I guess if it is said enough times it has to be true or does it have to be? The Biden rescue since he took office is far better than what we experienced in 2008 onward. Yet Another in the Economy Is Bad Under Biden by Dean Baker CEPR Like other major news outlets, the Washington Post is perfectly happy to ignore the data to tell you the economy is bad under Biden. Past entries in this series included the many pieces telling us young people have given up ever being able to own a home, even though the number of young people who are homeowners is considerably higher than before the pandemic, the CNN classic telling us about the retirement crisis even though the net worth of near retirees is up almost 50 percent from 2019, and the

Topics:

Bill Haskell considers the following as important: Journalism, politics, US EConomics, Washington Post

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

I guess if it is said enough times it has to be true or does it have to be? The Biden rescue since he took office is far better than what we experienced in 2008 onward.

Yet Another in the Economy Is Bad Under Biden

by Dean Baker

CEPR

Like other major news outlets, the Washington Post is perfectly happy to ignore the data to tell you the economy is bad under Biden.

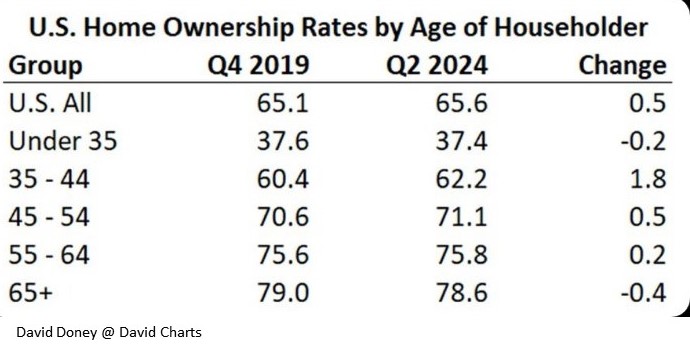

Past entries in this series included the many pieces telling us young people have given up ever being able to own a home, even though the number of young people who are homeowners is considerably higher than before the pandemic, the CNN classic telling us about the retirement crisis even though the net worth of near retirees is up almost 50 percent from 2019, and the Washington Post and New York Times pieces telling us new college grads couldn’t find jobs even though their unemployment rate is near a twenty year low. Census – Quarterly Residential Vacancies and Hone Ownership, Second Quarter 2024.

The media are absolutely determined to tell everyone the economy is awful in spite of the longest stretch of low unemployment in more than 70 years, healthy real wage growth, especially at the bottom, in spite of the pandemic, and record levels of job satisfaction. The media will not be deterred by good news in its effort to tell its audience that the Biden-Harris economy is awful.

Today’s entry in the data be damned awful Biden economy saga is an opinion piece that tells us in its title, “A big problem for young workers: 70- and 80-year-olds who won’t retire.” The story is that younger workers are being blocked in their career paths by old-timers who refuse to retire. (The observant ones out there might recall that we were supposed to be bothered by the flood of retirees who had to be supported by younger people still in the workforce. Oh well, both situations are awful.)

Anyhow, the punch line in the piece is a graph that purportedly shows an increase in the ratio of the wages of older workers to younger workers. The problem is the graph actually doesn’t show a continual increase in the ratio of the pay of older workers to younger workers.

It does show a rise from the 1970s until around 2010. It then levels off and then has trended down slightly from 2012 until 2018, which is the last year in graph. At that point, it was roughly back to its 2000 level.

There may have been a story in these data, but that was a decade ago when the ratio was peaking. It is more than a bit bizarre that the Washington Post would choose to highlight this trend now. But when you have an economy that is doing great by almost every standard measure, I guess it’s necessary to dig deep to tell the bad economy story. The Washington Post deserves a big hand MAGA for this one!

David Doney @David Charts: “Quarterly Residential Vacancies and Homeownership, Second Quarter 2024. Home ownership rate was higher overall in Q2 2024 than Q4 2019 pre-pandemic. In general, age 35-64 had higher ownership rates, while under 35 and over 65 had lower rates. See table 6.”