By Bill McBride Calculated Risk, May 29, 2024 The FDIC released the Quarterly Banking Profile for Q1 2024: Reports from 4,568 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) report aggregate net income of .2 billion in first quarter 2024, an increase of .4 billion (79.5 percent) from the prior quarter. A large decline in noninterest expense because of several substantial, non-recurring items recognized by large banks in the prior quarter, as well as higher noninterest income and lower provision expenses this quarter, contributed to the quarterly increase. These and other financial results for first quarter 2024 are included in the FDIC’s latest Quarterly Banking Profile released

Topics:

Bill Haskell considers the following as important: banks, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

by Bill McBride

Calculated Risk, May 29, 2024

The FDIC released the Quarterly Banking Profile for Q1 2024:

Reports from 4,568 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) report aggregate net income of $64.2 billion in first quarter 2024, an increase of $28.4 billion (79.5 percent) from the prior quarter. A large decline in noninterest expense because of several substantial, non-recurring items recognized by large banks in the prior quarter, as well as higher noninterest income and lower provision expenses this quarter, contributed to the quarterly increase. These and other financial results for first quarter 2024 are included in the FDIC’s latest Quarterly Banking Profile released today.

. . .

Asset Quality Metrics Remained Generally Favorable With the Exception of Material Deterioration in Credit Card and Commercial Real Estate (CRE) Portfolios: Loans that were 90 days or more past due or in nonaccrual status increased to 0.91 percent of total loans, up five basis points from the prior quarter and 16 basis points from the year-ago quarter. The quarterly increase was led by commercial and industrial loans and non-owner-occupied CRE loans. The noncurrent rate for non-owner occupied CRE loans of 1.59 percent is now at its highest level since fourth quarter 2013, driven by office portfolios at the largest banks. Despite the recent increases, the industry’s total noncurrent ratio remains 37 basis points below the pre-pandemic average of 1.28 percent.emphasis added

From the FDIC:

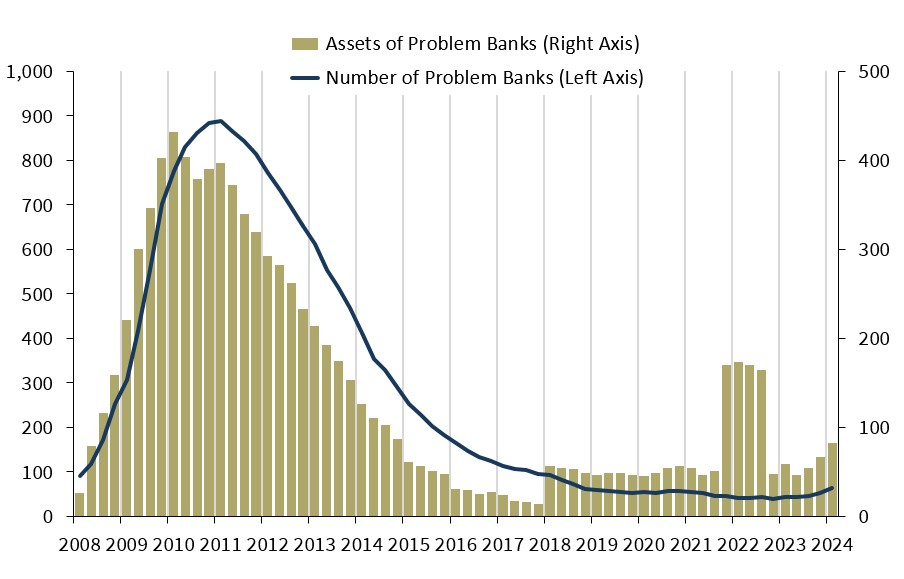

The number of banks on the FDIC’s “Problem Bank List” increased from 52 to 63. Total assets held by problem banks rose $15.8 billion to $82.1 billion. Problem banks represent 1.4 percent of total banks, which is within the normal range for non-crisis periods of 1 to 2 percent of all banks.

This graph from the FDIC shows the number of problem banks and assets at problem institutions.

Note: The number of assets for problem banks increased significantly back in 2018 when Deutsche Bank Trust Company Americas was added to the list. An even larger unknown bank was added to the list in Q4 2021, however that bank is now off the problem list.

It appears the recent increase in problem banks is related to office CRE* loans.

*Commercial real estate (CRE) lending includes acquisition, development, and construction (ADC) financing and the financing of income-producing real estate.