. If the UI data gives a different picture than the survey of employers, then the filings are almost certainly right and BLS revises it data accordingly.

For reasons that we can only speculate about, there was an unusually large gap this year. Many economists and statisticians will spend many hours trying to figure out why this is the case. But one thing we should be confident of is that no one cooked the data. BLS did the best they could in structuring their survey of employers. If they can find ways to improve it, they will, as they have in the past.

What Does This Tell Us About the Economy?

Turning briefly to the substance of the revision, I realize many people will be quick to say that this is bad news for our picture of the economy. That is not clear at all.

First, we should be clear that even with the revision the economy still created jobs at a very rapid pace in the period covered, from March 2023 to March 2024. While BLS had previously reported that we created 2.9 million jobs over this period, or 242,000 a month. The revision means we created 2.1 million jobs or 172,000 jobs a month. By comparison, in the three years prior to the onset of the pandemic, we created jobs at a rate of 179,000 a month. Even with the downward revision, we were still creating jobs at a very healthy pace.

To put these numbers in a larger context, it is necessary to have a broader picture of the labor market. Every month we look at two independent surveys in the BLS Employment Report. One is the establishment survey which will be revised based on today’s report from the UI filings. The other is the survey of households, the Current Population Survey (CPS), which tells us the percentage of the workforce that is employed and unemployed.

The CPS also has a measure of employment, but we generally pay it much less attention, since on a monthly basis it is highly erratic. For example, in October of 2017, when the economy seemed to be growing at a healthy pace, the CPS showed a loss of 677,000 jobs. It is implausible there actually was a job loss anything like that in the month, just as it was implausible there was a job gain like the 783,000 reported for the prior month.

Over longer periods of time, the erratic jumps and plunges tend to average out, but even here there are problems. The CPS gives us ratios for the percent of people who are employed and unemployed and the characteristics of their employment, such as whether their job is full-time or part-time, the industry they are employed in, their race, gender, education, and other factors.

However, the total employment figure depends on population controls that come indirectly from the decennial Census. The population controls take the total number of people found in the Census and then adjust based on estimates of births, deaths, immigration, and emigration. This process is imperfect and can often lead to large errors.

For example, at the end of the decade of the 1990s, more than two million people were added into the population controls for the survey because of an underestimate of population growth in the decade. In recent years, the employment growth in the CPS has seriously lagged job growth in the CES. This is true even after today’s downward revision to the CES.

The most plausible explanation for the large gap between the two surveys is that the population controls are underestimating the impact of immigration. A recent paper from the Brookings Institution calculates that undercounting immigration may have led the CPS to understate employment growth by more than 1 million a year.

While we may not be able to use the CPS to get a more accurate count of the actual number of jobs generated by the economy, what it does give us is actually more important. It tells us the share of the population that is employed, unemployed, employed part-time, and even gives us data on wages.

These factors are more important because these factors tell us more directly how well people are doing. The number of jobs in itself doesn’t answer that question. It is not like runs in a baseball game. We care about jobs because people who want to work should be able to get a job. If it turns out that we are generated somewhat fewer jobs than we thought, but most people who want jobs have jobs, then this is a pretty good story.

That looks like the situation today. The unemployment rate was 4.3 percent in July. That is higher than the 3.4 percent low hit in April of last year, but it is still quite low by historical standards. It was only this low for three months of the George W. Bush administration, it only got down to 4.3 percent or lower for the last two years of the late 1990s boom. It never got close to 4.3 percent during the Reagan “boom” years.

To be clear, the rise in the unemployment rate since last April is cause for concern. If that continues, unemployment will definitely be a serious issue. But if we just take the snapshot for the unemployment rate for July of this year, it is hard to see much cause for complaint.

We can also flip this over and ask the opposite question of what share of the population is employed. Here we have a very good story. If we look at the prime age population, people between the ages of 25 and 54, the employment to population ratio stood at 80.9 percent in July. We would have to go back to April of 2001 to find a higher rate.

It is reasonable to look at prime-age employment to control for the effect of the aging of the population. Most of us would not consider it a bad thing that people in their sixties and seventies opt to retire rather than work. As the huge baby boom cohorts age, we are seeing a growing share of the population in retirement. Looking just at the prime age population allows us to see the share of the population that we think would want to work, who can actually get jobs.

We can also look at other factors like the share of the population who are working part-time, but want full-time jobs, which is now very low. And we can look at the growth rate of real wages (wages adjusted for higher prices), which has been good overall and especially for those at the lower end of the wage distribution.

How Do the Revisions Change the Economic Picture?

Nothing about the revisions to the CES change the story of an economy where jobs are relatively plentiful, and workers are seeing wage increases in excess of inflation. What they tell us is that the economy is creating fewer jobs than we had previously believed. But if we have high levels of employment with fewer jobs, what exactly is the problem?

In fact, there is a very positive side to this story. Assuming that we have accurately measured output (there are issues here too), if we generated this output with fewer jobs than we had previously estimated, this means productivity growth has been faster than had previously been estimated.

Productivity growth is the change in output per hour of work. If the economy created fewer jobs than we thought, then the growth in hours of work was less than we had previously believed. This means that productivity growth was stronger than had been reported.

This is a big deal since productivity growth ultimately determines how rapidly living standards can improve. There are huge issues of distribution, and also measurement (much of what affects living standards will not be picked up in productivity), but if productivity is growing at a 2.0 percent annual rate, this means that we can in principle see more rapid gains in living standards than if it is growing at just a 1.5 percent annual rate.

The one-year change doesn’t matter much, but over time this difference is substantial. In the case of a gap between a 2.0 percent growth rate versus a 1.5 percent growth rate, after a decade it would be almost 6.0 percent. For a worker near the median wage this would be the difference between taking home $53,000 a year versus $50,000 a year.

After 20 years, the gap would grow to almost 14 percent. This would amount to a wage gap of close to $7,000 for a worker earning near the median annual wage.

The lower job growth resulting from the revisions today would imply that hours grew by 0.5 percent less from the first quarter of 2023 to the first quarter of 2024. Productivity growth for this period is currently reported as 2.9 percent. A reduction in hours growth of 0.5 percent would mean that productivity growth is 0.5 percentage points faster than had been reported, or 3.4 percent over this period.

Before celebrating this extraordinary rate of productivity growth (we had averaged just 1.1 percent in the decade prior to the pandemic) it is important to realize that the data are highly erratic, especially in the period following the pandemic. Productivity had actually fallen 0.5 percent in the prior year.

So, it’s far too early to celebrate a pickup in productivity growth, but the downward revision to hours growth implied by today’s revision to the jobs data unambiguously raises the pace of productivity growth over the last year. In that sense, it is good news. But as with all economic data, it’s part of a big picture, and we can’t make too much of any specific data release in isolation.

Take Away from Revision—More Fears of Weakness and Hope for Faster Productivity

The rise in unemployment since its recovery low has caused many to fear a new recession. This is definitely a cause for concern, but most other data, including very current data on items like road and air travel and restaurant reservations, do not give evidence of a recession. Nonetheless, the report showing that we were creating jobs at a slower pace than previously reported, albeit still very rapid, points in the direction of weakness.

On the other hand, the revision is encouraging in that it bolsters the case for a productivity upturn. It is far too early to declare the upturn is here, but it’s great to get another data point in the right direction. For this reason, the slower job growth indicated by this revision should be seen as more good than bad.