– by New Deal democrat I never used to pay much attention to the ISM non-manufacturing report. That is partly because it only has a 20 year history, and partly because it seems to be more coincident than leading: But because manufacturing has faded so much as a share of the US economy, with at least two false recession signal in the past 10 years (2015-16 and 2022-23): there is no choice but to pay more attention. In particular, it does seem that when we include this as part of a weighted average (75%) along with the ISM manufacturing index (25%), it has generated a much more reliable, and still timely, reading over this Millennium (note: graph ends last summer): On Monday, the ISM manufacturing index, and its more leading new

Topics:

NewDealdemocrat considers the following as important: ISM non-manufacturing, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

I never used to pay much attention to the ISM non-manufacturing report. That is partly because it only has a 20 year history, and partly because it seems to be more coincident than leading:

But because manufacturing has faded so much as a share of the US economy, with at least two false recession signal in the past 10 years (2015-16 and 2022-23):

there is no choice but to pay more attention.

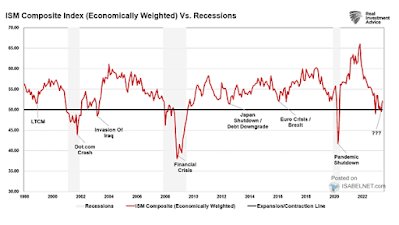

In particular, it does seem that when we include this as part of a weighted average (75%) along with the ISM manufacturing index (25%), it has generated a much more reliable, and still timely, reading over this Millennium (note: graph ends last summer):

On Monday, the ISM manufacturing index, and its more leading new orders component, came in poor. But the non-manufacturing index this morning completely outweighed that in its strength. Here are the last five months of both the manufacturing (left column) and non-manufacturing index (center) numbers, and their weighted average (right):

JAN 49.1. 53.4. 52.3

FEB 47.8 52.6. 51.4

MAR 50.3. 51.4. 51.1

APR 49.2 49.4. 49.3

MAY 48.9. 53.8. 52.5

And here is the same data for the new orders components:

JAN 52.5. 55.0. 54.4

FEB 49.2 56.1. 54.4

MAR 51.4. 54.4. 53.6

APR 49.1. 52.2. 51.4

MAY 45.4. 54.1. 51.9

Only the weighted average for the total indexes for one month, April, comes in below 50. To generate a reliable signal, we would need the 3 month average to be below 50, which it clearly is not. The new orders weighted average for all months is unambiguously positive.

The signal for the combined weighted ISM indexes remains expansionary in its forecast for the next few months.

The Bonddad Blog

May new manufacturing orders slide, truck sales rise, construction spending close to unchanged, Angry Bear, by New Deal democrat