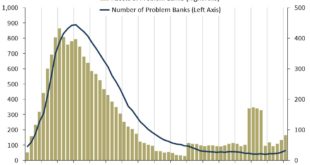

by Bill McBride Calculated Risk, May 29, 2024 The FDIC released the Quarterly Banking Profile for Q1 2024: Reports from 4,568 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) report aggregate net income of $64.2 billion in first quarter 2024, an increase of $28.4 billion (79.5 percent) from the prior quarter. A large decline in noninterest expense because of several substantial,...

Read More »The “Wayback Machine” and Rescuing Problem Banks

It is unfortunate we do not possess a “Wayback Machine” to fix the issues we are experiencing with banks since 1986. Instaed we bumble again and again, making the same mistake over and over with banks. In a cartoon series called Peabody’s Improbable History, Mr. Peabody and Sherman would open the door to the past, speak in English to everyone they met (even if they could not speak English). The translation was a part of the machine. Both Mr....

Read More »The Lie Banks Use To Protect Late-Fee Profits

Hal Singer at Lever News wrote a commentary explaining how banks (mostly) are upset with the Consumer Financial Protection Bureau capping credit card late fees at $8. One would think this covers every bank. It does not and only covers banks with more than 1 million card holders. Any bank or organization with less customers can avoid the new rule. And of course there are other exceptions. The new rule takes effect sixty days after being posted in...

Read More »Destroy ‘creative ambiguity’ in order to change the world – Against Varoufakis’ conformist sci-fi

Destroy ‘creative ambiguity’ in order to change the world Stavros Mavroudeas Professor of Political Economy Panteion University In a recent (much publicized by systemic circles) article, G. Varoufakis, referring to the current international banking turmoil, uttered the supposedly radical slogan ‘let the banks burn’. Of course, G. Varoufakis is not famous for the coherence of his economic analyses. As he has described himself, he is a fairy tale creator impersonating an...

Read More »A fractional reserve crisis

This is a slightly amended version of a keynote speech I gave on 14th April 2023 at the University of Ghent, for the Workshop on Fintech 2023. The crisis that has engulfed crypto in the last year is a crisis of fractional reserve banking. Silvergate Bank and Signature Bank NY were fractional reserve banks. So too were Celsius Network, Voyager, BlockFi, Babel Finance and FTX. And still standing are the crypto fractional reserve banks Coinbase, Gemini, Binance, Nexo, MakerDAO, Tether,...

Read More »What really happened to Signature Bank NY?

As the world reeled in shock at the sudden collapse of Silicon Valley Bank (SVB), another bank quietly went under. On Sunday 12th March, the U.S. Treasury, Federal Reserve and FDIC announced that all SVB depositors, whether insured or not, would have access to their funds from Monday. And then they added: We are also announcing a similar systemic risk exception for Signature Bank, New York, which was closed today by its state chartering authority.Signature Bank NY's state chartering...

Read More »The Peston effect

The last week or so has seen some of the worst bank communications since 2007, when the Bank of England started a bank run by leaking news of Northern Rock's emergency liquidity request to the journalist Robert Peston. Then as now, awful communications have frightened the horses, triggered stampedes and caused banks to fail. Three banks in particular have shown an extraordinary insensitivity to popular fears: Silicon Valley Bank, Credit Suisse, and Wells Fargo. Two of these have paid a heavy...

Read More »Why the Banking System is Breaking Up

[unable to retrieve full-text content]Support my work via Patreon The collapses of Silvergate and Silicon Valley Bank are like icebergs calving off from the Antarctic glacier. The financial analogy to the global warming causing this collapse is the rising temperature of interest rates, which spiked last Thursday and Friday to close at 4.60 percent for the U.S. Treasury’s two-year Continue Reading The post Why the Banking System is Breaking Up first appeared on Michael Hudson.

Read More »Silvergate Bank – a post mortem

Silvergate Bank died yesterday. Its parent, Silvergate Capital Corporation, posted an obituary notice (click for larger image):Silvergate Bank bled to death after announcing significant delay to its 10-K full-year accounts and warning that it might not be able to continue as a going concern. We will never know whether it could have recovered from the bank run after the failure of FTX. The bank run after the announcement was far, far worse. The exit of its major crypto customers sealed...

Read More »Hollow Promises

Today, I bring you the sad tale of a crypto lender that promised safety and high returns to its depositors, but whose promises have proved to be as hollow as its name. Donut Inc., a self-proclaimed DeFi" lender, has a "Proof of Reserves" section on its website. This is supposed to reassure customers that their deposits are matched one for one by the platform's liquid assets. I am firmly of the opinion that "Proof of Reserves" statements prove nothing without a corresponding statement of...

Read More » Heterodox

Heterodox

_reporters_swarming-310x165.png)