Ran across am Americans for Tax Fairness article last night. Corporation tax dodging and executive pay has both is far out of control. A significant number of major U.S. corporations are paying their top executives more than they’re paying federal income taxes. Matters have worsened with trump taking office in 2016 and the TCJA Making the Tax System, and the Tax Season More Burdensome. There is roughly a .1 trillion deficit resulting from this tax break. It was passed using Reconciliation and can be repealed, etc. It has not increased revenues and has worsened the deficit. Key Findings Thirty-five profitable corporations paid top executives more than they paid in federal income taxes between 2018 and 2022. The 35 companies not only paid

Topics:

Angry Bear considers the following as important: 2017 TCJA, politics, Taxes/regulation, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Ran across am Americans for Tax Fairness article last night. Corporation tax dodging and executive pay has both is far out of control. A significant number of major U.S. corporations are paying their top executives more than they’re paying federal income taxes.

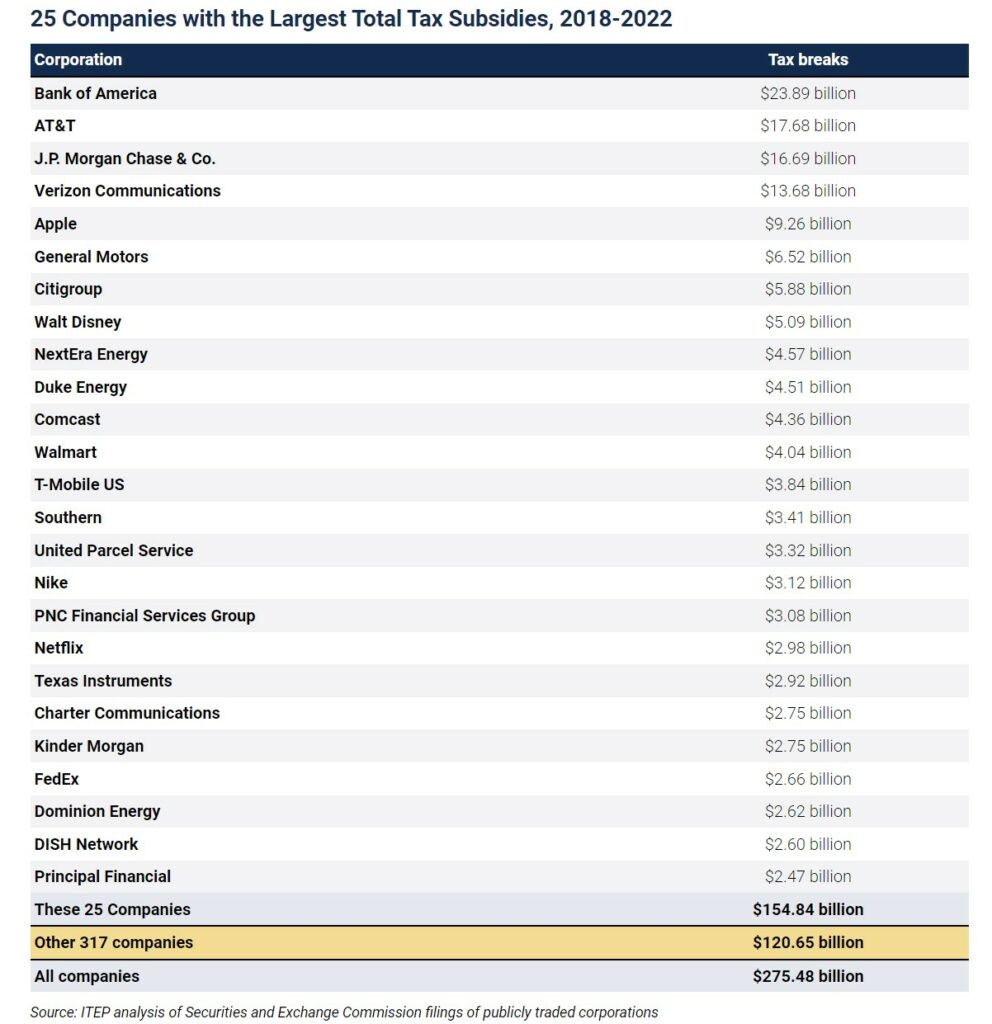

Matters have worsened with trump taking office in 2016 and the TCJA Making the Tax System, and the Tax Season More Burdensome. There is roughly a $2.1 trillion deficit resulting from this tax break. It was passed using Reconciliation and can be repealed, etc. It has not increased revenues and has worsened the deficit.

Key Findings

- Thirty-five profitable corporations paid top executives more than they paid in federal income taxes between 2018 and 2022.

- The 35 companies not only paid less to the federal government than their top bosses—they paid less than nothing to Uncle Sam, instead receiving almost $2 billion in cumulative refunds.

- 29 other big firms handed out bigger paychecks in the executive suite than they mailed in federal tax checks in at least two of the five years studied.

- Electric-car maker Tesla paid founder Elon Musk and the other four highest-paid executives $2.5 billion over that period. Despite $4.4 billion in domestic profits paid nothing in cumulative federal income taxes and instead got back a net $1 million in tax refunds.

- Wireless giant T-Mobile paid its top five executives $675 million, racked up almost $18 billion in domestic profits Yet instead of paying net taxes, they pocketed a cumulative refund of $80 million.

- Streaming king Netflix paid next to nothing on over $15 billion in domestic profits, only paying $236 million (or 1.6%) in taxes while rewarding their top five occupants of the executive suite with over $650 million in compensation.

Corporate Tax Avoidance in the First Five Years of the Trump Tax Law

Observations

“Both kinds of corporate misbehavior, underpaying taxes and overpaying executives ultimately make working families the victim through smaller paychecks and diminished public services,” said David Kass, executive director of Americans for Tax Fairness.

“Executives of big corporations are rewarded for aggressive tax avoidance while working families and small businesses are left to pick up the tab,” said IPS Global Economy director and report co-author Sarah Anderson.

Corporate taxes as a share of federal revenue and of the American economy have both been declining for decades. The 2017 Trump-GOP tax law — the centerpiece of which was a 40% corporate tax cut — only made things worse. The report also notes that while there have been attempts in recent years to rein in excessive executive compensation, the pay packages keep getting bigger.

Some policy solutions to end corporate tax dodging and rein in excessive executive pay:

- Raising the corporate tax rate to 28% (just half way back to Obama-era levels) would generate $1.3 trillion in new revenue over the next decade.

- Closing loopholes and eliminating tax breaks, through measures such as the No Tax Breaks for Outsourcing Act, which would remove the incentives for American firms to shift profits and production offshore.

- Enacting tax and procurement reforms and stronger curbs on stock buybacks and banker bonuses, which would help return executive pay to more reasonable levels.

“Rather than more tax breaks, Congress should focus on addressing these deficiencies by cracking down on the use of tax havens, eliminating wasteful corporate subsidies and closing loopholes that further enrich wealthy corporate executives,” the report concludes.

More for Them, Less for US: Corporations That Pay Their Executives More Than Uncle Sam