The issue of the Tax Cuts expiring will be arriving at everyone’s doorstep come the end of 2025. They do not give an exact date so i will go with EOM December 2025. Does someone making close to or more than 0,000 annually deserve a continuation into 2026 and beyond? Not sure. I think the 1 percenter should be paying more tax. My wife and I paid some high taxes (what we would call high) when we were under 0,000 annually after deductions. That was near the end of our careers so this was not lifestyle changing for us. Trump tossing a tax break to the one percenter through to the one-tenth of one percenter has to come to an end. It should have also happened with the Bush tax breaks. They did not and Trump just added to the pile of deficit

Topics:

Angry Bear considers the following as important: politics, Taxes/regulation, TCJA

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

The issue of the Tax Cuts expiring will be arriving at everyone’s doorstep come the end of 2025. They do not give an exact date so i will go with EOM December 2025. Does someone making close to or more than $400,000 annually deserve a continuation into 2026 and beyond? Not sure. I think the 1 percenter should be paying more tax.

My wife and I paid some high taxes (what we would call high) when we were under $200,000 annually after deductions. That was near the end of our careers so this was not lifestyle changing for us. Trump tossing a tax break to the one percenter through to the one-tenth of one percenter has to come to an end.

It should have also happened with the Bush tax breaks. They did not and Trump just added to the pile of deficit spending if that is your worry.

In Comfort Oshagbemi and Louise Sheiner’s commentary “Which provisions of the Tax Cuts and Jobs Act Should Expire in 2025?” they answer the question at the end by providing a benefit of letting it expire after some changes.

Best to read through . . .

The Tax Cuts and Jobs Act (TCJA) of 2017 included significant changes to the tax code. Many of these changes were to be on temporary basis and were to expire at the end of 2025. Former President Donald Trump favors extending all the expiring provisions. Vice President Kamala Harris hasn’t been specific, but says she opposes any tax increases on people making less than $400,000, which implies extending some provisions of the TCJA.

Which are the most significant expiring provisions?

Standard deduction: The TCJA increased the standard deduction and eliminated personal exemptions. For example, if the TCJA expires as under current law, the standard deduction for a married couple will be approximately $16,525 in 2026, while the personal exemption will be about $5,275. If this provision of the TCJA were extended through 2026, the standard deduction would be roughly $30,725, and the personal exemption would be zero.1

Individual income tax rates: The TCJA lowered marginal income tax rates throughout much of the income distribution. For example, the TCJA cut the top marginal tax rate from 39.6% to 37%. These rates will increase to pre-2017 levels if the TCJA expires.

State and local tax (SALT) deduction: The TCJA imposed a $10,000 cap on the deductibility of state and local taxes (SALT). If this provision of the TCJA expires, all state and local property taxes and income taxes (or sales taxes in states without income taxes) will be deductible, primarily benefiting high-income taxpayers in high-tax states.

Child Tax Credit: The TCJA increases the tax credit for each child under 17 from $1,000 to $2,000. This is not adjusted for inflation. The maximum credit that can be refunded increased from $1,000 to $1,400 per child in 2018; that is adjusted for inflation and is set at $1,700 in 2024. The TCJA also increased the income thresholds at which the credit phases out. The child tax credit will fall back to $1,000 if the TCJA expires, which would make the real value of the credit about 25% lower than it was in 2017.

Deduction for small business income: The TCJA provided a 20% deduction for qualified pass-through income (section 199A) for sole proprietorships, partnerships, and S-corporations. If the TCJA expires, this deduction will no longer be available.

Alternative minimum tax (AMT): The TCJA increased the AMT exemption amounts and raised the income levels at which the exemptions phase out, resulting in fewer taxpayers liable for the AMT. If this provision of the TCJA expires, the 2026 AMT exemption for married couples filing jointly will be about $110,075, compared to about $140,300 if the provision is extended.

Estate taxes: The TCJA doubled the estate tax exemption. If this provision expires the exemption in 2026 will be about $14.3 million for married couples, compared to $28.6 million if the provision is extended.

Which provisions of the TCJA were not enacted on a temporary basis?

Corporate provisions: Most of the TCJA’s provisions that affect corporations—including the reduction in the corporate tax rate from 35% to 21%— do not sunset. One exception is the provision that permitted a 100% bonus depreciation deduction for assets with useful lives of 20 years of less. This deduction began phasing out in 2023 and will be fully phased out by 2026.

Individual and estate provisions: Most of the provisions affecting individuals and estates do sunset. One exception is the change in the inflation adjustment methodology. This was enacted on a permanent basis. In particular, the IRS is now required to use the chained CPI-U rather than the CPI-U to index the various provisions of the tax code that are inflation-adjusted—including the tax brackets and the standard deduction. The chained CPI-U typically rises more slowly than the CPI-U, resulting in increased tax revenues.

How much additional revenue is raised by the expiration of the TCJA’s individual tax policies?

In May 2024, the Congressional Budget Office estimated that the expiration of the TCJA’s individual tax provision would raise government revenues by $4.6 trillion from FY2025 – 2034, about 1.3% of projected GDP.

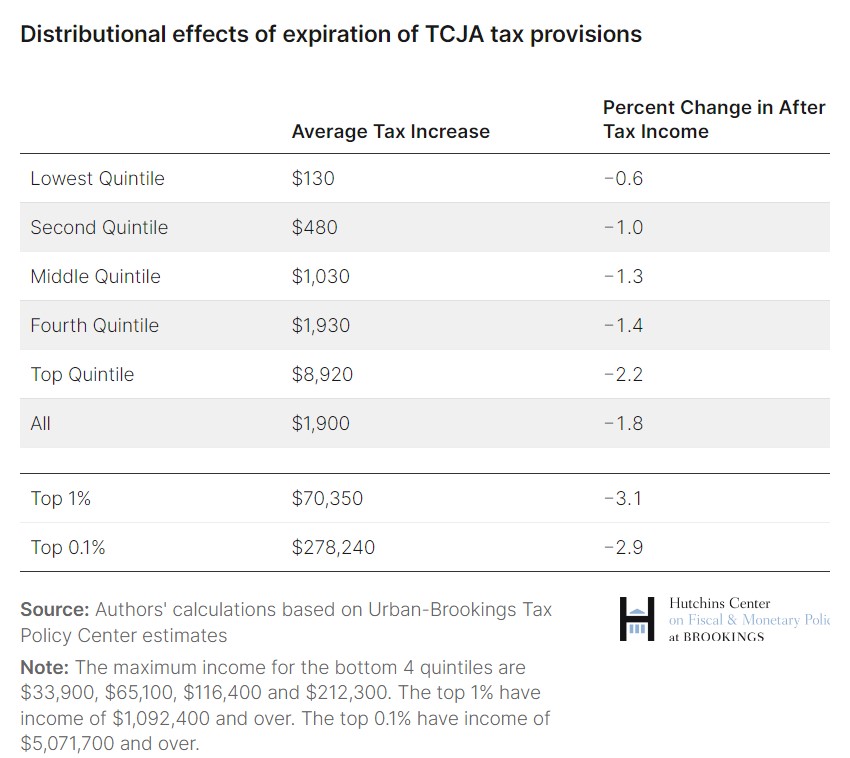

What are the distributional impacts of allowing the TCJA’s provisions to expire?

The TCJA provided the largest benefits to the richest taxpayers, and so the expiration of many of its provisions will disproportionately affect the rich. The table below reports estimates from the Tax Policy Center of the distributional effects of the expiration of the TCJA provisions.2 Households in the lowest income quintile will pay roughly one-half percent more of their income in taxes if all the provisions of the TCJA expire, while households in the top 1% will pay an additional 3.1% of their income in taxes.

Distributional effects of expiration of TCJA tax provisions

1. For all the calculations in this explainer, we assume that the CPI-U rises at a 2.5% annual rate though August 2024, and at a 2% annual rate thereafter.

2. The TPC tables report the effects of extending the tax provisions; we recalculate the percent change in after-tax income so that it reflects the effects of allowing them to expire relative to extending them.

The sunsetting of the Tax Cuts & Jobs Act: What federal employees need to know, Government Executive

2017 Tax Breaks and Jobs Act Failed to Deliver, Angry Bear

Looking at the Trump 2017 Tax Breaks and Extension of them, Angry Bear