– by New Deal democrat If residual post-pandemic seasonality has been affecting jobless claims statistics, the real acid test is going to begin next week, as for the next 7+ months, any number higher than 220,000 is almost always going to be higher than one year ago. In the meantime, for this our last week of the seasonal downtrend, initial jobless claims rose 2,000 to 230,000. The four week moving average rose 750 to 230,750. Continuing claims, with the typical one week delay, rose 5,000 to 1.850 million: Turning to the more important YoY comparisons for forecasting purposes, initial claims were unchanged, the four week moving average was down -0.8%, and continuing claims were higher by 2.2%: This YoY comparison for continuing

Topics:

NewDealdemocrat considers the following as important: initial claims, Producer Price Index, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

If residual post-pandemic seasonality has been affecting jobless claims statistics, the real acid test is going to begin next week, as for the next 7+ months, any number higher than 220,000 is almost always going to be higher than one year ago.

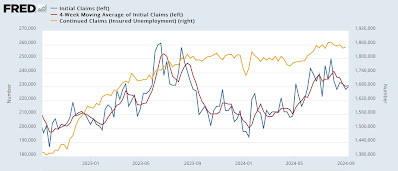

In the meantime, for this our last week of the seasonal downtrend, initial jobless claims rose 2,000 to 230,000. The four week moving average rose 750 to 230,750. Continuing claims, with the typical one week delay, rose 5,000 to 1.850 million:

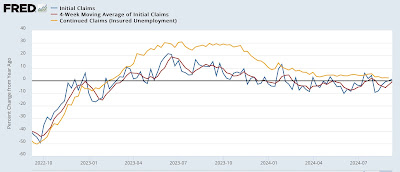

Turning to the more important YoY comparisons for forecasting purposes, initial claims were unchanged, the four week moving average was down -0.8%, and continuing claims were higher by 2.2%:

This YoY comparison for continuing claims was the lowest in the past 1.5 years.

Needless to say, these are all positive results which forecast continued economic expansion in the next few months.

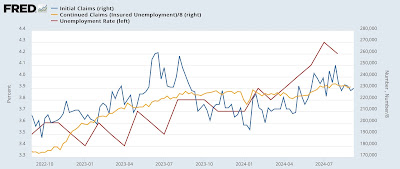

Since we are only one week into September, there is not much to say about the implications for the unemployment rate in next month’s report, but here is the updated graph:

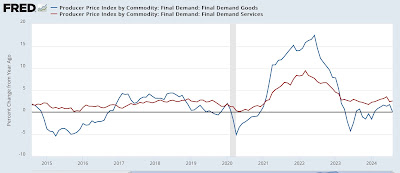

Finally, a quick note about the producer price index which was also released this morning. Like employment, goods prices are far more volatile than prices for services, which tend to rise throughout good times and bad. Here is the YoY% look at each:

PPI for services YoY is higher by 2.6%, about average for the past 10 years. For goods it is unchanged YoY, which is not uncommon and is generally a good thing for downstream consumer inflation. On a monthly basis, PPI for goods was also unchanged; for services it rose 0.4%.

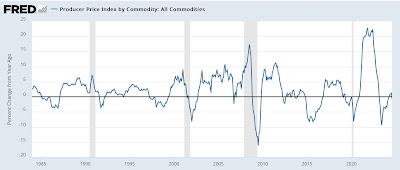

Perhaps more significant is that raw commodity prices fell -0.7% in August, and on a YoY basis are down -0.8%:

Such a decline more often than not telegraphs present or short term weakness, but also is a positive coming out of recessions.

An important consideration, therefore, is whether this weakness is a supply side issue (e.g., lower gas prices) or a demand issue (weak global demand at the producer level).

Both of these may be in play at present. On the one hand, oil prices declined in the past month to the low end of their last two year range. On the other, it appears that China has begun a genuine deflationary spiral, as not only have consumer prices declined there, but there is evidence that in at least some sectors wages have declined as well. This is definitely not good for China, but it may be a boon to the US, since we mainly benefit from the lower prices that are likely to make their way through to consumers without any negative effect on wages. An interesting global situation, with all that implies.

The Bonddad Blog

As the Debby effect dissipates, initial claims remain positive for the economy, Angry Bear by New Deal democrat