– by New Deal democrat The Bonddad Blog Yesterday I wrote of how Fed rate hikes had not translated into a decline in the amount of housing under construction, and without that I did not see how a recession could occur. And in reaction to January’s housing construction report I concluded, “To signify a likely recession, units under construction would have to decline at least -10%, and needless to say, we’re not there. With permits having increased off their bottom, I am not expecting such a 10% decline in construction to materialize.” This morning’s report for February confirmed that sentiment, as single-family permits, total permits, and housing starts lol rose, with starts making up almost all of their steep, and noisy, decline in January:

Topics:

NewDealdemocrat considers the following as important: housing, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

The Bonddad Blog

Yesterday I wrote of how Fed rate hikes had not translated into a decline in the amount of housing under construction, and without that I did not see how a recession could occur. And in reaction to January’s housing construction report I concluded, “To signify a likely recession, units under construction would have to decline at least -10%, and needless to say, we’re not there. With permits having increased off their bottom, I am not expecting such a 10% decline in construction to materialize.”

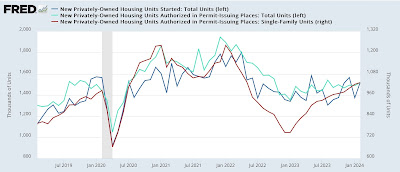

This morning’s report for February confirmed that sentiment, as single-family permits, total permits, and housing starts lol rose, with starts making up almost all of their steep, and noisy, decline in January:

Single family permits, which are the most leading and least noisy of the above metrics, made a new 18 month high at 1.031 million annualized, which is 37% higher than their low of 748,000 annualized last January. They have made up about 60% of the ground they lost since the start of the Fed’s rate hikes over 2 years ago. Starts, which lag slightly and are much noisier, have likely bottomed as well.

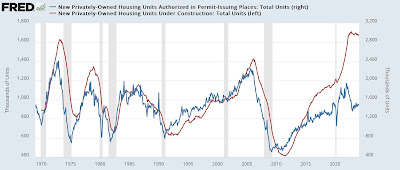

To reiterate: housing units under construction (red in the graph below) are the best measure of the actual economic activity in the housing market, and while these declined -8,000 for the month to a new nearly 2 year low, they are only down -2.6% from their peak. Single family units have actually increased 17,000 from their bottom last October, while multi-family units have declined -3.5% from their all-time 50+ year high last July:

The reason I have broken out single vs. multi-family construction is because, in response to record high house prices, builders turned to higher density, lower cost apartment and condo construction. Hence the record high last year in that metric.

Unsurprisingly, permits (blue in the graph below) lead housing units under construction (red), but a major disconnect has opened over the past 10 years, as especially large multi-unit developments take longer to complete:

I do expect a further gradual decline in total housing units under construction in the months ahead, to catch up with the decline in permits that bottomed one year ago. But I doubt we will cross the -10% threshold that it would normally take to signal a recession.

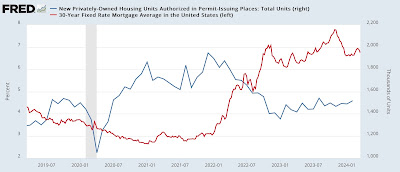

A large part of that is because mortgage rates have stabilized (red in the graph below), and since permits and starts follow mortgage rates, they have generally stabilized as well:

The best way to view this relationship is YoY, which is shown below:

Mortgage rates are slightly higher than they were 12 months ago. After a brief decline last spring, mortgage rates rose to multi-year highs last autumn. So, unless there is a renewed major move upward in mortgage rates, I expect the YoY comparison by permits to turn positive by this summer sometime. That is going to translate into gains in permits and starts, and a likely bottom in housing units under construction.

As to prices, they generally follow housing sales. Because of the bifurcation in the housing market, with many existing homeowners frozen in place by their 3% existing mortgages, new home sales have rebounded, and new home prices are in a bottoming process. We’ll get more information later this week and next week when new and existing home sales are reported.

Housing construction rebounds in February, as permits and starts are stable and rebounding at Angry Bear by New Deal democrat

Housing construction essentially stable in January at Angry Bear by New Deal democrat.