– by New Deal democrat Initial claims declined -8,000 last week to 215,000, well within its recent nine month range, after a two week elevated excursion. The four week moving average, reflecting that excursion, increased to a nine month high of 219,750. Continuing claims, with the usual one week delay, rose 8,000 to 1.794 million, also well within their recent nine month range: As per usual, the YoY% change is more important for forecasting purposes. There, initial claims are lower by -5.3%, and the four week average lower by -1.3%. Continuing claims, however, remain higher YoY, by 4.9%: Continuing claims have been higher YoY for well over a year, and relative to that, they are close to the bottom of that YoY range.As per the first

Topics:

NewDealdemocrat considers the following as important: May 2024, Ubemployment, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

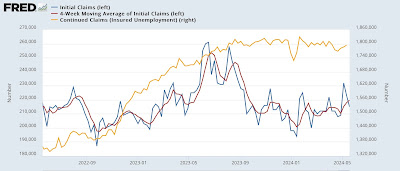

Initial claims declined -8,000 last week to 215,000, well within its recent nine month range, after a two week elevated excursion. The four week moving average, reflecting that excursion, increased to a nine month high of 219,750. Continuing claims, with the usual one week delay, rose 8,000 to 1.794 million, also well within their recent nine month range:

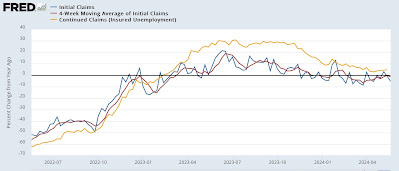

As per usual, the YoY% change is more important for forecasting purposes. There, initial claims are lower by -5.3%, and the four week average lower by -1.3%. Continuing claims, however, remain higher YoY, by 4.9%:

Continuing claims have been higher YoY for well over a year, and relative to that, they are close to the bottom of that YoY range.As per the first graph above, if there is no significant higher movement in the next three months, they will again be lower YoY.

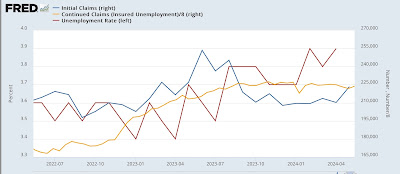

Turning to the Sahm Rule forecast, the recent two-week excursion higher means that the monthly average for May is likely to be higher than previous eight months, while continuing claims will be right in line. Since the unemployment rate lags initial claims by a number of months, and continuing claims by a shorter duration, there is no further pressure upward, and some downward pressure, on the unemployment rate for the next several months. It should remain rangebound between 3.7% and 3.9%. To trigger the Sahm Rule, the unemployment rate would have to average 4.1% in the next several months. That should not happen:

Finally, here’s a graph I haven’t posted in awhile – the quick and dirty easy economic forecast, using initial claims YoY and the stock market YoY. If the former is lower and the latter higher, all is well in the immediate future:

Not only is the stock market higher YoY, but those YoY gains have been increasing. The quick and dirty forecast for the economy in the next few months remains positive.

The Bonddad Blog

Initial claims jolted awake from snooze-fest by highest number in almost nine months, Angry Bear by New Deal democrat