– by New Deal democrat One of my fundamentals-based systems for monitoring the economy is to look at the health of household balance sheets. Most recessions happen when consumers are under stress. If real wages are growing, if assets that can be leveraged or cashed in (mortgage payments, home equity, stocks) are increasing in value, if monthly debt payments are not increasing, then there is no reason for consumers to pull back, and economic expansions continue. It is only when all of these conduits for spending are constricted that recessions typically occur. And at present, households are generally in good shape. None of the avenues of spending power have been constricted. To begin with, real hourly and weekly wages have been increasing

Topics:

NewDealdemocrat considers the following as important: US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

One of my fundamentals-based systems for monitoring the economy is to look at the health of household balance sheets.

Most recessions happen when consumers are under stress. If real wages are growing, if assets that can be leveraged or cashed in (mortgage payments, home equity, stocks) are increasing in value, if monthly debt payments are not increasing, then there is no reason for consumers to pull back, and economic expansions continue. It is only when all of these conduits for spending are constricted that recessions typically occur.

And at present, households are generally in good shape. None of the avenues of spending power have been constricted.

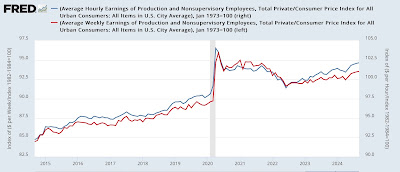

To begin with, real hourly and weekly wages have been increasing steadily since their June 2022 lows:

Values in the above graphs are normed to 100 as of January 1973, the previous all time high for both series. There is also some immediate post-pandemic distortion due to the fact that the 2020 layoffs were heavily tilted towards lower income laborers. Thus the averages increased. Even so, real average hourly wages are presently at all time highs except for several months in spring 2020, while real weekly wages are at 2.5 year highs, and above all pre-pandemic levels except for 1973.

In terms of assets that can be cashed in or borrowed against, I’ll spare you the graphs, but suffice it to say that both real, inflation adjusted home prices, and stock prices, are at all time highs – the latter having made another such all-time high only yesterday.

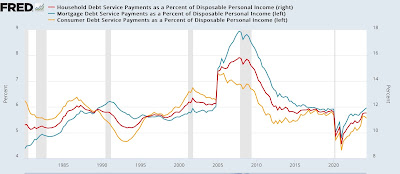

Finally, here is the long-term historical look at mortgage, non-mortgage (left scale), and total (red, right scale) debt services payments of households as a percent of disposable income:

While these have risen through Q2 of this year, the last data available, along with the Fed’s interest rate hikes, they are at pre-pandemic average levels.

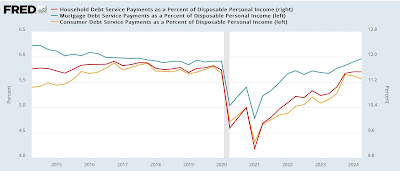

Here is a close-up of the last five years:

What is noteworthy in this zoomed in look is that total debt service payments as a percent of income stabilized once the Fed was done hiking rates. If a recession were in the offing, I would expect this ratio to be continuing to increase. What this tells me is that average households’ debt service payments are well in line, despite being higher than their immediate post-pandemic historic lows.

In summary, real household wages and asset values are in good shape. The Fed rate hikes did not overly stress their balance sheets. There is no evidence households have been reining in spending. There is every reason to believe that the economic expansion will continue in the next few months.