– by New Deal democrat Every month I write about the Jobs Report. But while it is timely, it is only an estimate. There is an actual census of over 95% of all employers that also gets reported, called the QCEW, and it is the “gold standard” of actual jobs growth (or loss). Its two drawbacks are that it is not seasonally adjusted, and it is reported almost 6 months after the end of the quarter it updates. Which is a lengthy introduction to saying that it was just reported through March of this year this morning. More importantly, the BLS preliminarily re-benchmarked all of its data beginning in March of last year. And which is a further introduction to saying that, as expected, job growth was a lot less late last year and earlier this year

Topics:

NewDealdemocrat considers the following as important: benchmark revisions, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

– by New Deal democrat

Every month I write about the Jobs Report. But while it is timely, it is only an estimate. There is an actual census of over 95% of all employers that also gets reported, called the QCEW, and it is the “gold standard” of actual jobs growth (or loss). Its two drawbacks are that it is not seasonally adjusted, and it is reported almost 6 months after the end of the quarter it updates.

Which is a lengthy introduction to saying that it was just reported through March of this year this morning. More importantly, the BLS preliminarily re-benchmarked all of its data beginning in March of last year.

And which is a further introduction to saying that, as expected, job growth was a lot less late last year and earlier this year than we originally thought.

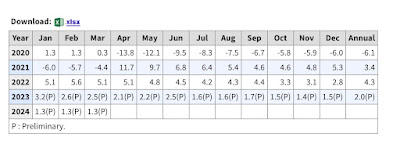

To wit, according to the QCEW, job growth was only 1.3% YoY through March (sorry, no graph, just the chart):

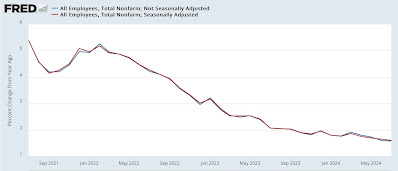

This compares with the official payrolls data showing 1.9% YoY growth through that same period:

Note that the two are consistent through last June. It is beginning last July that there is a major divergence, with payrolls estimating 2.1% job growth and the QCEW only showing 1.7% growth.

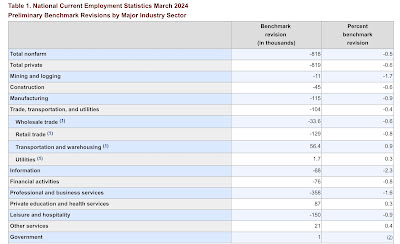

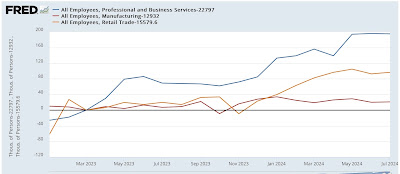

The actual total preliminary revision to job growth over this period was -818,000. Note that the biggest hits were to manufacturing (-125,000), retail (-129,00) leisure and hospitality (-150,000), and professional and business services (-358,000 !). These four areas made up over 750,000 of the 818,000 decline:

Here’s what the “official” total jobs gain since March of last year looks like:

But instead of a nearly 3 million gain, this is going to be raised down to only about a 2 million gain – a loss of about 30% of the total official gain.

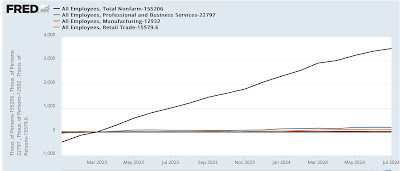

Here is what the other “official” gains look like in the 3 sectors hardest hit by the reivions:

*All but one* of these sectors will be revised to show losses. Manufacturing will be down -96,000 YoY as of this past March, retail down -45,000, and professional and business services down -202,000. Only leisure and hospitality will still show a gain, of 296,000 (vs. 446,000).

Note that this is not the “final” benchmark revision, which we’ll get at the beginning of next year. So the numbers are not going to change yet in the official payrolls report.

The bottom line is that, while this is not recessionary, it takes the “pretty good” growth over the last 16 months and revises it to mediocre growth.

The Bonddad Blog

The blockbuster January jobs report 2: revisions do not resolve discrepancies in the reports, Angry Bear by New Deal democrat