Jobless claims join other data series inching in the direction of yellow caution territory – by New Deal democrat Ever since jobless claims started higher in May, I’ve cautioned that I suspected that unresolved seasonality may be at play. We are now at the point where claims were at their low points for all last summer. In other words, last week through next weeks are the acid test for that hypothesis. Last week the news was good. This week it was more mixed. Initial jobless claims rose 20,000 to 243,000, while the four week moving average rose 1,000 to 234,750. Continuing claims, with the usual one week delay, rose 20,000 to 1.867 million, the highest level since December 2021. I’ve needed to expand the graph below from its usual 2 year time

Topics:

NewDealdemocrat considers the following as important: Jobless Claims 2024, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Jobless claims join other data series inching in the direction of yellow caution territory

– by New Deal democrat

Ever since jobless claims started higher in May, I’ve cautioned that I suspected that unresolved seasonality may be at play. We are now at the point where claims were at their low points for all last summer. In other words, last week through next weeks are the acid test for that hypothesis. Last week the news was good. This week it was more mixed.

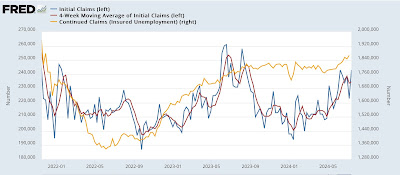

Initial jobless claims rose 20,000 to 243,000, while the four week moving average rose 1,000 to 234,750. Continuing claims, with the usual one week delay, rose 20,000 to 1.867 million, the highest level since December 2021. I’ve needed to expand the graph below from its usual 2 year time period in order to show that:

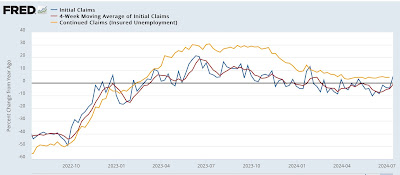

On the YoY basis that is more important for forecasting purposes, initial claims were higher for the first time since early May, up 5.2%. But the less noisy four week average remained lower by -1.1%. Continuing claims were 4.5% higher, still within the lower end of their recent range:

There is an additional seasonal complicating factor this week, in that July 4 fell during different counting weeks last year vs. this year. For the combined 2 week period, initial claims were only 1,500, or 0.6%, higher than last year, at 233,000 vs. 231,500.

This is a very mixed signal, and seems likely to resolve higher YoY next week. The continuing uptrend in continuing claims in particular absolutely speaks to relative weakness in the labor market relative to one and two years ago.

Which brings me to the update of the “Sahm rule” forecast. As I have written numerous times, for over 50 years initial claims have led the unemployment rate. This year that has not been the case, as the unemployment rate has trended higher despite a downturn in initial claims during the first four months of this year. The likely reason is a surge of working age immigrants in the last two years, some of whom are having a more difficult time finding employment. Since they are in the labor force but have not previously held jobs, they are not filing for unemployment benefits.

With that lead-in, here is the updated graph through mid-July:

Both initial and continuing claims suggest that there will be upward pressure on the unemployment rate in the next few months. Since it is already at 4.1%, this suggests a significant chance that it will trigger the “Sahm rule,” although note that the comparison point, of the lowest 3 month average during the past 12 months, will also be moving higher. Because the likely trigger is immigration, however, as I have previously written the economy is likely to be nevertheless expanding – in other words, if triggered it is likely to be a false positive.

A one week 5.2% YoY. Increase in new jobless claims is not nearly enough to trigger even a yellow caution flag. For that we would need, at absolute minimum, a 10%+ comparison lasting multiple weeks. Still, together with the combined economically weighted ISM composite index, real retail sales, and housing under construction, we now have a number of significant sectors signaling weakness.

The Bonddad Blog

“On jobless claims, the unresolved seasonality hypothesis is holding up,” Angry Bear by New Deal democrat