Credit conditions in Q2 improved, and are typical of an economy having come *out* of a recession, not going in to one – by New Deal democrat The Senior Loan Officer Survey, the premier quarterly measure of the loose- or tight-ness of bank lending, was published yesterday for Q2. And since lending conditions are a long leading indicator for the economy, and several of the metrics contained in this release have a good and lengthy track record, let’s take a look. And to cut to the chase, the news is positive. The first measure that has a lengthy and accurate historical record is the percentage of banks tightening or loosening criteria for making commercial and industrial loans. This is one of those data series where a positive number is

Topics:

NewDealdemocrat considers the following as important: 2024, Q2 Credit Conditions, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Credit conditions in Q2 improved, and are typical of an economy having come *out* of a recession, not going in to one

– by New Deal democrat

The Senior Loan Officer Survey, the premier quarterly measure of the loose- or tight-ness of bank lending, was published yesterday for Q2. And since lending conditions are a long leading indicator for the economy, and several of the metrics contained in this release have a good and lengthy track record, let’s take a look.

And to cut to the chase, the news is positive.

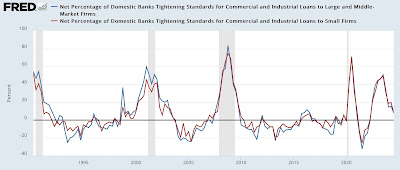

The first measure that has a lengthy and accurate historical record is the percentage of banks tightening or loosening criteria for making commercial and industrial loans. This is one of those data series where a positive number is negative, as it means more banks tightening than loosening. A negative number means more banks are loosening conditions.

Although the data for lending to both large and small firms was negative, it was less negative than at any point in the last two years, with on net only 8% of banks tightening:

Going back 30+ years, this is typically what we see 2 to 4 quarters *after* a recession has ended, not going in to one.

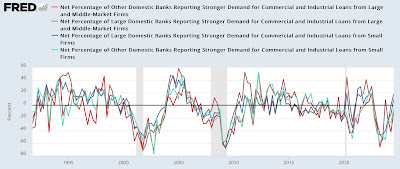

The second measure is the percentage of banks reporting strong demand for commercial and industrial loans. This is divided into large and small banks, and large and small firms, giving us four series. And in this case, positive means positive for the economy as well. In the graph below, the two series for large firms are in light and dark rend, the two fo small firms are in light and dark blue:

Although the graph looks a little like spaghetti, the trend in the past 6 quarters is clear. The percentage of banks reporting weakening demand got smaller and smaller, until finally this past quarter on net the data was positive, with the percent of large banks reporting stronger demand was higher by 10%+, and the percent of smaller banks reporting weaker demand dwindled to under 10%, for an unweighted average of +4%. Across all four divisions, the numbers are the best since Q3 of 2022.

Again, this is very much what we see just after having come *out* of recessions rather than going into one.

By no means are all of the long leading indicators so sanguine; in particular real money supply and the yield curve are still negative. But credit conditions are improving.

Q1 credit conditions showed no significant change, Angry Bear, by New Deal democrat