– by New Deal democrat My “quick and dirty” economic status indicator is the stock market (still making new all-time highs) and initial jobless claims, which are also still positive for the economy despite being in an apparent uptrend. Last week initial claims rose 8,000 to 229,000, their second highest level in the past 9 months. The four-week moving average declined -750 to 222,250, just below its own 9 month high of the week prior. With the usual one week delay, continuing claims rose 2,000 to 1.792 million, right about in the middle of their 10 month range: Some of this, as I have speculated in the past month, may be some residual post pandemic seasonality that has not been worked out, given last year’s similar increase. As per

Topics:

NewDealdemocrat considers the following as important: June 2024, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

My “quick and dirty” economic status indicator is the stock market (still making new all-time highs) and initial jobless claims, which are also still positive for the economy despite being in an apparent uptrend.

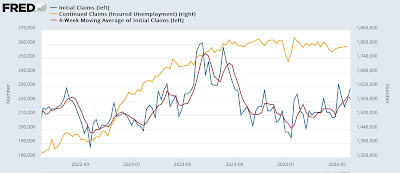

Last week initial claims rose 8,000 to 229,000, their second highest level in the past 9 months. The four-week moving average declined -750 to 222,250, just below its own 9 month high of the week prior. With the usual one week delay, continuing claims rose 2,000 to 1.792 million, right about in the middle of their 10 month range:

Some of this, as I have speculated in the past month, may be some residual post pandemic seasonality that has not been worked out, given last year’s similar increase.

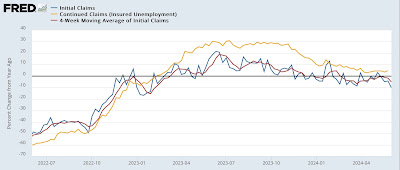

As per usual, the YoY change is what is most important for forecasting purposes. And there the news is considerably better, as initial claims were down -10.2%, and the four-week moving average down -5.2%. Continuing claims were up 4.2%, which is a negative, but on the other hand, as noted above, these have been in a tight range for the past 10 months, so I do not believe they are much of an issue:

The bottom line is that the initial claims indicator remains positive for the economy as to the next few months.

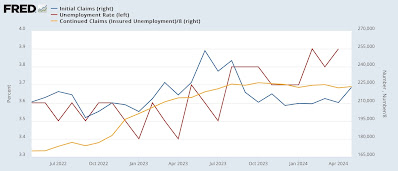

Finally, as we await tomorrow’s jobs report, here is our last update as to the May Sahm rule indicator:

Because initial claims lead the Sahm rule by several months at least, the May upturn in initial claims does not put any upward pressure on the unemployment rate, and indeed the late winter and early spring downturn in claims should still be feeding through. Nor are continuing claims, which have a slighter lead, putting any upward pressure on the unemployment rate. In short, there is no support for the “Sahm rule” being triggered.

So tomorrow I am looking for no increase, and a possible decrease, in the unemployment rate. Per my discussion of the JOLTS report, I am looking for stabilization or no more than a slight deceleration in average hourly earnings gains. And I will be most interested to see if declines in manufacturing and housing under construction translate into a stall or even downturn in goods-producing employment, which has held up surprisingly well in the past year.

The Bonddad Blog

Slight increasing trend in initial jobless claims, but continuing claims continue slightly lower, Angry Bear by New Deal democrat